This article, "Last minute change: Amendment to the discount rate guidance in ASC 842," originally appeared on GAAPDynamics.com.

Summary provided by MaterialAccounting.com: This article discusses recent changes to ASC 842 as we reach the effective date for the new standard.

—

Last minute change? I thought the new guidance on leases (ASC 842) has been around for a while? Well, it has. The new guidance was issued in early 2016 with six updates issued subsequently to address implementation issues and two to delay the effective date for private companies. But the time is now; ASC 842 is finally effective for private companies! However, the FASB made one last minute change related to the discount rate guidance by issuing ASU 2021-09 in November 2021. This post will refresh the discount rate guidance in ASC 842 and explain the recent update.

Selecting the appropriate discount rate is quite important when applying ASC 842. This is because discount rates are used to:

- Determine lease classification;

- Determine the present value of the lease payments; and

- Measure a lessor’s net investment in the lease (for sales-type and direct financing leases)

Lessors are required to use the rate implicit in the lease as the discount rate. Lessees on the other hand will use the rate implicit in the lease or the lessee’s incremental borrowing rate.

It is important to note that lessees do not have a choice with respect to which rate is used. If the rate implicit in the lease is readily determinable, then it must be used. The incremental borrowing rate can only be used if the rate implicit in the lease cannot be readily determined. In practice, this is most often the case because the lessee usually doesn’t know, or can’t determine, all the inputs required to calculate the rate implicit in the lease.

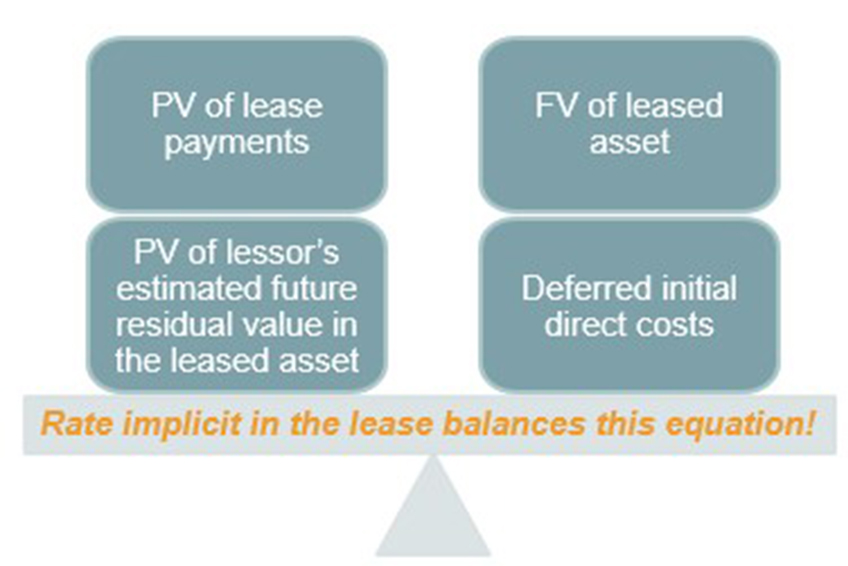

The rate implicit in the lease is the rate of interest that, at a given date, causes the aggregate present value of (a) the lease payments and (b) the amount that a lessor expects to derive from the underlying asset following the end of the lease term to equal the sum of (1) the fair value of the underlying asset minus any related investment tax credit retained and expected to be realized by the lessor and (2) any deferred initial direct costs of the lessor. The following image illustrates this definition.

Now it makes sense why lessees usually can’t determine the rate implicit in the lease! So, on to the incremental borrowing rate. ASC 842 defines the incremental borrowing rate as “the rate of interest that a lessee would have to pay to borrow on a collateralized basis over a similar term an amount equal to the lease payments in a similar economic environment.” Therefore, lessees need to consider the term of the lease, collateral, and the current economic environment. Incremental borrowing rates must be determined on a lease-by-lease basis, not for the entity as a whole. However, the standard does allow the application of a portfolio approach when certain conditions are met.

Determining the incremental borrowing rate can be challenging in practice. Thankfully, ASC 842 provides lessees that are not public business entities with a practical expedient that allows them to elect, as an accounting policy, to use the risk-free rate as the discount rate. An example would be the rate of a zero-coupon U.S. Treasury instrument. The risk-free rate is determined using a period comparable with the lease term. If a lessee makes this election, it must make appropriate disclosures in the notes to the financial statements. As with all discount rates, the risk-free rate should not be less than zero.

Wait, you might be thinking, I thought this post was about a recent change? So far what you have told me is old news. Yes, so far, we’ve only discussed the original discount rate guidance in ASC 842, but that was necessary to lead up to the recent change. It was also a good opportunity to refresh this guidance since ASC 842 is newly effective for private companies, and this has been an area where there have been a lot of questions in practice. So, at long last, the change. Previously, if the practical expedient to use the risk-free rate was elected, it had to be applied on an entity-wide basis to all leases. ASU 2021-09 changed this, now allowing lessees to elect the practical expedient by class of underlying asset. Disclosure guidance was also added, requiring an entity to disclose the asset classes to which it has elected to apply a risk-free rate. Additionally, the ASU highlights that the rate implicit in the lease must be used for any individual lease for which it is readily determinable, regardless of whether the practical expedient to use the risk-free rate has been elected.

For private entities that had not yet adopted ASC 842 as of the date of issuance of ASU 2021-09 (November 11, 2021), this new guidance is effective at the same time as ASU 842 which is for fiscal years beginning after December 15, 2021, and interim periods within fiscal years beginning after December 15, 2022. For those that early adopted ASC 842, the effective date is the same, but the transition guidance is different. Please see ASU 2021-09 for more information about the effective date and transition guidance.

While this change was last minute, the intent by the FASB was to provide lessees that are not public business entities more flexibility in determining the discount rate, thus reducing initial and ongoing ASC 842 implementation issues and costs. Want to learn more about the new guidance for leases? Check out our comprehensive collection of Leases courses on our online learning platform, the Revolution.

About GAAP Dynamics

We’re a DIFFERENT type of accounting training firm. We don’t think of training as a “tick the box” exercise, but rather an opportunity to empower your people to help them make the right decisions at the right time. Whether it’s U.S. GAAP training, IFRS training, or audit training, we’ve helped thousands of professionals since 2001. Our clients include some of the largest accounting firms and companies in the world. As lifelong learners, we believe training is important. As CPAs, we believe great training is vital to doing your job well and maintaining the public trust. We want to help you understand complex accounting matters and we believe you deserve the best training in the world, regardless of whether you work for a large, multinational company or a small, regional accounting firm. We passionately create high-quality training that we would want to take. This means it is accurate, relevant, engaging, visually appealing, and fun. That’s our brand promise. Want to learn more about how GAAP Dynamics can help you? Let’s talk!

Disclaimer

This post is published to spread the love of GAAP and provided for informational purposes only. Although we are CPAs and have made every effort to ensure the factual accuracy of the post as of the date it was published, we are not responsible for your ultimate compliance with accounting or auditing standards and you agree not to hold us responsible for such. In addition, we take no responsibility for updating old posts, but may do so from time to time.