This article, "ICYMI | A Refresher on Accounting for Leases," originally appeared on CPAJournal.com.

In Brief

FASB’s long-debated exposure draft of a new standard on accounting for leases has raised the possibility that almost all leases will need to be capitalized in the near future. Although some of the methods in the proposed standard are similar to those used under current GAAP, there are several significant differences that will affect the classification of leases, the calculation of lease values, and the presentation of leases in the financial statements. This article introduces an example that compares the current GAAP treatment with the proposed treatments, highlighting the differences between current GAAP and the exposure draft.

***

Leases have been a significant issue for the accounting profession since the original (SFAS 13) standard’s publication in 1976. How should a lease be treated? Are managers and lessors purposely structuring transactions so they qualify as operating leases? Are leases an acceptable form of off–balance sheet financing? The arguments have gone back and forth for years—and in 2006, a joint project between FASB and the IASB reopened the issue. The two boards worked together to draft a new standard that requires essentially all leases to be recorded in the manner of today’s capital leases.

The proposed standard has received mixed feedback: The SEC, many academics, and investors seem to approve of the basics of the standard. On the other hand, professional leaders have argued that it will jeopardize sources of future funding by increasing the amount of debt reported on the balance sheet, subsequently increasing their debt-to-equity ratio and reducing times interest earned, cash flow to debt, and other risk ratios. They have also argued that the proposed rules will impose a significant cost because they require more calculations and record keeping than the original standards. Though the arguments have kept FASB from issuing a final standard, the board has not substantially changed the rules and methods since the original exposure draft, “Leases (Topic 842),” was issued on May 16, 2013. It appears, then, that the profession will soon have a new standard for reporting leases, which will significantly change the appearance of the financial statements for years to come.

How would the proposed standard change financial reporting for leases? This article explores the differences between recording a lease under the current standard and under each option in the 2013 exposure draft, as well as the changes that FASB has voted on since issuing the exposure draft.

The proposed standard has received mixed feedback: The SEC, many academics, and investors seem to approve of the basics of the standard. On the other hand, professional leaders have argued that it will jeopardize sources of future funding by increasing the amount of debt reported on the balance sheet, subsequently increasing their debt-to-equity ratio and reducing times interest earned, cash flow to debt, and other risk ratios. They have also argued that the proposed rules will impose a significant cost because they require more calculations and record keeping than the original standards. Though the arguments have kept FASB from issuing a final standard, the board has not substantially changed the rules and methods since the original exposure draft, “Leases (Topic 842),” was issued on May 16, 2013. It appears, then, that the profession will soon have a new standard for reporting leases, which will significantly change the appearance of the financial statements for years to come.

How would the proposed standard change financial reporting for leases? This article explores the differences between recording a lease under the current standard and under each option in the 2013 exposure draft, as well as the changes that FASB has voted on since issuing the exposure draft.

Classification

Under current GAAP, this contract does not meet any of the requirements to be classified as a capital lease for either the lessee or the lessor (see ASC 840-10-25-1). There is no transfer of ownership or bargain purchase option, and the term of the lease is for 73% of the asset’s remaining useful life (11 out of 15 years). The present value of the lease payments using Hamford’s 5% incremental borrowing rate is $225,002 (75% of the $300,000 market value); using CTF’s 4% interest rate, it is $289,202 (78% of the market value).

Under the proposed standards, lease classification requires following a different set of steps. The first is to determine whether the transaction qualifies as a lease. In order for it to qualify, an identified asset must either be named in the contract and physically distinct from other assets, or be so similar to other assets that whichever asset the lessee actually gets doesn’t matter (Project Update 2015, http://bit.ly/1SkGEQb). Furthermore, the lessee must have control of that asset—defined by FASB as the ability to direct the use of the asset, not just its outputs (Project Update 2015). In this example, the storage facility has been specialized for Hamford, which will be in physical control of the asset with no limitations on how the company can use it; thus, this contract qualifies as a lease.

