This article, "Impacts and Challenges in Auditing CECL," originally appeared on CPAJournal.com.

Summary provided by MaterialAccounting.com: FASB’s new CECL standard is creating issues for auditors and other users. Learn how it could impact you in the article below.

In Brief

Although its full implementation has been delayed, FASB’s new standard on current expected credit losses (CECL) continues to create issues for financial statement preparers, independent auditors, and users of those statements. The author discusses how the new CECL standard will affect the metrics companies traditionally use to estimate their future credit losses, particularly as it relates to the subjectivity of those estimates and the difficulty of evaluating them.

The current expected credit loss (CECL) accounting standard enacted under Accounting Standards Update (ASU) 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, will have a significant impact on the methods that organizations use to estimate their expected credit losses. Under the prior accounting standard, loan loss estimations were primarily determined using a historical loss calculation methodology, whereby historical credit performance was used as the basis to estimate probable future losses. The new CECL standard requires organizations to recognize an estimated loss provision on the day of origination that reflects all losses expected to occur during the lifetime of the loan. Implementation of ASU 2016-13 was required by January 1, 2020, for SEC-filing public business entities (PBE) and will be required by January 1, 2023, for non-SEC filing PBEs, non-PBEs such as privately held institutions, and SEC-filing PBEs that are considered smaller reporting companies (SRC). The SEC currently defines an SRC as an organization with public float of less than $250 million, or an organization with annual revenues of less than $100 million and public float less than $700 million.

During the 2008 financial crisis, financial institutions that foresaw a looming downturn in the economy expected materially larger credit losses than what their historic performance otherwise suggested. These institutions were unable to justify taking larger allowance for loan and lease loss (ALLL) provisions, as their forecast-based estimates did not meet the required “probable” threshold. As institutions were unable to reflect their true expected credit loss provisions, investors had a reduced level of confidence in the reliability and adequacy of ALLL reserve balances and provision expenses reflected on financial institutions’ financial statements during the crisis.

The implementation of CECL introduces increased subjectivity to the ALLL calculation process and will potentially affect certain lending products’ profitability. The combination of these impacts will create significant changes and challenges in auditing post-CECL ALLL reserve calculations, primarily in gaining assurance that management is not using subjective measures to manipulate earnings.

Subjectivity Impacts

The new CECL standard is principles-based and does not prescriptively direct institutions as to how they should determine and integrate forward-looking information into their lifetime credit loss estimates. This will drive diversity in practice. Institutions that have comparable loan portfolios and take similar approaches may still arrive at materially different results if they have different levels of sensitivity to forward-looking estimates.

While not explicitly required by ASU 2016-13, large financial institutions have generally developed econometric models (models that are sensitive to macroeconomic conditions and forecasts) for their larger and more complex portfolios. The use of econometric models enables management to integrate economic forecasts into their lifetime credit loss estimates in a structured and consistent manner that can be subject to governance oversight and change management controls.

