This article, "GASB Proposes Recognizing More Leased Assets and Liabilities," originally appeared on CPAJournal.com.

Accounting for leases has received considerable attention from standards setters in recent years. Under current FASB and GASB accounting rules, many leases are structured to avoid the recognition of leased assets and corresponding liabilities on the balance sheet. Seeking to remedy this, FASB, in a joint project with the IASB, issued a revised Exposure Draft of its proposed Accounting Standards Update (ASU) on lease accounting on May 16, 2013 and released its final standard in February 2016 (available at http://bit.ly/2mG3j2D). GASB issued its own Exposure Draft, “Leases,” on January 25, 2016, with comments due by May 31, 2016 (http://bit.ly/1XyYEJ4). Based on comments, GASB is in the process of re-deliberating the Exposure Draft.

This article explores the differences between recording a lease within the governmental activities/funds under the current and proposed standards for a lessee. It delineates differences between the proposed standards for government and private sector reporting, using a simplified version of the financial reporting example from “A Refresher on Accounting for Leases: A Detailed Example under the Proposed Guidance,” by Jason Porter (CPA Journal, January 2016, http://bit.ly/2neu22U). Finally, it estimates the possible effect of capitalizing operating leases using the 2015 New York State Comprehensive Annual Financial Report.

Example of a Basic Lease

As per Porter’s example, on January 1, 2015, the City of Hamford and CTF Leasing signed an 11-year lease agreement for a storage facility with an estimated remaining economic life of 15 years and a final salvage value of $60,000. The storage facility is near the city’s Department of Public Works building and will be remodeled by CTF to meets its requirements. The city will be responsible for maintaining the facility throughout the lease term. The contract has no restriction on how the storage facility might be used, and at the end of the lease period, CTF will retain the facility.

The estimated market value of the storage facility on the day the lease is signed ($300,000) is also its carrying value on CTF’s books. At the end of the lease period, CTF estimates that the facility will be worth $100,000. Based on these estimates and a 4% interest rate, CTF has set the lease payment at $25,798, payable at the beginning of the lease and then on January 1 each following year. The city has agreed to the terms of the lease but has not guaranteed the residual value. Because the city does not know the exact interest rate the CTF used to calculate the interest payments, it will use its own 5% incremental borrowing rate. The city spent $4,000 to initiate the lease.

Under current governmental GAAP, as well as its FASB counterpart, the contract does not meet any of the requirements to be considered a capital lease for the lessee [GASBS 62, Paragraph 213 (or L20.105)]. There is no transfer of ownership nor bargain purchase option and the term of the lease is 73% of the asset’s remaining useful life (11 out of 15 years). The present value of the lease payments using the city’s 5% incremental borrowing rate is $225,002 (75% of its $300,000 market value).

The first step under the proposed standard is to determine whether the contract meets the definition of a lease as a “contract that conveys the right to use a non-financial asset (the underlying asset) for a period of time in an exchange or exchange-like transaction” (“Leases,” ED, para. 3). The proposed standard excludes leases for intangible assets, biological assets, and service concessions, as well as some leases financed by outstanding conduit debt (para. 5). In addition, the lease should neither transfer ownership (para. 14) nor be a short-term lease with a maximum possible contract term less than 12 months (para. 60). The second step is to determine how many components the lease includes and how to account for them. Although the example contract involves both the warehouse and land, they are highly interrelated, have the same term, and contain no observable stand-alone pieces. Thus, the contract may be accounted for as a single lease.

The proposed GASB standard establishes a single model for leases with a maximum term of more than 12 months. It eliminates the distinction between capital and finance leases in current GASB and FASB standards. Unlike the proposed FASB standard, there is no separate treatment for capitalizing Type A (finance) and Type B (operating) leases. To meet the needs of governmental reporting, the exposure draft specifies treatment for financial statements using the current financial resource measurement perspective (fund account).

