3. Interest expense calculation & journal entries

4. Interest expense for a finance lease

- Which reporting frameworks does this apply to?

- How is finance lease interest expense calculated?

- Interest expense formula

- How is lease interest expense reported?

5. Example: Finance lease interest expense

6. Summary

What is interest?

Interest is the additional consideration paid in excess of the value of what is borrowed, usually expressed as an annual rate. From the perspective of the borrower, interest is the fee paid for the use of borrowed money or an asset which is not yet owned. From the perspective of the lender, interest is the income collected from allowing a third party use of money over a period of time.

For example, a company wants to buy a $100,000 piece of equipment and chooses not to pay the total amount up front. Instead, the company borrows the $100,000 from a bank. The company can immediately use the borrowed $100,000 to purchase the equipment from the seller. They will then pay back the borrowed amount to the bank periodically over a set amount of time – let’s assume it’s one year.

The bank charges a fee on the principal amount borrowed, which is paid by the borrower over the time it takes to pay back the borrowed amount. The fee is the bank’s consideration for assuming the risk of the possibility the company may not be able to pay the amount borrowed back or for allowing the company to use the funds. The total amount paid to the bank will ultimately be more than the $100,000 initially borrowed. The difference between the principal amount borrowed and the total amount repaid is interest.

What is accrued interest?

From an accounting perspective, the borrower records interest as an expense on the income statement. If the borrower is a cash-based company, they record the interest expense as it is paid. If the borrower is an accrual-based company, they match expenses to the period incurred and will aggregate, or accrue, interest over the time the funds are borrowed in an accrued liability account on the balance sheet. When periodic principal and interest payments are made to the borrower, the amount of accrued interest being paid is relieved from the accrued interest account.

To illustrate interest accrual with the example from above, let’s assume the company entered into the loan for the equipment with an annual interest rate of 6% and agrees to make four quarterly interest payments. We’ll also assume the company pays interest on the total principal balance evenly over the life of the loan (calculated as simple interest rather than compound interest) and pays the full principal amount of the loan back as a lump sum at the end of the year. This is known as a balloon payment.

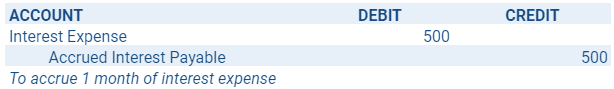

Interest expense calculation with journal entries

To calculate the interest expense, multiply the principal borrowed by the interest rate and the time period. When the company closes the books each month, they incur 1/12 of the interest expense due over the one-year loan: $500 ($100,000 x 6% x 1/12). Here’s what the journal entry would look like to reflect this interest accrual:

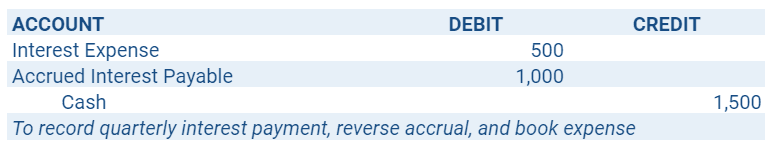

When the borrower makes the quarterly interest payment to the lender, they will reverse the previous two months of interest accrued, record interest expense for the current month, and credit cash for full quarterly payment amount. Here is the entry that will be booked:

When the borrower makes the quarterly interest payment to the lender, they will reverse the previous two months of interest accrued, record interest expense for the current month, and credit cash for full quarterly payment amount. Here is the entry that will be booked:

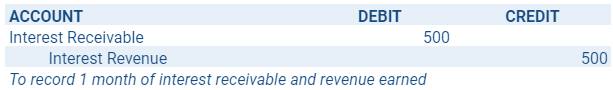

From the perspective of the lender, interest is reflected as revenue on the income statement. Using the same example, the lender would make the following entry at the end of the first month to accrue 1/12 of the interest receivable:

From the perspective of the lender, interest is reflected as revenue on the income statement. Using the same example, the lender would make the following entry at the end of the first month to accrue 1/12 of the interest receivable:

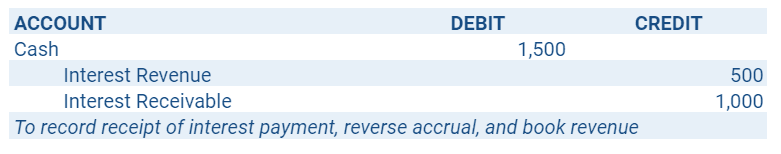

When the lender receives the quarterly interest payments from the borrower, the following entry will be booked:

When the lender receives the quarterly interest payments from the borrower, the following entry will be booked:

Interest expense for a finance lease

In the context of lease accounting, interest is paid by a lessee to a lessor for the right to use a particular leased asset and pay for it over time. Conversely, interest will be received by a lessor from the lessee for the use of the same asset.