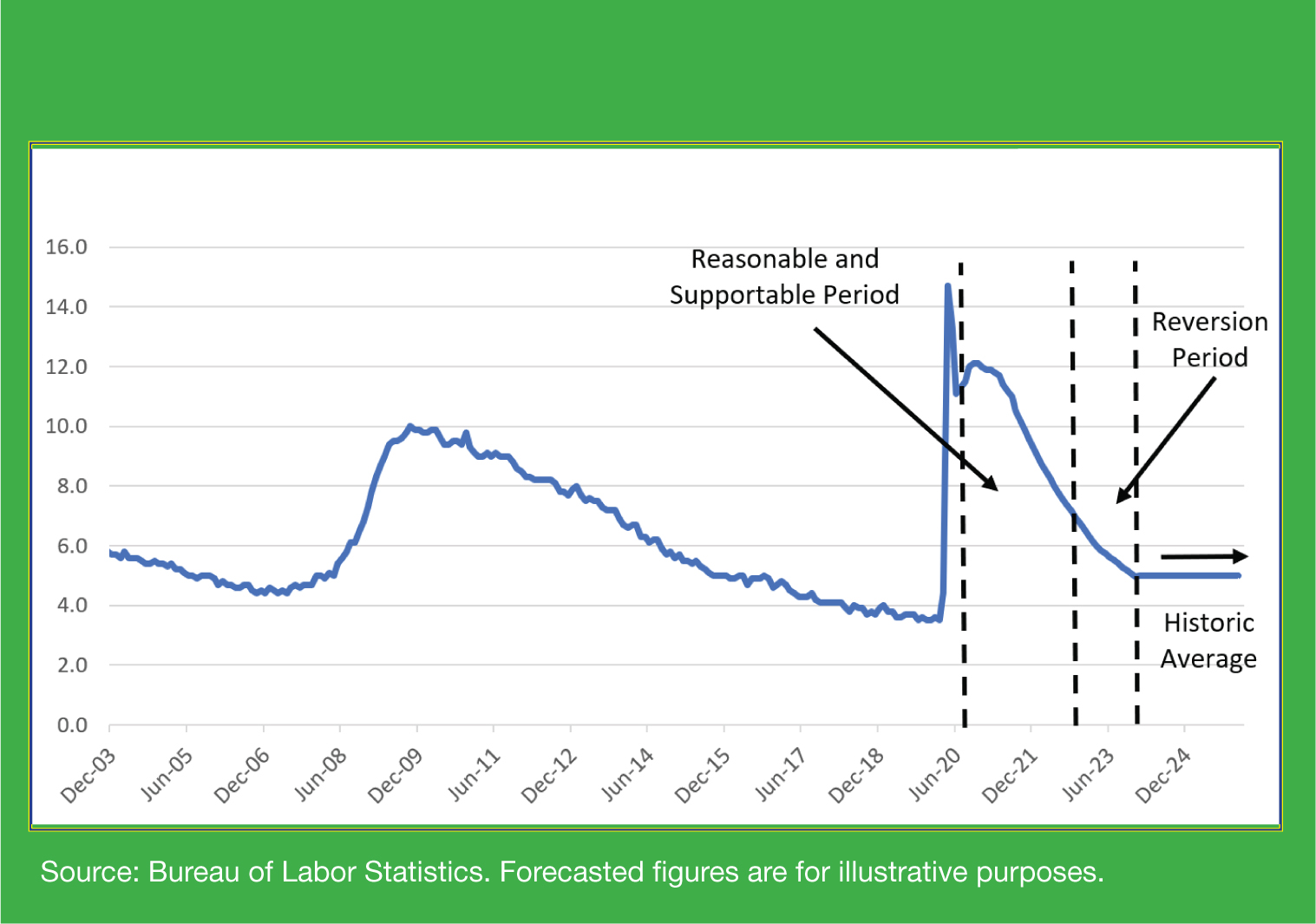

When determining lifetime loss estimates, economic loss forecasting models will have several components, as required by the principles outlined by the CECL guidance. These include a reasonable and supportable period (where forward-looking information that affects the estimated collectability of loan balances is incorporated into the calculation) and a reversion period (where organizations revert their loss estimates from their reasonable and supportable period-based calculations to their historic loss average); the remainder of the lifetime loss is then calculated based on the historic loss averages.

In order to create macroeconomic sensitive forward-looking estimates, organizations will need to have a data set of forecasted key macroeconomic metrics over the lifetime of their loans, similar to those presented in Exhibit 1.