Initial Recognition—Lessee

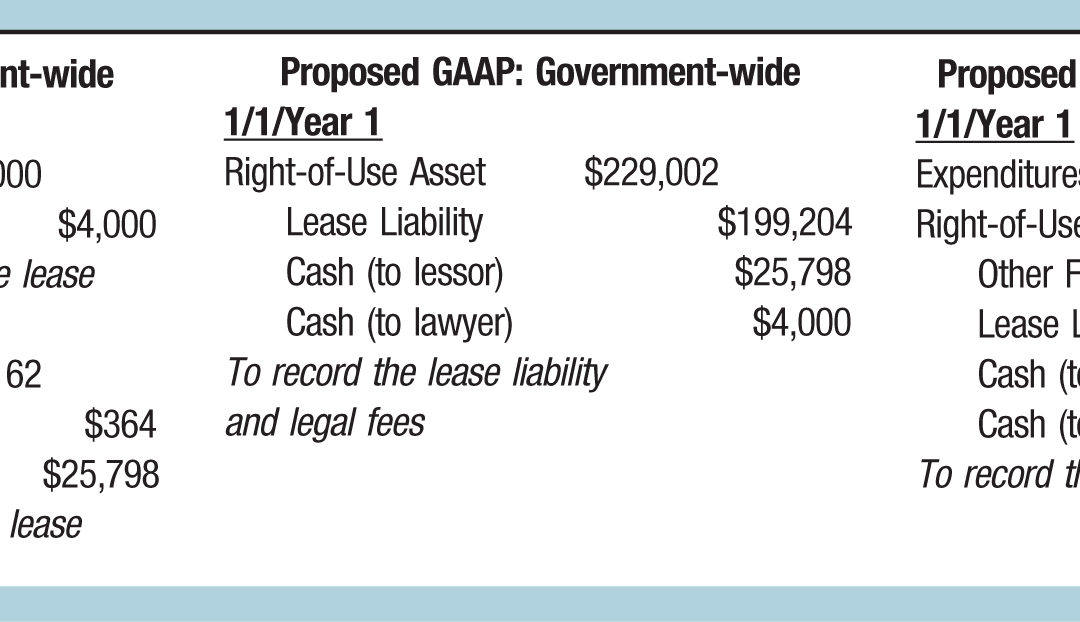

Exhibit 1 shows the journal entries for a government lease using the existing government-wide method, the proposed government-wide method, and the proposed method for governmental fund accounting. Government-wide financial statements have a total economic resource measurement focus and use accrual basis accounting; governmental fund financial statements have a current economic resource measurement focus and use modified accrual basis accounting. Under the current rules, this contract is treated as an operating lease, although the lessee controls the asset for most of its useful life. The city recognizes lease expense ($26,162) for the lease payment ($25,798) and the amortization of initial direct costs ($364) in this and all subsequent years. The transaction affects both the statement of net position and statement of activities of the government-wide financial statements (analogous to the balance sheet and income statement). The city recognizes neither a leased asset nor a lease liability on the statement of net position, using the operating lease treatment in the current rules.

EXHIBIT 1

Initial Recognition of Lease by Governmental Lessee

With the official release of FASB’s new standard for leases, the GASB lease project has become more important.

Under the proposed accounting rules for government-wide financial statements, the city recognizes a right-of-use leased asset ($229,002) for the sum of 1) the present value of the lease payments using the city’s incremental borrowing rate ($225,002) and 2) the initial direct costs of the lease ($4,000). Its lease liability ($199,204) consists of the amount for the right-of-use of leased asset ($229,002), less the initial lease payment ($25,798). The transaction affects the statement of net position for the government-wide financial statements, which uses accrual accounting.

Under the proposed rule for government fund accounting, an expenditure for the right-of-use leased asset is recognized in the statement of revenues, expenditures and changes in fund balances for the governmental funds. The lease liability is counted as an “other financing source” on the same statement. This transaction does not yet affect the governmental fund “balance sheet,” which uses a current financial resource measurement focus.