The second step is to determine how many components the lease includes. Any part of the lease that 1) provides benefit on its own or with other assets readily available to the lessee and 2) is not highly interrelated with other parts of the lease will be treated as a separate lease (proposed ASC 842-10-15-21, 22). For example, leasing a warehouse and the land it stands on would result in one lease because the warehouse can’t be used without the land. Leasing the warehouse, the land, and a nearby parking garage would result in two leases: 1) the warehouse and land, and 2) the garage, assuming that it can provide benefit on its own (see proposed ASC 842-10-55-49 to 57). In this article’s example, Hamford is leasing a specialized storage facility, so there is only one lease.

The third step is to determine how each leased asset will be classified. For lessees, this process will be essentially the same as it is now. A lease that is “effectively an installment purchase by the lessee” (Project Update 2015) will be classified as a “finance” lease (formerly referred to as a “Type A” lease). Essentially, this category will include all leases that are currently classified as capital leases; the real difference is that this classification will be based upon professional judgment rather than bright-line rules. For example, lessees paying substantially all of the asset’s value or those using the asset for the majority of its useful life will classify the lease as a finance lease (see proposed ASC 842-10-25-6). The wording replaces the current standard’s rule that a lease requiring the lessee to pay 90% or more of the asset’s value or using the asset for 75% or more of its useful life is treated as a capital lease (see ASC 840-25-10-1). Lease contracts with a bargain purchase option will also be treated as capital leases (see proposed ASC 842-10-25-8).

Those leases that don’t meet the new requirements for finance leases will be classified as “operating” leases, referred to as “Type B” leases in earlier versions of the exposure draft (Project Update 2015). These will be leases for which the lessee pays an insignificant portion of the fair value at the commencement of the lease and uses the leased asset for an insignificant portion of its useful life (Proposed ASC 842-10-25-6). Both of these categories of leases, finance and operating, will require the lessee to capitalize the value of the lease asset and recognize a lease liability.

As a side note, the proposed standard does include a category of short-term leases “with a maximum possible term (including any options to extend) of 12 months” (proposed ASC Update, p. 3). The treatment under the proposed standard for these short-term leases will be the same as the current treatment for operating leases if the company elects to record them as short-term as an accounting policy choice for the “class of underlying assets to which the right of use relates” (proposed ASC 842-10-25-14).

In this article’s example, Hamford would most likely classify the lease as a financing lease. Because the lease term is 73% of the asset’s remaining useful life, Hamford will use the asset for the majority of its useful life. Of course, what figure exactly qualifies as “the majority” under the proposed standard is debatable, so Hamford could argue that the lease is an operating lease instead—it would simply be a more difficult position to defend.

For the lessor, the classification options will remain the same as they are now. They will recognize either a direct financing or sales lease if the lease is effectively an installment purchase or an operating lease if it is not. Determining whether or not the leased asset has been sold is based upon the transfer of control and the collectability of payments, aligning the requirements will the new ASC Topic 606 (Project Update 2015). If the lessor does not transfer control of the asset to the lessee or if collectability is not probable, it will be classified as an operating lease. In this example, CTF would classify the lease as direct financing because Hamford has control of the leased asset and there is no reason to believe that the payments will not be collected.

Initial Recognition

For the lessee (Hamford).

Under the current rules, at the time a lease is signed, lessees record a rent or lease expense equal to the cash paid (ASC 840-20-25-1). In this example, Hamford would record a total cost of $26,162—the $25,798 of its initial payment to CTF, plus $364 of the $4,000 deferred initial direct costs. In practice, these initial costs are typically capitalized at the beginning of the lease and amortized away using the straight-line method over the life of the lease (see Ernst & Young, “Financial Reporting Developments: Lease Accounting Revised November 2014,” Financial Reporting Developments: A Comprehensive Guide, 2014, pp. 71–72).