Exhibit 1

Historic and Forecasted Unemployment Rate

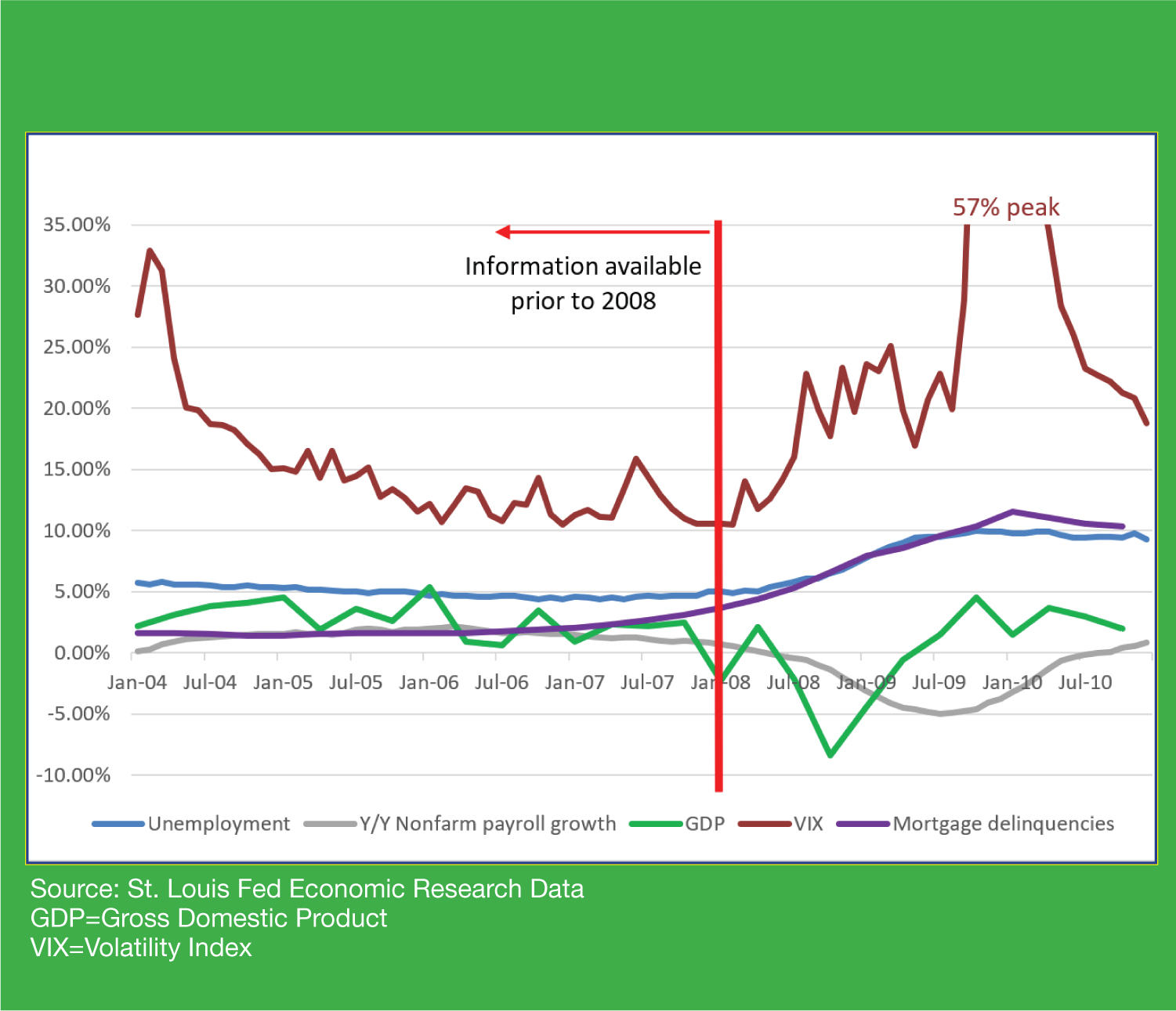

While the use of econometric models can be highly beneficial for large entities with complex portfolios, the challenge in these estimation processes is translating theory into practice. One of the largest challenges is the existence of degrees of error in forecasted economic conditions that need to be accounted for. If one looks at the historic macroeconomic reports leading up to the 2008 financial crisis, previous economic performance measures were generally not predictive of an upcoming recession. Metrics such as unemployment, year-over-year nonfarm payroll growth, gross domestic product, the volatility index, and mortgage delinquency rates all showed relatively stable values into late 2007 (Exhibit 2).