Subsequent Recognition—Lessee

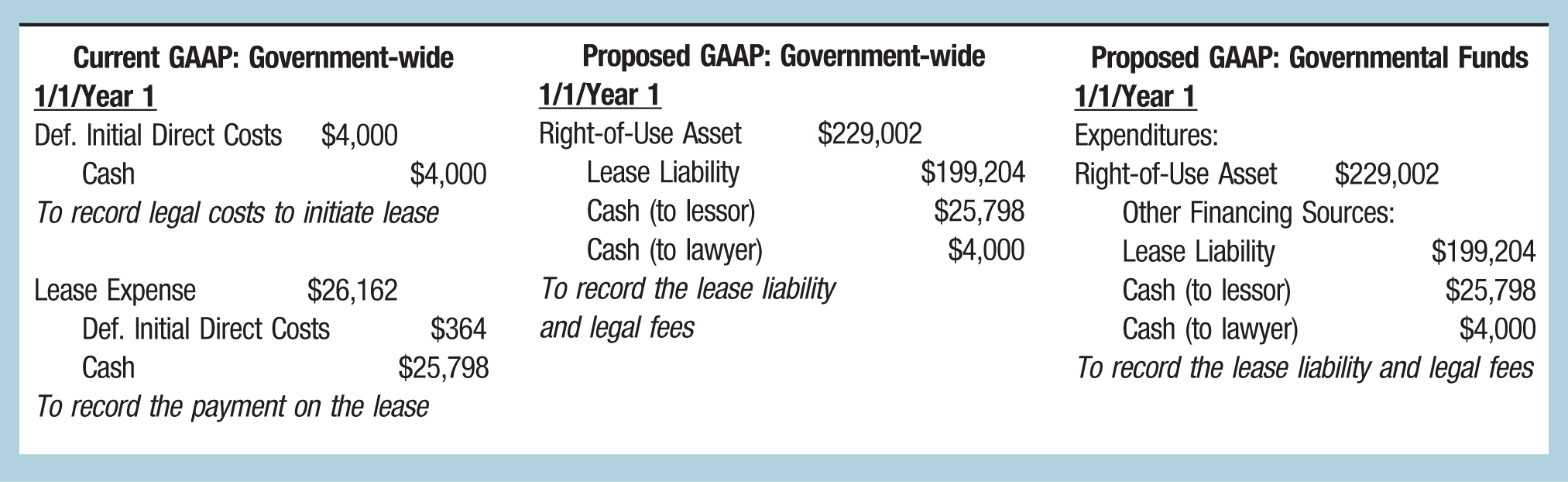

Exhibit 2 shows the recognition of the lease over the next two years. At the end of the first year, on December 31, 2015, there are no further entries for this lease using the current GAAP for operating leases in the government-wide financial statements. In the proposed GAAP for the government-wide financial statements, however, it is necessary to accrue 1) interest expense on the lease liability based on the lessee’s 5% incremental borrowing rate and 2) amortization expense for the right to use the leased asset. Using the proposed GAAP for governmental funds, it is necessary to accrue the interest expense on the lease liability because it will be paid out of current funds early in 2016. There is no amortization expense because the right-to-use leased asset is treated as a one-time expenditure instead of as an asset on the balance sheet.

EXHIBIT 2

Subsequent Recognition of Lease by Governmental Lessee

Using the current government-wide GAAP for operating leases, the city will recognize a lease expense for $26,162 on January 1, 2016 (for the lease payment plus the amortization of the deferred initial direct costs). An identical transaction occurred on January 1, 2015, and will occur again on January 1 for each remaining year of the lease. Under the proposed GAAP for government-wide financial statements, the city will recognize a reduction in the lease liability for its cash lease payment of $25,798. This transaction will also occur on January 1 for each remaining year of the lease. Using the proposed GAAP for governmental funds, the city will recognize an expenditure representing the reduction of lease principal of $15,388 and a $9,960 reduction in interest payable when it makes the second lease payment of $25,798.

Changes in the Exposure Draft for the Governmental Lessor

Most governments are lessees; fewer are lessors. Under the current GAAP for governmental activities, this example contract is an operating lease for the lessor. The lessor will continue to keep the asset on its statement of net position and will expense any initial direct costs, then amortize the leased asset on its statement of net activities over its remaining useful life. The lessor will recognize rent revenue upon receipt of the lease payment on the statement of activities.

