This article, "An FAQ on California’s Proposition 39 and How It Affects School Districts," originally appeared on MossAdams.com.

Construction bond programs are often the largest expenditure of a district’s capital and operating budget. With bond program costs ranging from millions to several billion dollars, citizens and stakeholders want to know where and how funds are spent.

High-profile, high-dollar projects—such as infrastructure upgrades, upgrades to schools, and athletic facilities—likely receive extra scrutiny from the organization, the media, and the public.

Common program pitfalls might include project charges not specifically addressed in the ballot language and cost overruns resulting from ineffective procurement practices, schedule delays that impact operations, or penalties for noncompliance with state or federal regulations. Expertise in construction programs and the related controls aren’t typically core competencies for school districts and the individual departments within them.

Understanding California Proposition 39, the accountability requirements, and best practices is essential to support a successful bond program. In the following, you’ll find details on the following questions:

What Is Proposition 39?

California voters passed Proposition 39 on November 7, 2000, which amended provisions to the California Constitution and subsequently amended the California Education Code accordingly.

The purpose and intent of the initiative was “to implement class size reduction, to ensure that our children learn in a secure and safe environment, and to ensure that school districts are accountable for prudent and responsible spending for school facilities.”

It provided for the following amendments to the California Constitution:

- “To provide an exception to the limitation on ad valorem property taxes and the two-thirds vote requirements to allow school districts, community college districts, and county offices of education to equip our schools for the 21st Century, to provide our children with smaller classes, and to ensure our children’s safety by repairing, building, furnishing and equipping school facilities;

- To require school district boards, community college boards, and county offices of education to evaluate safety, class size reduction and information technology needs in developing a list of specific projects to present to the voters;

- To ensure that before they vote, voters will be given a list of specific projects their bond money will be used for;

- To require an annual, independent financial audit of the proceeds from the sale of the school facilities bonds until all of the proceeds have been expended for the specified school facilities projects; and

- To ensure that the proceeds from the sale of school facilities bonds are used for specified school facilities projects only, and not for teacher and administrator salaries and other school operating expenses, by requiring an annual independent performance audit to ensure that the funds have been expended on specific projects only.”

Background Leading to Proposition 39

During the 1980s and 1990s, California experienced tremendous population growth and demand for new school construction, as well as the need to modernize, repair, and refurbish many of the schools built in the 1950s and 1960s.

Raising funds for new and refurbished schools required voter approval via the passage of general obligation bonds, which were difficult to pass with a two-thirds supermajority.

In recognition of this need and difficulty in obtaining two-thirds approval, California voters passed Proposition 39, which lowered the voter approval for school general obligation bonds to 55% with accountability requirements.

What Are Accountability Requirements for Proposition 39?

Proposition 39 bond programs are often the largest portion of a K–14 school district’s annual expenditures.

With program costs ranging from a few million to several billion dollars, stakeholders want to know where and how funds are spent.

High-profile, high-dollar projects—such upgrades to schools and facilities—receive extra scrutiny from the various stakeholders, including taxpayers, given the many requirements and best practices expectations by district and community members.

To that end, Proposition 39 created several accountability requirements associated with the lower 55% threshold for approval.

Accountability Requirements for Proposition 39

- Present voters with specific project list that indicates how the money would be spent

- Establish a Citizens Oversight Committee to oversee the spending and reporting of such expenditures to the public

- Don’t use funds for salaries or operating expenses

Conduct annual performance and financial audits that comply with generally accepted government auditing standards (GAGAS)

How Does the Citizens Oversight Committee Requirement for Proposition 39 Affect School Districts?

Proposition 39 requires school districts that pass bonds to establish and appoint members to an independent Citizens Oversight Committee to support a successful, transparent, and accountable bond program.

What Are the Core Duties of a Citizens Oversight Committee Member?

Based on Education Code Sections 15278, the Committee’s three core duties are:

- Inform the public on the district’s expenditures of bond revenue

- Actively review and report on the proper expenditures of taxpayer’s money for school districts

- Produce and present an annual report to summarize the committee’s findings, proceedings, and activities within the prior year

What Are Membership Requirements for the Citizens Oversight Committee?