Exhibit 2

Economic Performance Measures

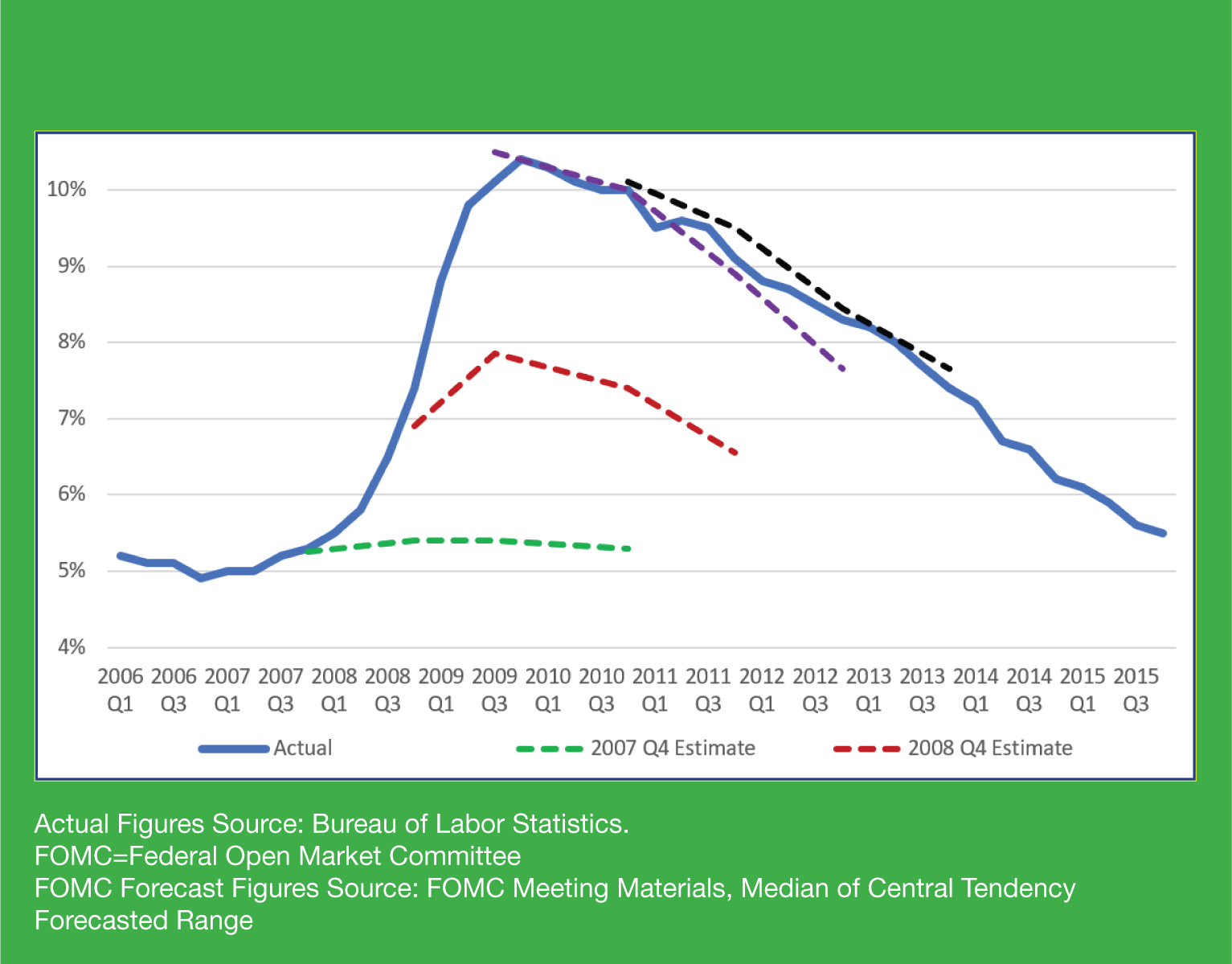

If the use of historic trends to determine future results is a weak indicator of future changes to key economic metrics, the next logical source to consider would be forecasted estimates. Forward-looking macroeconomic forecasts, however, can also prove to be unreliable. For example, as seen in Exhibit 3, unemployment forecasts by the Federal Reserve show a tendency to underestimate the likelihood and velocity of economic downturns. As seen in the Q4 20 07 and Q4 20 08 estimates (the green and brown dashed lines, respectively), the forecasts would have been insufficient to provide advance warning of the magnitude of rising unemployment during the recession. Consequently, pure reliance on economic forecasts could lead to procyclical reserve calculations (counter to the intent of the CECL standard), as late recognition of changes in economic conditions can create drastic changes in the outlook of key economic factors and drive large increases in reserve calculations derived from econometric models.

Exhibit 3

Unemployment Actual vs. FOMC Forecast

As historic economic metrics do not provide a reliable leading indicator of an economic downturn, and forward-looking economic forecasts can be late to recognize downturns, another method is required: management judgement.

Several different methodologies are being used to address the inherently imperfect nature of forward-looking estimates into an estimation process that will need to be defensible to both auditors and regulators. These practices range from taking multiple forecasts into consideration, taking a quantitative approach that measures historic “upside” and “downside” errors to narrow the range of likely outcomes, and limiting the risk of forecast error by having shorter forecasting periods. Because ASU 2016-13 is not prescriptive, it will ultimately be left to management’s subjective determination of how to arrive at forecasts and account for forecasting error. This creates a challenge from a comparability standpoint, which will be compounded by each institution also selecting its own inputs, such as the duration of the reasonable and supportable forecast period, the influencing factors used during that period, the duration of the reversion period, and the method of reversion back to historic averages.