The GASB exposure draft proposes some interesting accounting changes for the lessor in the government-wide financial statements. Normally, when the lease is treated as a financing lease, the lessor removes the asset from its balance sheet when it recognizes the lease receivable (also called the net investment in the lease). Under the proposed GASB standard, the lessor will recognize both a lease receivable and a deferred inflow of resources at the inception of most leases. The lessor will keep the leased asset (a debit) on its statement of net position, although it will be offset by the deferred inflow (a credit). Unlike the FASB proposal, initial direct costs will be an expense in the government-wide financial statements (and an expenditure in the fund-based statements). The lessor will recognize interest revenue on the lease receivable and revenue from the deferred inflow of resources and must amortize the leased asset. The proposed guidance also recognizes both the lease receivable and deferred inflows for fund accounting.

Estimating the Effect of Capitalizing Operating Leases Using the 2015 New York State CAFR

Many financial statement analysis textbooks give examples of how to estimate the effects of capitalizing operating leases. This article applies a method from a current text [Peter D. Easton, Mary Lea McAnally, Gregory A. Sommers, and Xiao-Jun Zhang, Financial Statement Analysis & Evaluation (Fourth Edition), Cambridge Business Publishers, 2015] to footnote disclosures in the New York State Comprehensive Annual Financial Report (CAFR) for the year ended March 31, 2015. Note 7 of the CAFR lists future minimum rental commitments under real property and equipment leases that are not capitalized under current GASB standards.