The Citizens Oversight Committee must consist of at least seven members to serve for a two-year term without compensation and for no more than two consecutive terms.

Members are required to meet certain requirements to ensure a well-balanced committee—such as one member needs to be active in a bona fide taxpayers’ organization, one member needs to be a parent or guardian of a child enrolled in the district, and more.

They should specifically engage in any of the following activities to maximize the benefit to the school district or community college organization and the community they serve:

- Receive and review the annual independent performance audit and financial audit reports

- Inspect school facilities and grounds to ensure that bond revenue is expended in compliance with bond requirements

- Receive and review copies of any deferred maintenance proposal or plans developed by the K–14 school district

- Review efforts by the school district or community college district to maximize bond revenue by implementing cost-saving measures

Cost-Saving Measures

Cost-saving measures include the following:

- Mechanisms designed to reduce the costs of professional fees, site preparation, and school site design by incorporating efficiencies

- Recommendations regarding the joint use of core facilities and a cost effective and efficient reusable facility plan

What Are Annual Performance and Financial Audit Requirements for Proposition 39?

The performance audit mentioned in the constitutional amendment can provide a tool for the Citizens Oversight Committee to report on the compliance of Bond expenditures.

However, there was little legislative guidance on the specific components of such a performance audit other than an audit must determine two things—that funds:

- Were spent on projects approved by the voters

- Weren’t spent on operating expenses—such as teacher and administration salaries and other school operating expenses

What Is GAGAS?

The Government Accountability Office (GAO) issues the GAGAS, also known as the Yellow Book. It provides performance auditors with standards and an understanding of how to apply them to complete audit objectives.

What Is a Compliance Audit?

It’s important to note that not all performance audit reports result in conclusions that improve efficiency and reduce business risk exposures. Most schools perform the minimum requirement assessing whether expenditures were for List Projects, as defined in the Bond Documents, only.

This audit objective may not be broad enough to provide information to an organization that would allow the organization to reduce its risks.

Such limited performance audits are termed compliance audits. Compliance performance audits are most often used by school districts and cited as so-called clean audits if there are no exceptions noted.

What Are Some Risks or Challenges with Performance Audit Components?

If an auditor doesn’t have the technical background in construction and bond programs, the following performance audit components may be at risk of not being properly addressed:

- Objectives

- Criteria

- Methodology and Scope

Objectives

The most appropriate objectives to address the various performance aspects of your capital program may not be selected. Your bond program may be experiencing cost overruns, inadequate identification of project scope, gaps in funding availability, or schedule delays.

Audit objectives may need to be selected that review project processes, procedures for managing scope, prioritization of projects, quality, schedule, budget, or change-control methodologies and reporting.

Criteria

The most appropriate criteria to evaluate results, controls, efficiency, and compliance may not be utilized.

Setting appropriate criteria is a critical step and may include purposes or goals prescribed by law, regulations, or the audited entity’s officials; policies and procedures; and technically developed standards or norms.

Methodology and Scope

The methodology and scope selected may not result in sufficient and appropriate evidence to support meaningful audit conclusions.

Scope and methodology should be designed to obtain sufficient, appropriate evidence that addresses the program’s objectives and provides a reasonable basis to support the report’s conclusions.

What Are Compliance Standards for Performance Audits?

All performance audits should at a minimum comply with standards outlined under Proposition 39.

There are, however, benefits for the school district to provide a more expansive audit that looks at the efficiency and effectiveness of spending. This more expansive audit often results in significant control improvements and cost savings to districts, which often exceed the fees of the expanded audit.

The challenge is convincing the school district to go beyond the basic performance audit requirements of reporting on whether funds were spent on authorized projects and not on operating expenses.

