Accounting for prepaid expenditures and ensuring they are properly recognized on your financial statements is a critical piece of financial reporting. Organizations recognize prepaid expenses for a myriad of reasons but generally, they occur when dealing with contracts, service agreements, and assets that allow the receiving party to pay in advance, hence the name, prepaid expense. In this article, we will delve further into how to appropriately account for prepaid expenses and their impact on the financial statements as well as decision-making.

What are prepaid expenses?

Prepaid expenses, or Prepaid Assets as they are commonly referred to in general accounting, are recognized on the balance sheet as an asset. A “prepaid asset” is the result of a prepaid expense being recorded on the balance sheet. Prepaid expenses result from one party paying in advance for a service yet to be performed or an asset yet to be delivered.

To note, if one party is recognizing a prepaid asset on their balance sheet, then the party providing the service or goods will recognize unearned revenue, a liability, on their balance sheet until they fulfill the contractual obligation of providing the service or goods for which they received payment.

Prepaid expenses vs. accrued expenses

It is also important not to confuse a prepaid expense with an accrued expense. Accrued expenses, such as accrued rent, are the result of receiving a service or goods before payment is made. As a result, a payable or accrued expense is recognized as a liability. As a rule of thumb, prepaid expenses have been paid but are yet to be realized whereas accrued expenses are incurred but yet to be paid.

Accounting for prepaid expenses

Accrual basis vs. cash basis

It is important to consider what basis of accounting an organization is operating under when assessing how to account for prepaid expenses. Entities following US GAAP and hence issuing GAAP-compliant financial statements are required to use accrual accounting. Accrual accounting adheres to the matching principle which requires recognizing revenue and expenses in the period they occur.

Therefore under the accrual accounting model an entity only recognizes an expense on the income statement once the good or service purchased has been delivered or used. Prior to consumption of the good or service, the entity has an asset because they exchanged cash for the right to a good or service at some time in the future. The advance purchase is recognized as a prepaid asset on the balance sheet.

On the other hand, an entity using the cash basis of accounting as opposed to the accrual basis expenses payments when incurred and does not attempt to match the cost of a good or service to the period or periods over which it is used. Under the cash basis an organization would immediately record the full amount of the purchase of a good or service to the income statement as soon as the cash is paid. No prepaid expense would be recognized.

Presentation on the balance sheet

Current asset vs. noncurrent asset

Sticking with the accrual method of accounting, a second important consideration when recording a prepaid asset is the utilization period. If the entirety of the prepaid asset is to be consumed within 12 months, then it is deemed a current asset. However, it is not uncommon to see contracts spanning multiple years, being paid in advance. In these scenarios the portion of the prepaid obligation which exceeds 12 months is recognized as a long-term or noncurrent asset.

Amortization of prepaid expenses

Generally speaking, when an organization pays for and then subsequently receives the asset, the resulting journal entry derecognizes the prepaid asset on the balance sheet and records the corresponding expense on the income statement. In most cases, this is the correct entry to book, however, in certain transactions we are paying upfront for the right to use an asset or receive a service over a defined period of time.

When we have the right to receive services or assets over an agreed-upon term and we prepaid for the right, the prepaid asset is not derecognized all at one time as with other prepaid expenses. Rather, under GAAP accounting, it should be gradually and systematically amortized over the term of the agreement.

When do prepaid expenses hit the income statement?

Under the accrual method, no expense is recorded until it is incurred. In layman’s terms, prepaid expense is recognized on the income statement once the value of the good or service is realized, i.e, the service or good is delivered. If the prepaid asset is to be utilized over a prolonged period of time, say 12 months, then a portion of the overall expense will be recognized equally each period over the course of the year until the prepaid expense is completely consumed.

Common examples of prepaid expenses

The most-common examples of prepaid expenses in accounting are prepaid rent from leases, prepaid software subscriptions, and prepaid insurance premiums. Below you’ll find a detailed description of each one as well as detailed accounting examples for each.

