This article, "ASC 946: Unique Accounting Issues for Funds – Free Webinar," originally appeared on GAAPDynamics.com.

If you’re reading this post, you know that investment companies are unique and must follow industry-specific accounting and reporting rules under ASC 946. You must also know that finding industry-specific training for investment management entities, like hedge funds and private equity funds, is nearly impossible. Well, good news! We are hosting a webinar, ASC 946: Unique Accounting and Reporting Issues for Funds, on Wednesday, October 26, 2023, starting at 11:00am ET, and you’re invited. You’ll get CPE and the best part is it’s FREE!

In this example-driven and interactive webinar, Bob Laffler and Chris Brundrett discuss some of the most common, yet challenging, accounting and reporting issues faced by various open-end and closed-end funds— highlighting the uniqueness of the industry and its application of U.S. GAAP accounting principles set out in ASC 946. If you’re responsible for the financial reporting for or auditing of investment companies, you’ll want to attend this webinar! Can’t make the date/time? No worries. We’ll record the webinar and make it available for viewing afterwards. Just use the same link and you’ll be taken to the recording.

If you’ve ever taken one of our courses, you know that they are fun, usually including a theme of some sort. You also know that they are filled with numerous class discussion questions that:

- Emphasize key learning points,

- Demonstrate application of the rules, and/or

- Spotlight current hot topics noted by regulators.

This is especially true for our U.S. GAAP and IFRS Update courses specifically tailored to investment management entities. This is because so many of the new standards released by the FASB and IASB just don’t relate to investment companies. That’s why firms around the world engage GAAP Dynamics to develop and facilitate industry-specific training, including annual updates, geared towards investment management, insurance, banking, and real estate entities. This is in addition to our “normal” update courses for commercial entities.

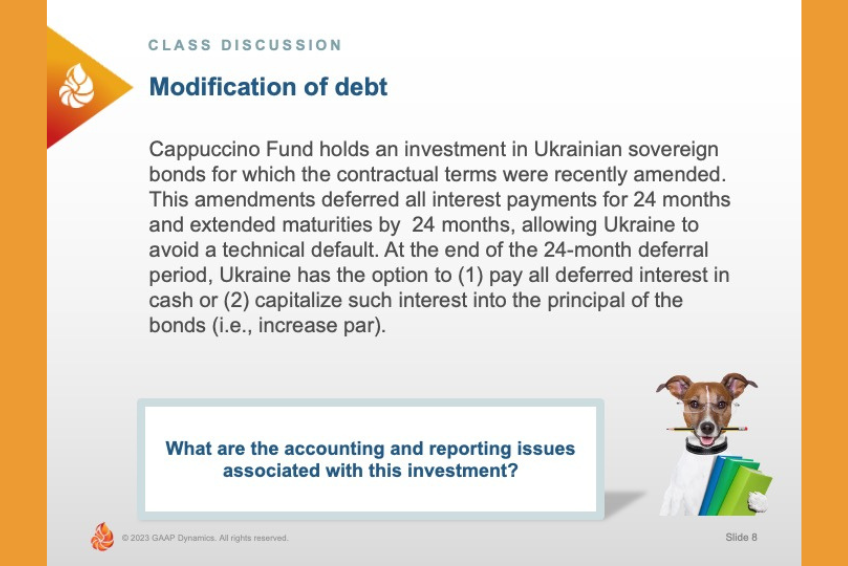

Our 2-hour U.S. GAAP Update: Investment Management (2023) course, which we are currently facilitating for accounting firms around the world, has 17 class discussion questions, many of which were derived from issues discussed by the AICPA Investment Companies Expert Panel. Here’s an example of a class discussion question which is included in this year’s U.S. GAAP Update: Investment Management (2023) course:

This question was derived from the AICPA Investments Companies Expert Panel (EP), specifically the highlights of their September 13, 2022, meeting, and it is based on real events. Like so many of our class discussion questions, there isn’t a definitive answer and judgment would need to be applied to determine the appropriate accounting. However, we use these types of questions to solicit feedback from participants and increase engagement.