While the flexibility of the CECL standard may well prove beneficial for organizations, auditors will be posed with the challenge of understanding management’s subjective decisions on methodology, data sets used, and how the imperfect macroeconomic forecasted estimates are adjusted to arrive at management’s own less-imperfect forecasted estimates. Furthermore, auditors will need to ensure that processes and controls are designed in a manner that would prevent or detect earnings manipulation, given the pressures that can arise from the standard’s impact on lending profitability.

Impacts on Lending Profitability

Financial institutions supervised by the Federal Deposit Insurance Corporation (FDIC) are required to maintain a capital position in conformance with FDIC Standards (Part 324). These rules were established to ensure that banks can absorb credit or other operating losses while still having the liquidity to honor withdrawals by their depositors.

The assessments conducted to determine whether a financial institution has adequate ALLL reserves and whether it has adequate capital reserves are separate determinations. This is because ALLL reserves are a measure of expected operating environment-based calculations, while capital reserves are a test to determine whether an institution can survive in a stressed environment. In other words, ALLL reserves account for expected losses, and capital reserves account for expected and unexpected losses.

Under the incurred loss methodology, the expected and unexpected loss distinctions between ALLL and capital reserve adequacy tests are rather clear. The new CECL requirements, however, impose changes to this dynamic, as the integration of forward-looking information and extension of the horizon of expected loss calculations through the lifetime of the asset will expand the purview of ALLL reserve calculations.

These impacts are most pronounced for institutions that have proportionally larger portfolios with longer-lived assets (i.e., 30-year mortgages) or organizations utilizing econometric forecasting models. These impacts result in increases to ALLL balances, as the integration of economic condition overlays and longer lifetime durations to reserve for would generally have incrementally larger reserve requirements than those generated by incurred loss ALLL calculations.

As a consequence, many financial institutions are recognizing the need to maintain larger ALLL reserve balances under the broader scope of the CECL standard, but still need to maintain capital levels. The impacts to capital management and planning can be significant, depending on how much the standard affects the ALLL reserves that institutions are now required to maintain. The magnitude of these impacts will also be affected by whether the existing regulatory thresholds for ALLL balances to be accounted for in financial institution capital requirements and stress testing measurements remain at the current levels.

The need for upfront recognition of provision expenses could create downstream impacts to the profitability of certain product offerings. Potential shifts in product offerings or strategies could create or change operating risks to an institution.

Upfront recognition of lifetime provision expense without an offset to capital requirements could have material bottom-line impacts on the financial performance of financial institutions, creating pressures on earnings and profitability. These pressures could motivate management to take advantage of the increased subjectivity in determining ALLL reserves in the form of earnings management.

The impacts to capital planning caused the financial services industry to raise concerns and request capital relief from banking regulators. In response to these concerns, the Office of the Comptroller of the Currency (OCC), Federal Reserve Board (FRB), and FDIC in May 2018 jointly proposed allowing financial institutions to phase in the capital impacts of the day one ALLL impact to retained earnings over time. Although this was a step towards providing financial institutions a form of capital relief, the American Bankers Association (ABA) raised concerns that the proposal did not address the impact of economic downturns occurring after implementation, which could have material impacts considering the procyclicality associated with econometric models (as described earlier). In December 2018, the FDIC issued a final ruling that acknowledged these concerns and noted that the impacts would be monitored.

Throughout 2018 and 2019, financial services trade organizations issued comment letters to FASB, regulatory agencies, and legislators urging for a delay in ASU 2016-13’s implementation date to allow for quantitative impact studies to be conducted in order to review systematic and economic risks that might occur. In October 2019, FASB responded to these concerns and approved a deferral of the standard’s implementation date to 2023 for non–SEC filing PBEs, non-PBEs, and SEC-filing PBEs that are considered SRCs. The implementation deadline was unchanged for SEC-filing institutions that do not meet the SRC exclusion.

In response to recent economic impacts from the coronavirus pandemic, the banking regulators issued an interim final ruling on March 31, 2020, that provides banking organizations that implement the CECL standard in 2020 with a form of regulatory capital relief. Organizations can choose to delay for two years an estimate of CECL’s effect on regulatory capital, relative to the old incurred loss methodology’s effect on regulatory capital. There is a three-year transition period to phase in the impacts.

As the impacts of the CECL standard are assessed through the results of institutions that have implemented it, and as industry practices evolve based on lessons learned from these organizations, FASB may well make changes to the guidance and requirements for complying with the new standard. Whether or not changes occur to the CECL guidance, such changes would likely only reduce, not eliminate, the potential risk of earnings manipulation. Competitive factors may still create pressures to take advantage of the increased flexibility in estimating loan loss provisions.