To further illustrate interest within lease accounting, we will review a lease from the perspective of the lessee making payments to lease an asset. In this example, the lease includes a transfer of ownership of the underlying asset to the lessee at the end of the lease term, making it a finance type lease (capital lease under ASC 840). The interest paid during the lease term is classified as lease interest expense by the lessee. Common examples of finance leases include leases for equipment and vehicles.

Conversely, when a lease is classified as operating, such as when there is no ownership transfer at the end of the lease term, then interest expense is not separately recognized and instead is incorporated into the period rent expense and lease asset amortization. A common example of an operating lease is a lease for office space.

Which reporting frameworks does this apply to?

Under ASC 842, leases are either classified as finance or operating. Under IFRS 16 and GASB 87, no distinction between lease types for lessees exists and all are reported as finance leases. As such, lease interest expense is calculated for finance leases under all three lease accounting reporting frameworks.

How is finance lease interest expense calculated?

Fortunately, the method used to calculate lease interest expense is the same for any type of interest expense and is consistent under all three lease accounting reporting frameworks – FASB, GASB, and IFRS. The details of the calculation, however, can be complex — for a lessee to accurately account for the interest expense portion of a finance lease, they must establish a borrowing rate.

The interest rate best representing the economics of a lease is the rate the lessor charges the lessee, known as the implicit rate of the lease. Many times this rate is not stated in the contract and must be estimated with specific inputs from the lease contract. Though similar, each of the standards has its own formula. LeaseQuery discusses the steps involved with calculating the rate implicit in a lease in the following articles for ASC 842, GASB 87, and IFRS 16.

In most cases, the lessee will not be privy to all of the information required to accurately calculate the rate implicit in a lease. Instead, the lessee will need to use one of the alternative rates offered by the appropriate guidance, which generally will be the incremental borrowing rate.

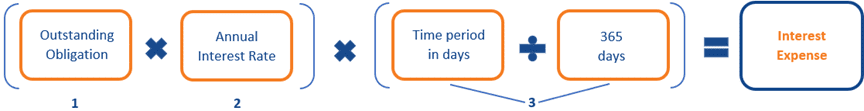

Interest expense formula

Interest expense can be calculated as the product of the following three pieces of information:

- Outstanding obligation

- Annual interest rate

- Time period over which interest is incurred expressed as a fraction of one year

The formula for interest expense can be expressed as follows with those three pieces of information:

When calculating interest expense for a finance lease, the outstanding obligation is equal to the previous period’s ending lease liability balance. Then the appropriate annual interest rate is multiplied by the fraction of one year for which the interest expense is being calculated. Most precisely, this is calculated as the number of days divided by 365. However, amortization tables are generally divided into monthly periods. As a result, some amortization tables simplify the periodic interest rate to be 1/12 of the annual interest rather than base it on the number of days per month.

When calculating interest expense for a finance lease, the outstanding obligation is equal to the previous period’s ending lease liability balance. Then the appropriate annual interest rate is multiplied by the fraction of one year for which the interest expense is being calculated. Most precisely, this is calculated as the number of days divided by 365. However, amortization tables are generally divided into monthly periods. As a result, some amortization tables simplify the periodic interest rate to be 1/12 of the annual interest rather than base it on the number of days per month.

How is interest expense reported for a lease?

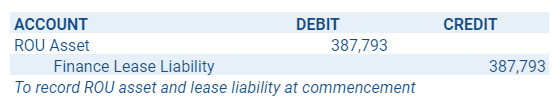

Under ASC 842, a finance lease is initially recorded as a lease liability and a right-of-use (ROU) asset measured at the present value of future lease payments. The subsequent accounting for a finance lease in all periods after commencement is similar to the amortization of a loan. The lessee periodically records depreciation expense representing the use and passage of time of ROU asset and interest expense on the outstanding lease liability over the term of the lease.

An important distinction to make here relates to a common financial reporting metric used when investors are looking at companies EBITDA, or Earnings before Interest, Taxes, Depreciation, and Amortization. Finance lease interest expense and depreciation expense under ASC 842 are not considered operating expenses, and thus will not be included as deductions to calculate EBITDA. Whereas lease expense, which is the combined interest and amortization expense of an operating lease under ASC 842, is considered an operating expense and would be included as a deduction to calculate EBITDA. Both of these reporting requirements are similar to how the expenses were reported under ASC 840. However, analysis of whether an operating or finance lease is preferred for a specific transaction may need to include the impacts to EBITDA.