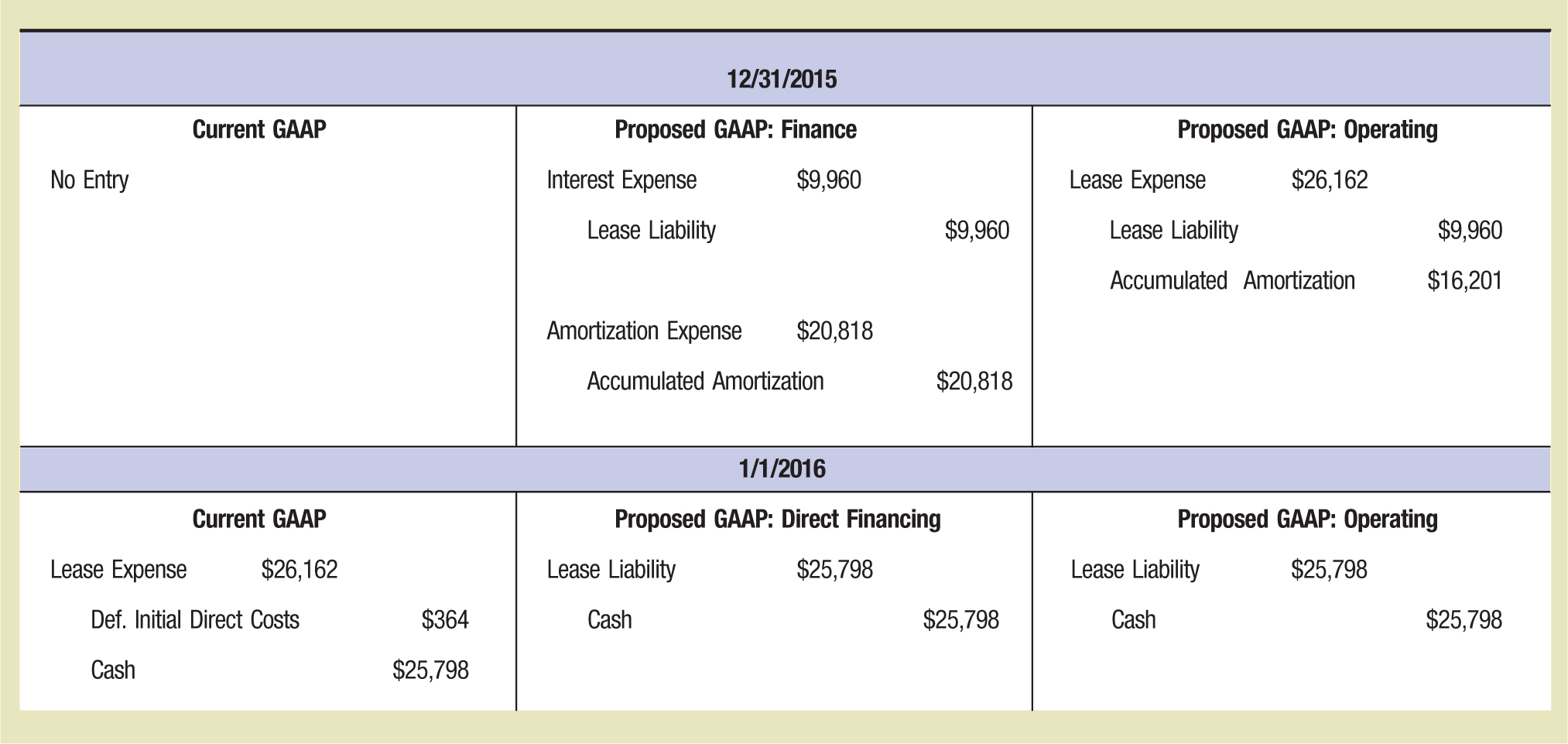

Under the proposed rules, the initial recognition for both finance and operating leases for lessees is the same as the current treatment for capital leases (see Proposed ASC 842-20-30-1, 30-3, and 30-4). So, Hamford would record a right-of-use asset equal to the present value of the lease payments plus the initial direct costs. The present value of the $25,798 for 11 years, at Hamford’s 5% incremental borrowing rate, is $225,002. Hamford will also recognize the cash paid to both CTF and its lawyer to initiate the lease and a lease liability for the balance. These entries, as well as those for the lessor, are shown in Exhibit 1.