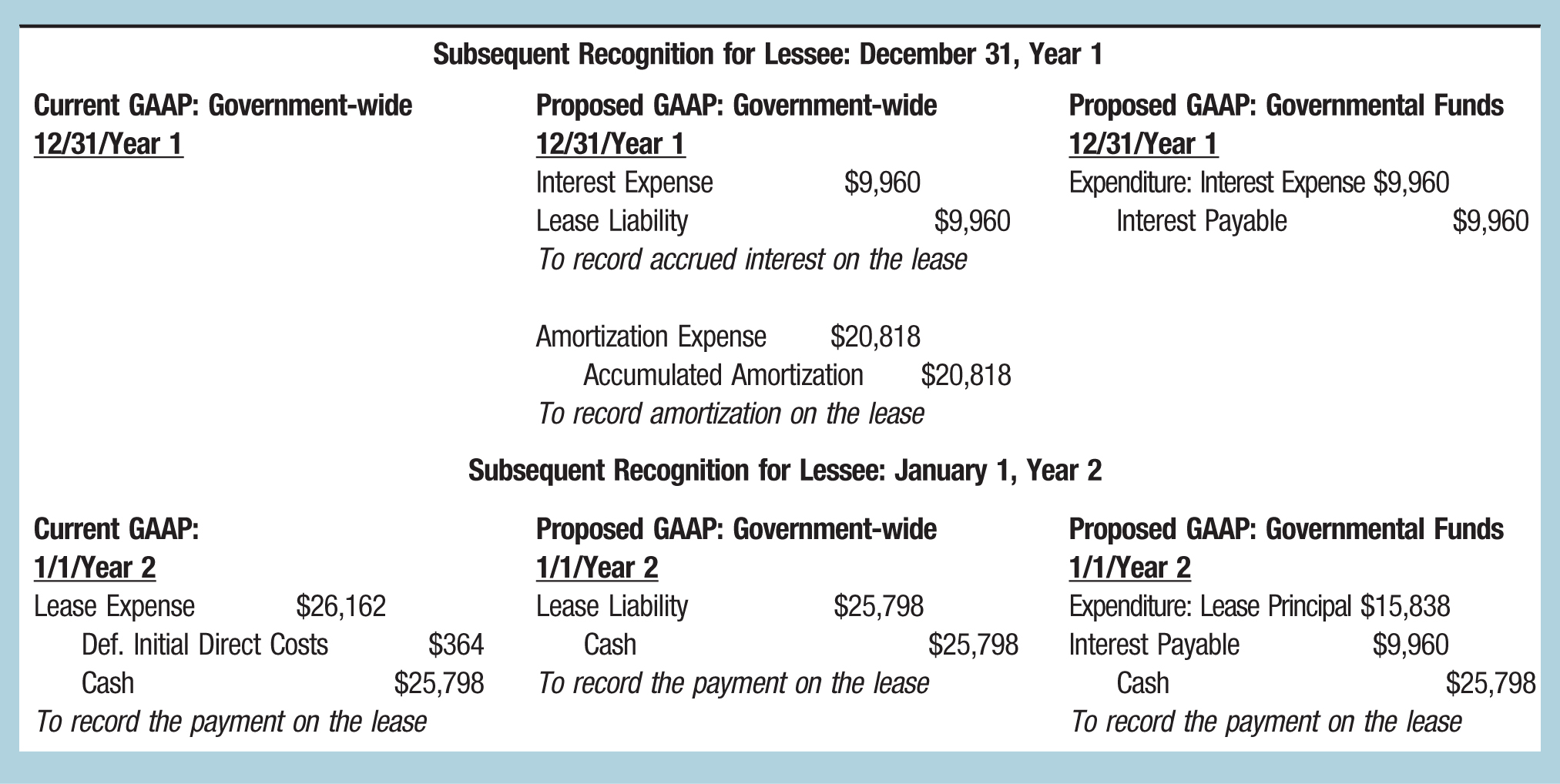

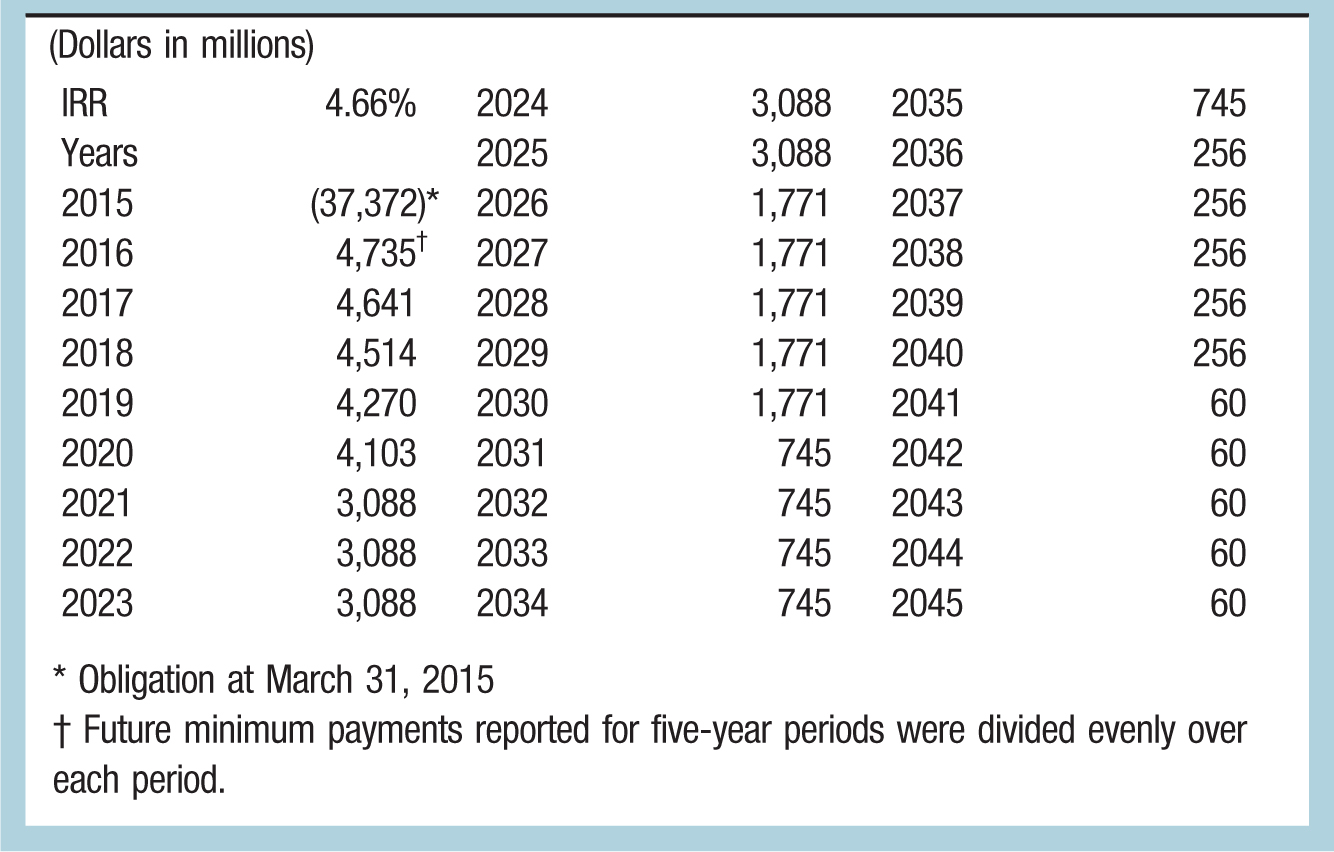

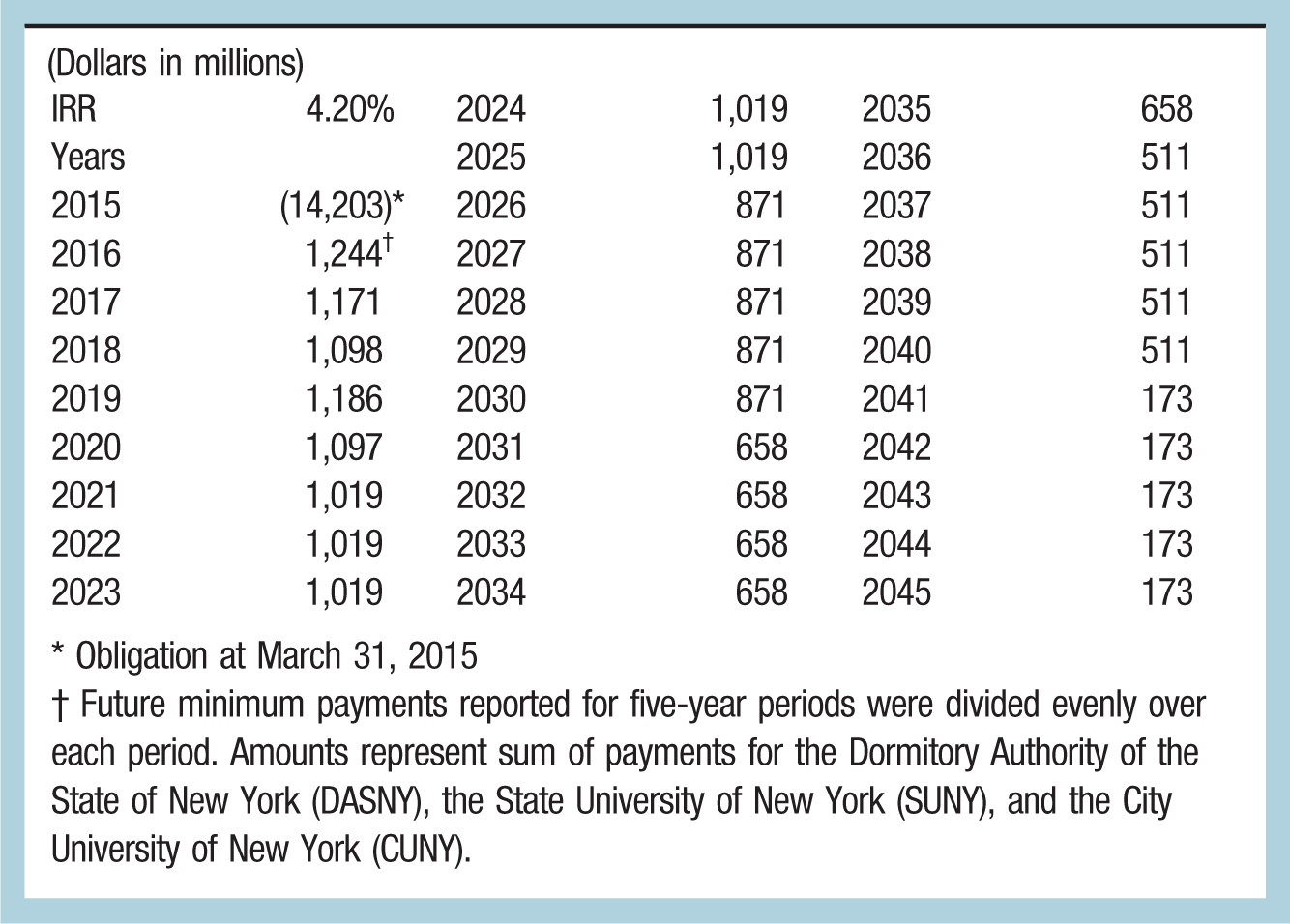

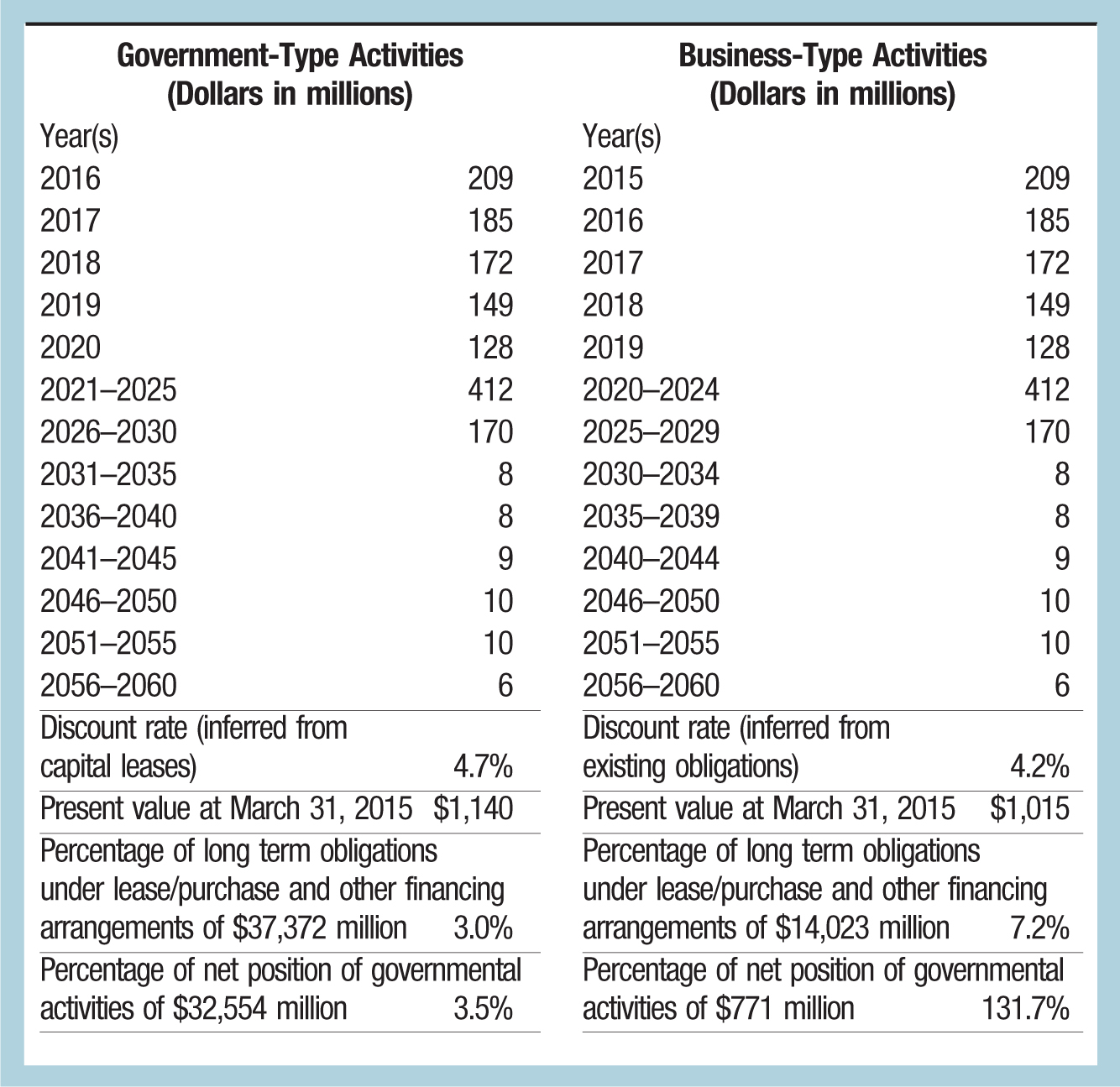

Capitalizing these minimum future rental commitments requires a discount rate. One method is to infer a discount rate from the internal rate of return on currently capitalized leases using information from Note 7 of the CAFR. For governmental activities, Exhibit 3 shows the calculation of a discount rate of 4.7% for existing obligations under lease/purchase and other financing arrangements by finding the internal rate of return (IRR) that equates the amount of the obligations to its future minimum payments. Exhibit 4 shows an analogous calculation of 4.2% for business-type activities. Both imputed interest rates are at the higher end of the range stated for long-term obligations of governmental and business-type activities (0.3% to 6.8%), making the resulting estimates relatively lower.

EXHIBIT 3