Lease contracts

Leases can be a great example of situations where a contract may require a lessee to pay a portion of their obligation prior to or at lease commencement. These types of stipulations are generally observed in real estate leases where the landlord typically requires one or two months of the monthly rent obligation upon execution of the contract or at lease commencement. Note that this situation is different from a security deposit which is generally refundable.

Now if this were a short-term lease, then a prepaid asset would be recognized on the balance sheet for prepaid rent expense. However, under the new lease accounting pronouncements, the guidance eliminates recognizing prepaid assets on the balance sheet related to leases exceeding a total lease term of 12 months. Rather, any prepaid rent pertaining to a long-term lease would be rolled into the ROU asset balance recognized on the balance sheet.

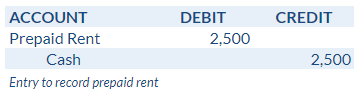

Example of accounting for a prepaid lease

For the purposes of this example, assume we’ve signed a short-term real estate lease for seven months which requires the first month’s payment be made on the contract execution date of January 1st, 2023 but the contract actually commences on March 1st, 2023. The contract terms are as follows:

Lease Execution Date: January 1st, 2023

Lease Commencement Date: March 1st, 2023

Lease Expiration Date: July 31st, 2023

Monthly Rent: $2,500

Lease payments are due at the end of each month

Our journal entry to record the prepaid rent expense is:

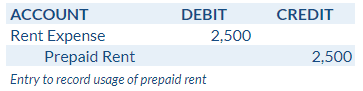

In this scenario, we’ve recognized a prepaid asset which will be utilized at the end of the first month of the lease. Therefore on March 31st, 2023, the journal entry to release the prepaid expense is:

Software subscriptions or SaaS

Typically, when an organization obtains a software subscription, the software vendor incentivizes the organization with favorable pricing if they sign a longer-term commitment and pay for the total contract upfront. Would you rather pay $200 each month for one year or prepay $1,500 for the entire year and save $900? The software that’s sold with this type of arrangement is often referred to as SaaS, or “Software as a Service,” because of its similarity to service contracts.

Example of accounting for a prepaid subscription

If we pay the $1,500 upfront, how are the financial statements affected? In this scenario, we would record a prepaid asset at the beginning of the contract and the expense of the subscription would be realized over the course of the year. This would achieve the matching principle goal of recognizing the expense over the life of the subscription.

To illustrate, let’s assume the following:

Subscription Commencement Date: January 1, 2023

Subscription End Date: December 31, 2024

Payment Terms: Full payment required on January 1, 2023

Subscription Amount: $2,000

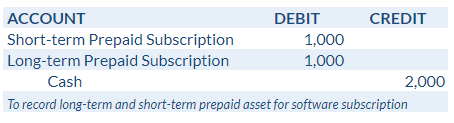

The journal entry at the commencement of the contract is:

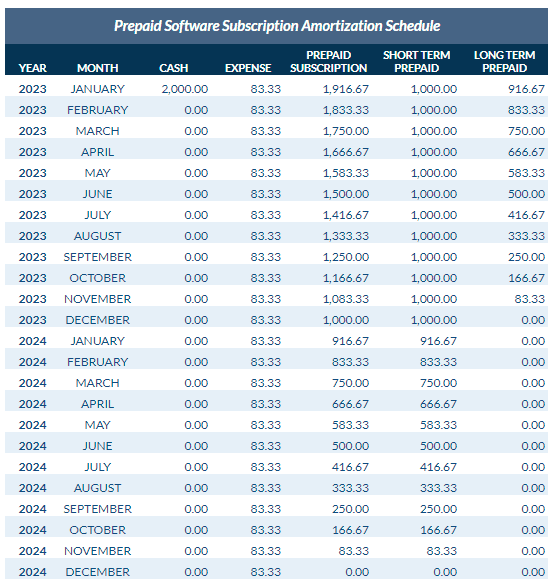

Note that in this example we established a short-term and long-term prepaid component because the initial payment was for a two-year subscription. The long-term subscription prepaid represents the value of the subscription paid for in advance beyond 12 months and is amortized at the beginning of the subscription term. The short-term subscription prepaid represents the value of the subscription to be used over the immediately following 12 months and is amortized after the long-term portion of the prepaid subscription is reduced to zero. The proceeding amortization schedule illustrates the appropriate amortization of the short-term and long-term portions of the prepaid subscription.