EXHIBIT 1

Initial Recognition

For the lessor (CTF).

Under the current rules, lessors record the initial lease payment as revenue at the time the cash is received (ASC 840-20-25-1). They then record an asset for any initial direct costs and the balance as cash received (ASC 840-20-25-16). Under the proposed standards, operating leases will still follow the same procedures as current operating leases for lessors (proposed ASC 842-25-2 to 25-4). Because the asset is written onto the lessee’s books and not written off the lessor’s books, the asset will be shown on the financial statements of both companies under operating leases. These entries are shown in Exhibit 1.

Under the proposed treatment for direct financing leases, the lessor will write off the leased asset and recognize the net cash received (the payment from the lessee, less the initial direct costs). The balance is recorded as a lease receivable (Project Update 2015).

Subsequent Measurement

For the lessee (Hamford).

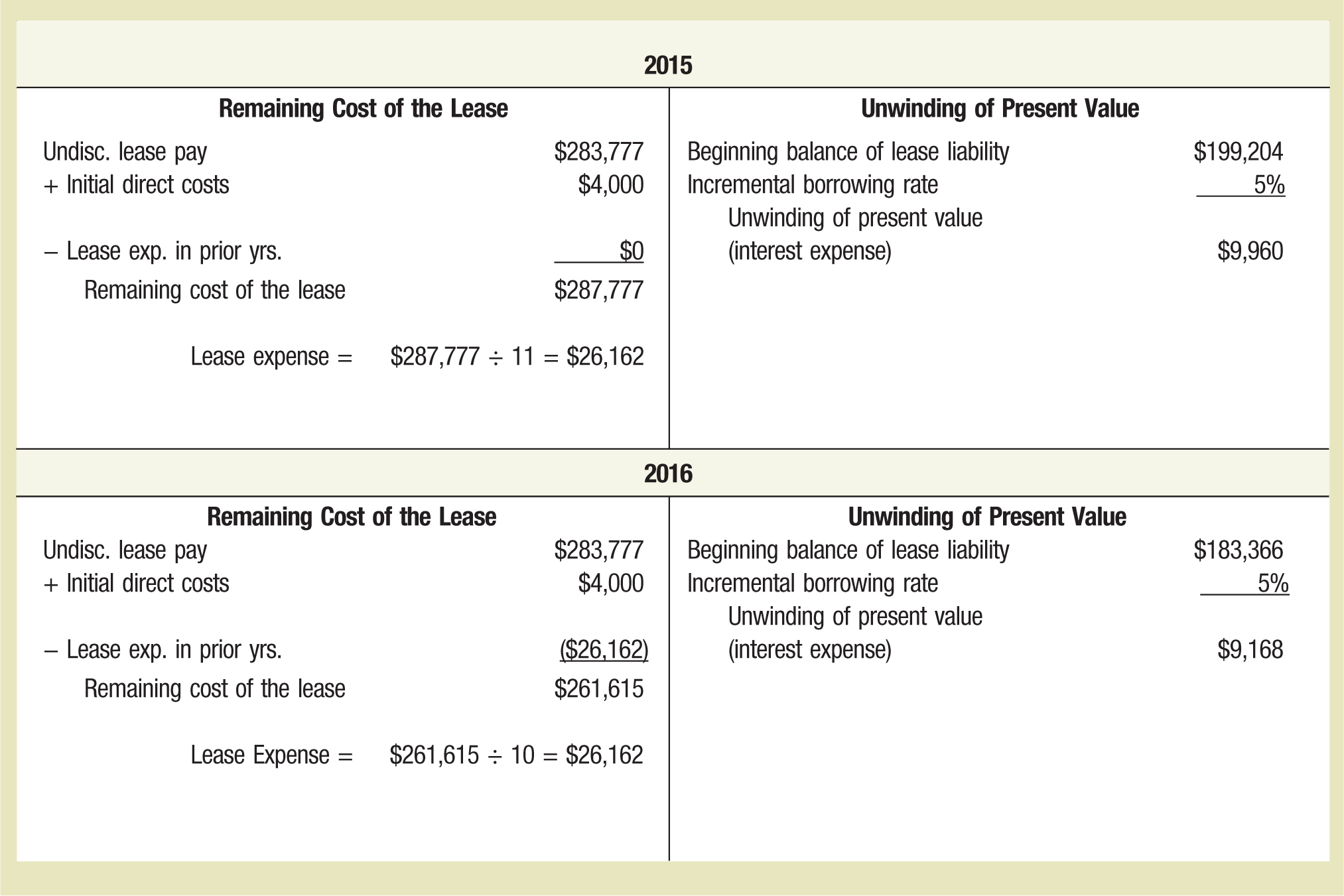

Under the current rules, lessees continue to record a rent or lease expense each year equal to the cash paid (ASC 840-20-25-1). They also amortize away the initial direct costs over the life of the lease. In this example, Hamford’s next entry for the lease would occur at the beginning of 2016, when the next payment is made. At that time, Hamford will again recognize $26,162 in lease expense: the amount of the lease payment, plus the amortization of its $4,000 of initial direct costs. The same entries will be made each year until the lease ends. These entries, as well as those for the proposed standards, are shown in Exhibit 2.

EXHIBIT 2

Subsequent Measurement for the Lessee

Under the proposed rules, subsequent measurement for finance leases for lessees will include adjusting entries each year for interest accrued (Proposed ASC 842-20-35-2a), as well as amortization expense (Proposed ASC 842-20-35-8 to 35-9). These entries are similar to those currently required for capital leases. In this example, Hamford begins the first year of the lease period with a lease liability of $199,204 and has an incremental borrowing rate of 5%. This leads to interest expense of $9,960 ($199,204 multiplied by 5%). As the lease liability balance changes, so will the amount of interest expense each year. Because the asset will be returned to CTF at the end of the lease term, the leased asset will be depreciated over the 11-year lease term with no salvage value. This leads to straight-line amortization expense each year of $20,818 (the initial asset value of $229,002, divided by 11).