Computation of Discount Rate for Existing Obligations under Lease/Purchase or Other Financing Arrangements for Governmental Activities

EXHIBIT 4

Computation of Discount Rate for Existing Obligations under Lease/Purchase or Other Financing Arrangements for Business-Type Activities

Exhibit 5 shows the estimated effect of capitalizing the future minimum rental commitments on government-wide financial statements. For governmental activities, this results in a liability (and corresponding asset) of $1.14 billion; this is 3.0% of the $37.372 billion reported in “obligations under lease/purchases and other financing arrangements” for the year ended March 31, 2015 in Note 7. This category includes obligations of public benefit corporations, including the Dormitory Authority, the Urban Development Corporation, and the Thruway Authority. Finally, it represents 3.5% of the net position of governmental activities.

EXHIBIT 5

Estimating the Effect of Capitalizing Future Minimum Rental Commitments

The estimated effect of capitalizing the future minimum rental commitments of business-type activities results in a liability (and corresponding asset) of $1.015 billion, 7.2% of the $14.023 billion of “obligations under lease/purchases and other financing arrangements” for business-type activities (NYS CAFR 2015, Note 7). The category consists largely of financial obligations for the educational facilities of the State University of New York (SUNY) and the City University of New York (CUNY). SUNY and CUNY obligations were reported at a fiscal year ended June 30, 2014, unlike the governmental activities. Finally, it is 131.7% of the net position of business-type activities of $771 million.

Looking Ahead

Governmental lessees currently have the ability to structure leases to avoid capitalizing leased assets and liabilities. The current GASB exposure draft, “Leases”—like its FASB counterpart—requires capitalization of virtually every lease. It differs from the FASB standard by having one category of capitalized leases instead of two, by considering the current financial resource perspective of government fund accounting and the economic resource perspective of government-wide accounting, and by recognizing a deferred inflow of resources by the lessor. The GASB exposure draft is also much less detailed than its FASB counterpart.

With the official release of FASB’s new standard for leases, the GASB lease project has become more important. The estimated effect of capitalizing future minimum rental commitments of New York State in 2015 would increase currently reported obligations of governmental and business-type activities by 3.0% and 7.2%, respectively. Furthermore, the estimated increase in liabilities represents 3.5% and 131.7% of the net position of governmental and business-type activities, respectively. CPAs in the public sector should be aware of the proposed changes and prepare to update their financial reporting systems.

Mary Michel, PhD is an assistant professor of accounting at Manhattan College, Riverdale, N.Y.