Changes to Audit Practices

Because the new CECL standard is a principles-based accounting pronouncement, auditors can expect to see a wide variety of practices across institutions. For organizations still in the process of implementing CECL, it is important for auditors and their clients to interact early and often, as new models and processes are being developed to ensure the conceptual designs of postimplementation operating environments are considered appropriate. This will allow auditors ample time to understand management’s intended postimplementation processes and practices, and an opportunity to share their thoughts, concerns, and perspectives along the way. This approach can help ensure that management has time to make adjustments where needed while implementation activities are still being conducted.

In comparison to historical loss–based ALLL estimation processes, ALLL estimates calculated postimplementation will have a greater degree of subjectivity, given the standard’s forward-looking nature. As noted earlier, historic economic conditions are often weak indicators of future economic downturns, and forward-looking estimates are imperfect and can be late to recognize economic downturns, which will require management judgment-based adjustments in the ALLL estimation processes. Furthermore, the diversity of practices that can be considered acceptable will create additional complexities in conducting peer analysis.

The open-ended nature of the CECL standard could increase the risk that organizations seize the opportunity to conduct earnings management through manipulations of their subjective forecasts that directly affect ALLL balances. Changing some of the factors and their weights in postimplementation ALLL models can have a greater impact on provision calculations, either by using creative rationales for adjusting forward-looking estimates that can flow through to ALLL models, or by changing model calculations to increase or decrease sensitivity to forward-looking forecasts.

As a consequence, auditors will be faced with the practical challenge of attesting to whether management’s representation of the financial statements is materially accurate in an environment where subjective management estimates of future outcomes can be a material basis of the reserve calculation. In recognition of the legitimate need to calibrate their models, management will still need the flexibility to make adjustments to their postimplementation ALLL estimation techniques and models. As such, key areas of focus for auditors should include governance controls, review and challenge practices, and change management controls. Auditors should look at the substantive assessments of the rationale behind changes to ensure that they are not conducted in a manner to intentionally drive certain end results.

Changes to estimation practices should be assessed to determine whether the adjustments are made to better calibrate estimation methods or to reflect changes to the underlying portfolio. Furthermore, auditors need to assess whether changes are driven by adjustments to management’s estimation practices or are corrective in nature. If management is correcting an error, an assessment should be conducted to determine whether the correction is material enough to warrant restatement.

The assessment of whether the practices are appropriate should be based on the size and scale of the organization.

Longer-term assessments to track the direction, magnitude, and velocity of changes that management conducts can also be a good practice to determine whether the changes made over time are honing in on a more appropriate target level of sensitivity, or if they appear to create inappropriate bias or inconsistent swings.

The diversity of practices that will emerge will also create a need for auditors to have a greater degree of diligence and documentation to support what they consider to be acceptable. While large and complex organizations with the size and scale to undergo complex estimation processes are generally employing econometric models, best practices in the industry should not be based on a yardstick of how similar the practices of smaller organizations are to what larger organizations are doing. Rather, the assessment of whether the practices are appropriate should be based on the size and scale of the organization. Even within large and complex organizations, the complexity of estimation processes should not be expected to be the same throughout the organization, as less material portfolios may be most appropriate to measure using noncomplex methods.

Guidance to address these and other areas of concern continues to be published. FASB’s Transition Resource Group (TRG) has issued technical guidance, and the AICPA’s Depository and Lending Institutions Expert Panel (DIEP) has issued a practice aid and guidance documents for auditors. Banking regulators also issued an Inter-agency Policy Statement in May 2020 that updated the guidance on allowance for credit losses practices.

Management and auditors should expect to see practices continually evolve as the industry fine-tunes the methods employed to conform to the new standard and identify practical challenges and impacts of computing postimplementation ALLL estimations. Audit firms and industry practitioners should monitor for additional guidance, potential changes to the standard, and adjustments to industry practices. As industry practices evolve, auditors should reassess in subsequent reviews to ensure that practices historically opined upon favorably are still designed in line with current industry best practices. Auditors and clients should stay in touch frequently to share both management’s changes and auditor’s views on industry practices as they evolve over time.

Matthew Clohessy, CPA, CIA, CISA, CRC, is a senior vice president with KeyBank’s credit risk review division and an adjunct professor at Canisius College, Buffalo, N.Y.