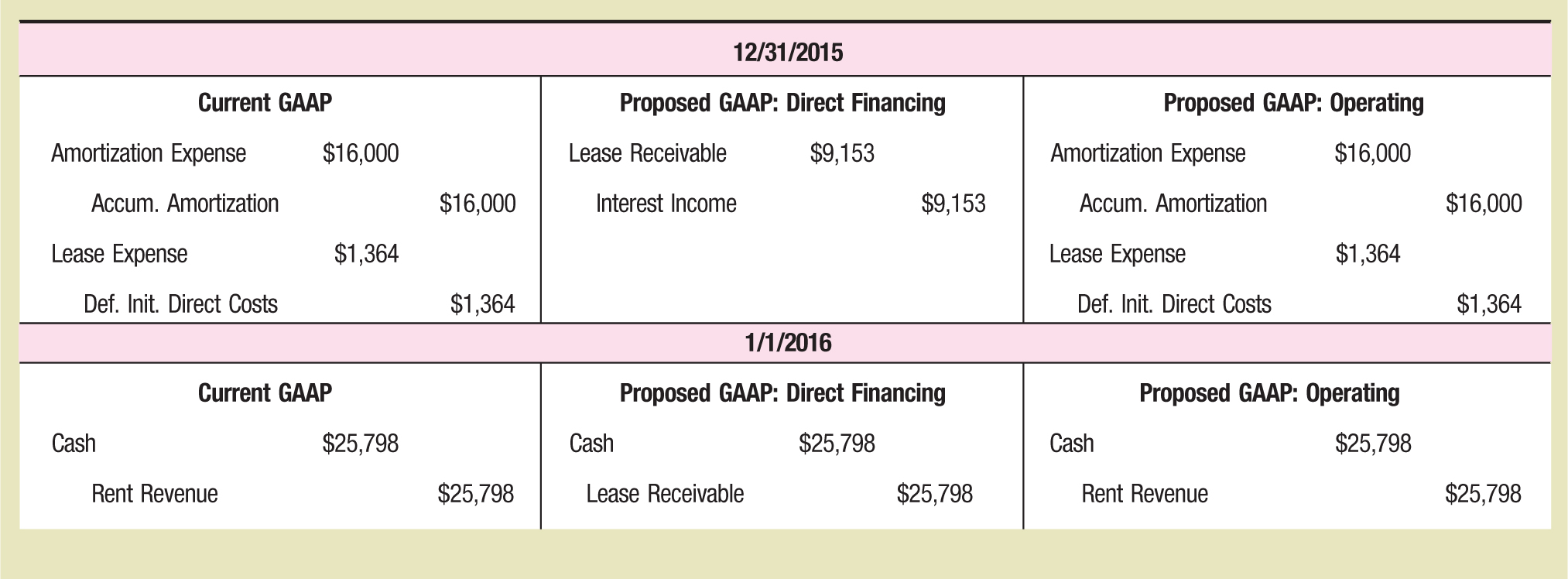

Under the proposed rules, subsequent measurement for operating leases for the lessee will follow a different method. Rather than record interest expense and amortization expense, companies will instead record a lease (or rent) expense. The amount of this expense will be the remaining cost of the lease divided by the remaining lease term, as long as that amount is greater than the amount needed to unwind the discount on the lease liability for the current year (see proposed ASC 840-20-35-2b). The remaining cost of the lease is defined as the undiscounted lease payments over the life of the lease plus the initial direct costs, less any lease expense already recognized. For example, Hamford’s calculations of lease expense in 2015 and 2016 appear in Exhibit 3. Because the straight-line allocation of the remaining costs is much larger than the amount needed to unwind the discount, Hamford will need to recognize the remaining costs as lease or rent expense in both 2015 and 2016.

EXHIBIT 3

Lease Expense for Operating Leases (Lessee)

After calculating the amount of the lease expense, Hamford must determine the credit amounts. The unwinding of the discount (the minimum amount of the lease expense) should be recorded as a credit to lease liability. In 2015, the amount of interest is $9,960, as shown in Exhibit 3. The difference between the lease expense and the increase to the lease liability is credited to accumulated amortization (proposed ASC 842-20-35-10). Hamford’s entry for an operating lease is shown in Exhibit 2.

The proposed standard requires the lessor to compute an “imputed interest rate.”

For the lessor (CTF).

Under the current rules, at the end of each year, lessors need to amortize the historical cost of an asset over its economic life (ASC 840-20-35-3) and the initial direct costs over the life of the lease (ASC 840-20-35-2). They must also recognize lease or rent revenue and cash each year as payments are received from the lessee. In this example, CTF will amortize away the $300,000 historical cost of the asset over the 15-year estimated useful life ($16,000 each year, given the assumed $60,000 salvage value) and the $15,000 of initial direct costs over the 11-year lease term. These entries, as well as those for the proposed standards, are shown in Exhibit 4.

EXHIBIT 4

Subsequent Measurement for the Lessor

Under the proposed rules, the subsequent measurement for a direct financing lease is similar to that currently required for capital leases; the only difference is in the interest rate used to determine interest revenue each period. Under current GAAP for capital leases, the lease receivable is equal to the present value of the lease payment, including the residual value or bargain purchase option (ASC 840-30-30-6). Under the proposed rules, however, the beginning lease receivable value must be reduced by the initial direct costs. Because the beginning balance of the lease receivable isn’t equal to the present value of the lease payments, using the actual interest rate charged to the lessee would not correctly amortize away the lease receivable. Instead, after receipt of the final payment, the lease receivable would still have a balance equal to the future value of the initial direct costs.