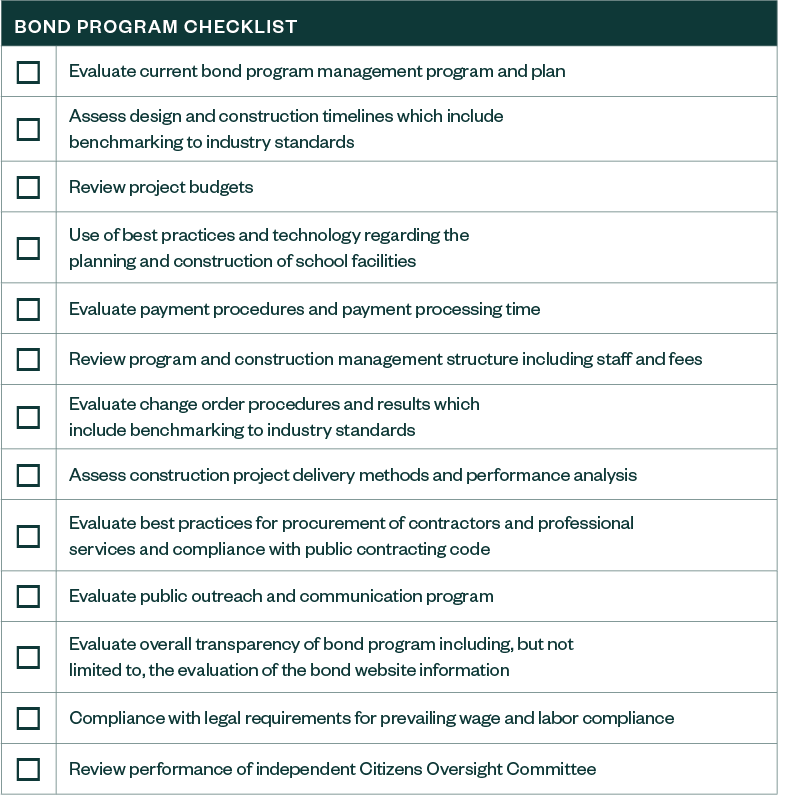

Next Steps: Checklist for Oversight Committees and Performance Auditors

Providing an independent review and evaluation of the bond program should consider including at least the following, consistent with best practices.

Find the Right Performance Auditor to Help with Proposition 39

Performance auditors are required to complete applicable continuing professional education (CPE), measured in required credits, and technical knowledge and competence with specialized subject matter.

Audit organizations conducting performance audits are also required to meet specific peer review requirements.

CPE Requirements

Specifically, in accordance with GAGAS, auditors should develop and maintain their professional competence by completing at least 80 hours of CPE for every two-year period.

Those 80 hours are made up of the following:

- 24 hours directly relating to government auditing, the government environment, or the specific or unique industry in which the audited entity operates

- 56 hours that enhance the auditor’s professional proficiency to perform audits

Auditor Competence

In addition to CPE, the auditors that management assigns to conduct the engagement must possess the competence necessary to address engagement objectives and perform their work in accordance with GAGAS.

Expertise in Proposition 39 requirements, construction, project management, and related controls aren’t typically core competencies for school districts, community colleges, oversight committee members, and even certain accounting firms.

Construction performance auditors bring to each engagement expertise in construction and performance audit methodologies and analysis techniques as well as their specialized construction knowledge relating to school districts, community colleges, and oversight committees.

These auditors can identify risks based on the audit objectives, recommend best practices, and help each district achieve its capital program and execution efficiently, effectively, safely, and transparently.

To support schools, community colleges, communities, and various stakeholders, it’s critical that performance auditors and oversight committee members understand the minimum requirements and best practices recommendations.

Peer Review

A recent update to GAGAS differentiates the peer review requirements for audit organizations, such as CPA firms and state audit organizations, that are affiliated with a recognized organization from those that aren’t.

Additional requirements are imposed for audit organizations not affiliated with recognized organizations.

Learn More

CABOC engages in issues of public policy regarding Proposition 39 school construction bond oversight including conducting educational meetings, preparing, and distributing educational materials, or otherwise considering school bond oversight issues in an educational manner.

Visit the California Association of Bond Oversight Committees (CABOC) to learn more about performing as a Citizens Oversight Committee member as well as details for its First Annual Virtual Statewide Conference on October 16, 2021.

We’re Here to Help

To learn more about Proposition 39 and how it could affect your school district, contact your Moss Adams professional.