Example: Finance lease interest expense

Now, let’s consider a full example of a finance lease to illustrate interest expense. Benjam, Inc. leases equipment for annual payments of $60,000 over an eight year term. Payments are due in arrears, on December 31st each year. After the eight year lease term, the equipment is expected to be worth $0, at which time ownership will transfer to Benjam, Inc, satisfying the one of the ASC 842 finance lease classification criteria.

Payments: $60,000 annually in arrears

Lease term: 8 years

Start/end dates: 1/1/2022 to 12/31/2029

Rate: 5% IBR (incremental borrowing rate)

Using the facts and circumstances presented we used LeaseQuery’s free present value calculator to compute a present value of remaining lease payments of $387,793. No other lease incentives, accruals, or initial direct costs exist for this lease. At commencement, the lessee will record a lease asset and lease liability of $387,793.

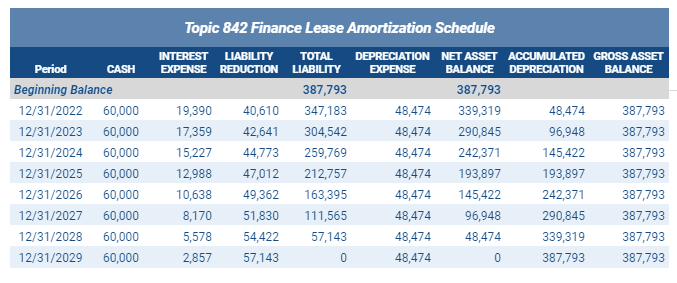

To understand the subsequent entries for this lease, the lessee will create an amortization table. (Note: This amortization table is presented annually instead of monthly to display the whole table)

To understand the subsequent entries for this lease, the lessee will create an amortization table. (Note: This amortization table is presented annually instead of monthly to display the whole table)

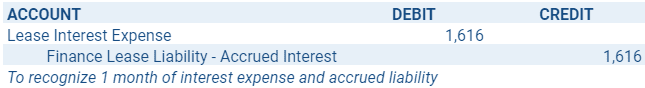

For each month during the lease term, Benjam, Inc. will record an accrual for one month of interest expense incurred. To determine this amount, Benjam, Inc. will multiply the prior month’s total outstanding liability balance by the interest rate and the time period. The amount of interest expense for the first month of the lease is $1,616 ($387,793 x 5% x 1/12) and the entry to accrue is below.

For each month during the lease term, Benjam, Inc. will record an accrual for one month of interest expense incurred. To determine this amount, Benjam, Inc. will multiply the prior month’s total outstanding liability balance by the interest rate and the time period. The amount of interest expense for the first month of the lease is $1,616 ($387,793 x 5% x 1/12) and the entry to accrue is below.

The total liability will increase each month by the amount of interest expense accrued until the annual interest payment is made at the end of each year. When the $60,000 cash payment is made at the end of each year it is allocated to the accrued interest and the remaining amount is applied to reduce the lease liability balance.

The total liability will increase each month by the amount of interest expense accrued until the annual interest payment is made at the end of each year. When the $60,000 cash payment is made at the end of each year it is allocated to the accrued interest and the remaining amount is applied to reduce the lease liability balance.

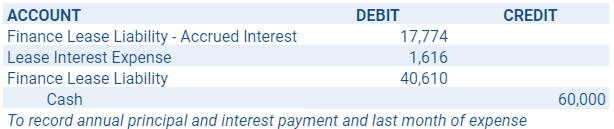

At the end of the first full year on December 31, 2022, Benjam, Inc. will make the $60,000 payment to the lessor. This $60,000 cash payment will be allocated accordingly to:

- a) Reverse the previous 11 months of interest accrued

- b) Expense the current month’s interest

- c) Reduce (debit) the finance lease liability account for the difference.

Per the amortization schedule above, at the end of 2022, $19,390 of lease interest expense was accrued. Of this $19,390, $1,616 (1/12) is the portion to be expensed for December. The remaining $40,610 ($60,000 – $19,390) will be applied for the reduction of principal. Here is the entry recorded at the end of the first year when Benjam, Inc. makes their payment:

Summary

Simplified, interest expense is the fee paid for borrowing a third party’s cash. Within lease accounting, interest is incurred by a lessee for the right to use an asset and pay for it over time. Interest is generally calculated as an annual rate of the amount borrowed over the period of time outstanding. However, judgements regarding the interest rate to use and the lease classification impact interest expense.

Properly accounting for interest expense associated with leases requires more than just a few simple calculations. LeaseQuery is here to help you automate every piece of this technical accounting puzzle so that you can focus on running your business.