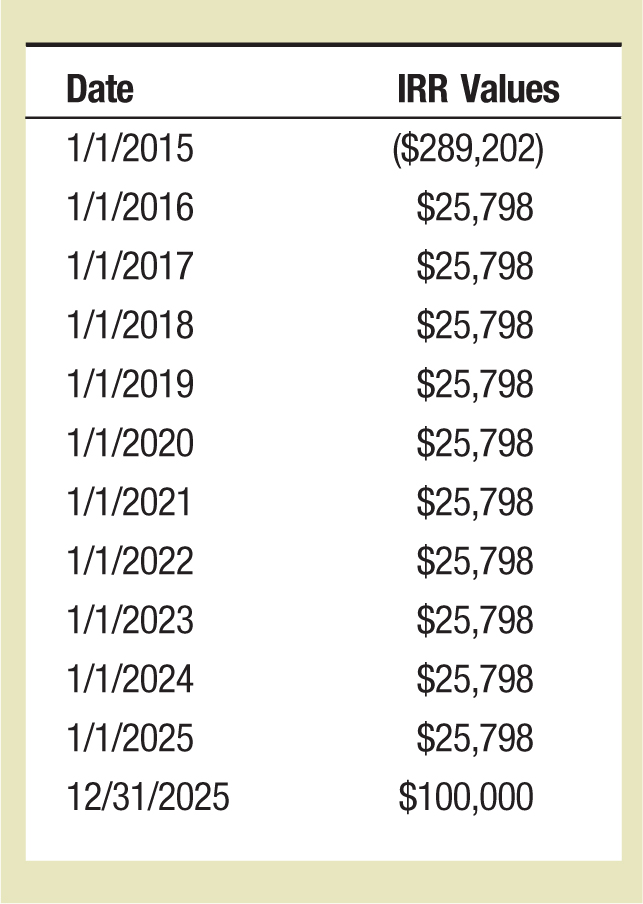

In order to address this issue, the proposed standard requires the lessor to compute an “imputed interest rate”—that is, the rate that will make the lease receivable balance equal to zero at the end of the lease (Project Update 2015). Perhaps the easiest way to calculate the imputed interest rate is with Microsoft Excel’s internal rate of return (IRR) function. To use it, one must create a table (as in Exhibit 5) that shows CTF’s information for its lease with Hamford. The table must list the initial loan balance (the lease receivable in this case) as a negative in the first row, and each lease payment and the residual value of the leased asset—if any—as positive values in the following rows. Once the table is set up, the equation is “=IRR (range of values in the table).” In this example, CTF has an imputed interest rate of 3.165%. Once the imputed interest rate has been calculated, the lessor uses that rate to calculate interest revenue throughout the life of the lease (proposed ASC 842-30-35-1). CTF would record interest revenue of $9,153 in 2015—the beginning receivable balance of $289,202, multiplied by 3.165%.

EXHIBIT 5

Values for the Imputed Interest Rate Calculation

Under the proposed rules, the entries for an operating lease will remain the same as those already discussed under current GAAP for operating leases (proposed ASC 842-30-35-14).

Other Lease Issues

While the biggest differences from current GAAP under the proposed standards lie in the overall classification and recording of leases, three other issues are worth mentioning. First, the lease term under the current standards includes the noncancellable period of the lease and any periods from renewal or purchase options that provide specific economic incentives to exercise the options. These economic incentives include a bargain lease renewal, a bargain purchase option, a lease renewal that allows the lessor to later exercise a bargain purchase option, renewals that extend the lease to cover periods for which the lessee has either guaranteed the lessor’s debt or extended a loan to the lessee, and lease renewals at the lessor’s discretion (see ASC Master Glossary).

Under the proposed standard, the lease term has been simplified to include the noncancellable portion of the lease, the cancellable portion if the lessee has no economic incentives to cancel, and any period that the lease can be extended if the lessee has an economic incentive to do so (proposed ASC 842-10-25-1). For example, a company might lease a piece of equipment that is integral to its production line and very difficult to install or remove. Under the current rules, the lease period of this asset would depend upon whether the specific terms of the lease contract included at least one item from the list of economic incentives previously mentioned; under the proposed standard, the lease term could be the full economic life of the asset because the cost of removing the leased equipment and installing a replacement (including the loss of production through downtime) provides an economic incentive to continue leasing the equipment.