Here’s the accounting and reporting issues associated with this investment:

How should the bonds be priced?

All investments held by investment companies need to be accounted for at fair value, with changes in fair value reported in earnings. However, what is the “price” of this bond investment? After these amendments were approved, U.S. pricing services began using “dirty” pricing for these bonds. This means that their price quote was inclusive of full, contractual accrued interest, rather than a “clean” price which would not include accrued interest.

Why does it matter? All entities, including investment companies reporting under ASC 946, need to accrue interest income using the effective rate method. However, if you used the “dirty” price and didn’t back out the accrued interest, then all the interest would be included in the fair value change, and not within interest income which is required by U.S. GAAP.

The EP also discussed that all facts and circumstances, including the approved amendments, should be considered in determining whether these debt instruments should be put on non-accrual status.

Do the amendments represent a “substantial” modification?

If these amendments are deemed to be a “substantial” modification, then it represents an extinguishment. If this were the case, then it means a realization event has occurred, as the “old” bonds (pre-modified bonds) would be taken off the books and the “new” bonds (post-modified bonds) would be put on. Any difference between the amounts of the “old” and “new” bonds would be recorded as a realized gain or loss on the investment.

The EP noted that tax rules would deem these investments as a “significant modification,” which triggers a taxable exchange of the legacy bonds for the newly amended bonds. However, under U.S. GAAP, there is some judgment involved. Generally, we’d look at the expected cash flows before and after the modification and, if they differed by more than 10%, we’d say you’d have an extinguishment, but that guidance is for debt (i.e., a liability), not for an investment.

The EP questioned whether the U.S. GAAP guidance related to TDRs would apply to investments that are measured at fair value through profit and loss and whether this would result in an extinguishment of the old bonds and establishing of new bonds, which would cause a realization event for the fund. One EP member observed that some view the guidance in ASC 310-20 as not strictly applicable to investments held at fair value, but some funds may look to the guidance in that Section, by analogy, when determining whether a change in loan terms results in a realization event and a new instrument.

Wasn’t that fun? Imagine an entire course filled with them. Well, if you join Bob and Chris for the webinar, your dreams will become reality!

Are you or your team new to the investment management industry and looking to get up to speed on the unique accounting and reporting requirements within ASC 946? Well, look no further than our Investment Management Industry Fundamentals course collection! We’ve bundled together nine eLearning courses (eligible for 10.4 CPE) at a great price, covering the topics you need to know if you’re responsible for financial reporting or auditing of investment companies under U.S. GAAP. And, since you’re a loyal IM enthusiast, we’ve got a special offer just for you! Enter the code IM4ME2023 to get 30% of the price of the collection. But hurry, this offer expires when we ring in the new year!

About GAAP Dynamics

We’re a DIFFERENT type of accounting training firm. We don’t think of training as a “tick the box” exercise, but rather an opportunity to empower your people to help them make the right decisions at the right time. Whether it’s U.S. GAAP training, IFRS training, or audit training, we’ve helped thousands of professionals since 2001. Our clients include some of the largest accounting firms and companies in the world. As lifelong learners, we believe training is important. As CPAs, we believe great training is vital to doing your job well and maintaining the public trust. We want to help you understand complex accounting matters and we believe you deserve the best training in the world, regardless of whether you work for a large, multinational company or a small, regional accounting firm. We passionately create high-quality training that we would want to take. This means it is accurate, relevant, engaging, visually appealing, and fun. That’s our brand promise. Want to learn more about how GAAP Dynamics can help you? Let’s talk!

Disclaimer

This post is published to spread the love of GAAP and provided for informational purposes only. Although we are CPAs and have made every effort to ensure the factual accuracy of the post as of the date it was published, we are not responsible for your ultimate compliance with accounting or auditing standards and you agree not to hold us responsible for such. In addition, we take no responsibility for updating old posts, but may do so from time to time.