Leasehold improvements (LHI) are modifications made to a leased space or leased asset to make it more useful to, or to fit the particular needs of, the tenant. A tenant may want to customize leased office or retail space for their business before moving in. This will likely involve spending money on build-outs or additions to the space (leasehold improvements) to ensure the space meets the tenant’s requirements. Sometimes, the lessor will reimburse the lessee for leasehold improvements. If a reimbursement or tenant improvement allowance is associated with leasehold improvements made by the lessee, it may be a lease incentive.

Common examples of leasehold improvements

Not every update made to a space can be considered a leasehold improvement. Some improvements, such as those made to the exterior of the building or those that benefit other tenants or the lessor, are not considered leasehold improvements. The criteria to capitalize and record leasehold improvements also depends on any internal capitalization or materiality policy of the company (i.e., tenant), and should be considered when accounting for leasehold improvements.

Here are some common leasehold improvement examples:

- Customized lighting fixtures

- Floor finishes, such as carpet, tile, etc.

- Painting walls or other interior space

- Partitions for separating space

- Addition of a building to leased land

Changes made to the exterior of a building or improvements that benefit other tenants are likely not leasehold improvements. Examples of non-leasehold improvements include things like construction or additions to the elevator, exterior roof, shared parking garage, or any external structural improvements. To clarify further, increasing the value or the life of an entire property is viewed as a building improvement whereas leasehold improvements are customizations or changes specific to only one tenant.![]()

Accounting for leasehold improvements

Leasehold improvements are assets, and are a part of property, plant, and equipment in the non-current assets section of the balance sheet. Therefore, they are accounted for with other fixed assets in accordance with ASC 360. The US GAAP lease accounting standards, both ASC 840 and ASC 842, also discuss the amortization of leasehold improvements related to operating leases.

Amortization of leasehold improvements

ASC 840-10-35-6 states that leasehold improvements to operating leases placed in service significantly after, and not contemplated at or near the beginning of, the lease term need to be amortized over the shorter of the useful life of the asset or the remaining lease periods and renewals that are deemed to be reasonably certain at the date the leasehold improvements are purchased.

Similarly, ASC 842-20-35-12 states that leasehold improvements need to be amortized over the shorter of the useful life of the leasehold improvements or the remaining lease term. However, if the lease transfers ownership of the underlying asset to the lessee or the lessee is reasonably certain to exercise an option to purchase the underlying asset, the lessee should amortize the leasehold improvements to the end of their useful life.

Ultimately, accounting for the amortization of leasehold improvements did not change from ASC 840 to ASC 842.

Example of leasehold improvement amortization

In order to amortize leasehold improvements appropriately, the lessee needs to determine the correct accounting period to apply the amortization rules outlined above.

As an example, let’s assume that a lessee signs a 10 year lease for a building to be used as office space. In addition to the 10 year term, the lessee also has an option to renew the lease for an additional 5 years at the end of the lease term. In order to meet their business needs, the lessee spends $200,000 to customize the offices in the building immediately after the lease commences. The useful life of these improvements (the offices) is 30 years. The lessee decides that, at lease commencement, they are not reasonably certain to exercise the 5 year option to renew the lease. Additionally, there are no purchase options for the office space and ownership does not transfer to the lessee at the end of the lease term.

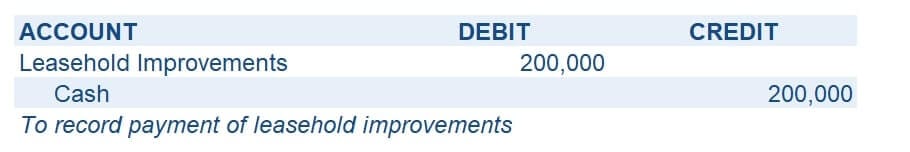

When the leasehold improvements are made, the lessee makes the following entry:

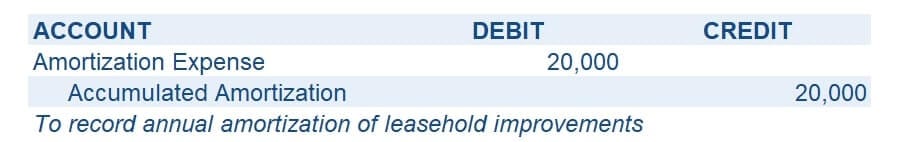

The lessee amortizes the $200,000 cost of the leasehold improvements over the shorter of the useful life of the improvements or the lease term. The lease term is 10 years, and the useful life of the improvements is 30 years, so the $200,000 should be amortized over 10 years. The lessee will recognize annual amortization expense of $20,000 ($200,000/10) over the next 10 years by making the following entry each year:

Leasehold improvements and AROs

Another consideration that must be made when a lessee has leasehold improvements is whether or not an asset retirement obligation (ARO) exists. An ARO is a liability for the removal of property, equipment, or leasehold improvements at the end of the lease term or retirement of the long-lived asset. ASC 410, Asset Retirement and Environmental Obligations, section 20 (ASC 410-20) contains the guidance from FASB on how to account for AROs.

Sometimes the terms of a lease contract require a lessee to remove leasehold improvements they have made to the leased asset prior to returning the asset to the lessor at the end of the lease term. If that is the case, the lessee will record an ARO liability and will need to account for it under ASC 410, in addition to accounting for the leasehold improvements as fixed assets.

For example, assume a lessee enters into a building lease and paints the walls to match their company brand colors. The lease agreement states that the lessee must repaint the walls to their original color. Therefore, the estimated cost to do so is an ARO for the lessee.

It is important to note that both AROs and leasehold improvements do not strictly apply to office space leases, but to all leased assets. An industrial gas production company that leases land and installs underground storage tanks on the site is an example of another ARO scenario. Within the lease terms, the lessor stipulated that the lessee is obligated to restore the site to its original condition prior to when the lessee took control of the leased land. Because the underground storage tanks were installed by the lessee, the lessee’s obligation to remove the tanks is an ARO.

Tax considerations for qualified leasehold improvements

Certain leasehold improvements, if qualified, allow for accelerated depreciation or bonus depreciation. Accelerated depreciation and amortization are concepts specific to tax filing. Essentially, tangible, real property that meets certain criteria may be eligible for this depreciation treatment which allows companies to incur more depreciation expense in the period placed in service as compared to the standard US GAAP straight-line methodology. As a result, the depreciation time frame is accelerated for tax purposes. Increasing a company’s upfront depreciation expense, reduces its taxable income, which eventually equates to reduced cash outflows.

Qualified improvement property for Section 179

Section 179 of the US Internal Revenue Code is the section of the federal tax code that establishes bonus depreciation criteria. For assets that meet the criteria, an immediate expense deduction, or bonus depreciation, is available for companies on purchases of this property instead of capitalizing and depreciating the asset over time. The amount of bonus depreciation allowed per asset and the total amount of bonus depreciation allowed in a certain year varies with the tax code. Section 179 property is generally tangible property but the criteria was expanded in 2018 to include qualified improvement property, which may include leasehold improvements.

Qualified improvement property (QIP) is any improvement to the interior of a nonresidential building if such improvement is placed in service after the date the building was first placed in service. QIP excludes expenses that are attributable to a building’s enlargement, elevators/escalators, or the internal structural framework of the building.

Make sure to talk to your tax advisors about whether or not your leasehold improvements are qualified for certain tax benefits and tax treatment.

Summary

Understanding what types of improvements are considered leasehold improvements is critical to ensuring you are applying the correct accounting treatment. Accounting for leasehold improvements has remained consistent, despite the change in the lease accounting standards. Leasehold improvements are an asset that must be accounted for and amortized over the shorter of the useful life of the improvement or the lease term. Additionally, certain types of improvements may be qualified for Section 179 tax treatment. Make sure to discuss any leasehold improvements you may have with your tax advisors to see if your improvements qualify for any special tax treatment or benefits.