Second, if a lease contract is renegotiated, the new contract is treated as a new lease, rather than simply an update of the values of the current lease. The differences in the carrying values of the leased asset and the lease liability (or the value of the lease receivable for the lessor) from the old lease to the new lease will be recognized in net income in the year of the change (proposed ASC 842-10-25-13).

Third, the proposed rules will require several additional disclosures or changes to the current financial statement presentation. Perhaps the most significant of these for lessees is that the new right-of-use assets and lease liabilities should be reported as separate line items or disclosed in the notes and that finance and operating leases must be reported separately from each other (Project Update 2015). In addition, the interest and amortization expenses of leased assets must be reported separately on the income statement (proposed ASC 842-20-45-3). Perhaps the most significant change for lessors is that if a lessor would typically sell the leased asset, then the sales revenue and cost of goods sold from sales through leases must be shown, or disclosed, separately from traditional sales (proposed ASC 842-30-45-4).

SUMMARY OF THE DIFFERENCES BETWEEN THE CURRENT AND PROPOSED LEASE STANDARDS

| Current GAAP | Proposed GAAP |

|---|---|

| Classification | |

| Leases that do not meet any of the “bright line” rules are classified as operating leases. | Operating leases essentially eliminated. |

| Lessees treat any lease that is effectively an installment purchase as finance and all others as operating. | |

| Lessors treat any lease that transfers control and is collectible as either directing financing or sales type and all others as operating. | |

| Initial Recognition | |

| Lessees capitalize initial direct costs and expense payments as rent expenses. | Lessees capitalize the initial payment, present value of future lease payments, and initial direct costs as a right-of-use asset. |

| Lessors capitalize initial direct costs and recognize the rest of the initial payment as rent revenue. | Lessors recognize a direct finance lease using the same basic format as a current capital lease and an operating lease using the same basic format as a current operating lease. |

| Subsequent Recognition | |

| Lessees recognize lease or rent expense at the time of each payment. | Lessees follow the same basic format as a current capital lease for a finance lease and for an operating lease record lease or rent expense for the average remaining cost of the lease broken down for the remaining years of the lease term. Exhibit 3 shows an example of calculating the average remaining cost. |

| Lessors recognize lease or rent revenue at the time of each payment and depreciation at the end of each fiscal year. | Lessors recognize a direct finance or sales-type lease using the same basic format as a current capital lease and an operating lease using the same basic format as a current operating lease. |

| Lease Period | |

| The lease period is the noncancellable period of the lease as well as any renewal or purchase options that provide specific economic incentives (as found in the Master Glossary) to exercise the options. | The lease period is the noncancellable portion of the lease, the cancellable portion if the lessee has no economic incentives to cancel, and any period that the lease can be extended if the lessee has an economic incentive to do so. |

| Additional Disclosures | |

| Lessees must disclose the values of all right-of-use assets and lease liabilities and of finance and operating leases separately. Interest and amortization expense for leased assets also need to be reported separately. | |

| Lessors must disclose sales revenue and COGS from leases separately from other sales revenues and COGS amounts. | |

Note: For simplicity, the current GAAP column refers only to operating leases, which are far more common under current GAAP. COGS = Cost of Goods Sold.

Looking Ahead

Most leases are currently reported as operating leases rather than capital leases. Under the proposed lease standards, however, virtually every lease will be capitalized. Although the proposed rules will result in a recording process that is similar to the current standards of capital leases, there are a few differences that accountants and auditors should be aware of—especially direct financing leases for lessors and operating leases for lessees.

Although the proposed standards have not yet been finalized, FASB’s recent decisions have made only minor revisions to the 2013 exposure draft, suggesting that the final standards will be similar to those in the current draft. What will this do to leasing companies and the financing strategies of other companies? Only time will tell. For now, though, CPAs need to be prepared to update financial records and reporting to incorporate the coming changes.

Jason C. Porter, PhD is an associate professor of accounting at the Beacom School of Business, University of South Dakota, Vermillion, S. Dak.

The author appreciates the comments and interest of participants at the 2013 OSCPA Business & Industry Conference and the 2014 OSCPA Real Estate Conference regarding an early version of this example.