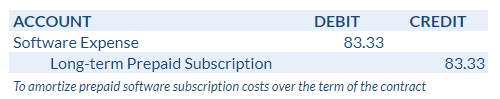

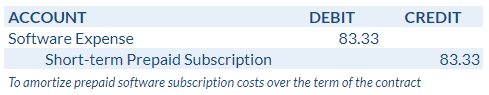

The amortization schedule has a column for the total cash payment made at the beginning of the subscription term of $2,000. We then divide the $2,000 over the 24 months of the subscription term to arrive at a monthly subscription cost of $83.33, to be recognized on the income statement each month the subscription is utilized. Concurrently, we are also amortizing both the long-term and short-term balances of the prepaid subscription.

The journal entries for the first 12 months of the subscription contract are as follows:

The journal entries for the second 12 months of the subscription contract are as follows:

Ultimately, by the end of the subscription term, both the long-term and short-term portions of the prepaid subscription account balances will be zero.

Insurance premiums

Insurance premiums are another common example of a prepaid expense. Typically an entity will pay its insurance premiums at the beginning of the policy period, recognizing a prepaid asset subsequently amortized over the term of the policy.

Example of accounting for prepaid insurance

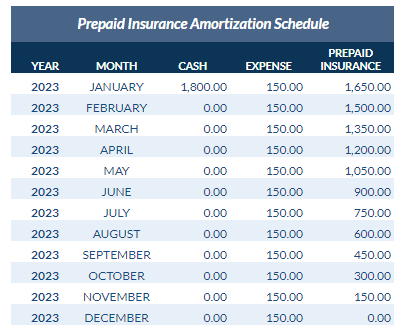

In this example, let’s assume we purchase a 12-month cyber insurance policy for $1,800 on January 1st, 2023. The term of the policy is only 12 months, therefore we will not recognize any long-term prepaid asset. To recognize the expense of the policy evenly over the policy term, divide the total policy amount of $1,800 by 12 for a monthly insurance premium expense of $150.

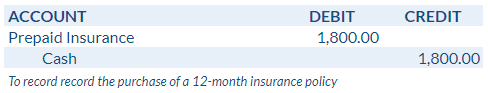

The journal entry to record the purchase of the insurance policy is as follows:

You may want to set up an amortization table to track the decrease in the account over the policy term and to determine what the journal entries will be.

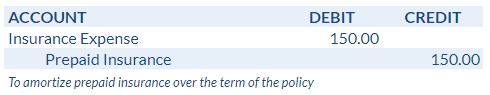

The journal entries in the proceeding months are as follows:

Impact of prepaid expenses on liquidity ratios

Current ratio

The current ratio is a useful liquidity metric to evaluate whether a company can meet its short-term obligations by utilizing assets which can quickly be converted into cash. The current ratio is calculated by dividing current assets by current liabilities. By definition, current prepaid assets would be included in the numerator, or current assets portion of the current ratio, and positively affect the results.

Quick ratio

The quick ratio, while also being a liquidity ratio, only factors in an organization’s most liquid assets such as cash and cash equivalents that can be converted the quickest, hence the same. The quick ratio is calculated by dividing cash, or an organization’s most liquid assets such as cash equivalents, marketable securities, and accounts receivable by its current liabilities. As a result of not being a cash equivalent or highly liquid, prepaid expenses do not impact the quick ratio.

Summary

Although being a simple concept, it is important for an organization to correctly account for and recognize prepaid expenses on its balance sheet. Prepaid assets typically fall in the current asset bucket and therefore impact key financial ratios. Additionally, an organization reporting under US GAAP must follow the matching principle by recognizing expenses in the period in which they are incurred. This requires proper calculation and amortization of prepaid expenditures such as insurance, software subscriptions, and leases.