This article, "Major Revisions to the Auditor’s Report," originally appeared on CPAJournal.com.

Summary provided by MaterialAccounting.com: There are significant changes in audit reporting standards coming soon. CPAs who audit any entity will be impacted. Read more below.

The AICPA Auditing Standards Board recently issued SAS 134, Auditors Reporting and Amendments, Including Amendments Addressing Disclosures of Financial Statements, and SAS 135, Omnibus Statement on Auditing Standards—2019. This suite of standards places the auditor’s opinion at the front of the audit report and otherwise strengthens the transparency for the auditor’s opinion; clarifies entity management’s and the auditors’ responsibilities; and otherwise strengthens the U.S. financial audit process. This article summarizes the new standard and provides insights for auditors implementing its provisions.

***

A major change in audit reporting standards soon will affect all CPAs who audit any entity. The PCAOB and the International Auditing and Assurance Standards Board (IAASB) started the process. Now the AICPA Auditing Standards Board (ASB) has completed the circle.

The PCAOB and IAASB have recently significantly modified the audit reporting standards applicable to their constituents. The ASB has also modified its standards and made other changes that will affect audit practice in the areas of potential fraud, communications, related party transactions, going concern, and other subjects.

Framework

In 2011, the ASB issued the first standard in its Clarity Project, aimed at revising the Statements on Auditing Standards (SAS). The principal part of the project was completed in 2014 with the issuance of SAS 128, which made the standards easier to read, understand, and apply, but did not significantly change them. It separated audit requirements from guidance on how auditors could satisfy the requirements. Today, all SASs modify or create new sections in the Clarified Statements on Auditing Standards, which are identified as AU-C sections in the AICPA Professional Standards.

A secondary aspect of the clarity project was to converge the SASs with IAASB-promulgated International Standards on Auditing (ISA). The IAASB and PCAOB revised their standards for financial statement audits in 2015 and 2017, respectively. Many similarities and differences exist between the two standards. In 2019, the ASB modified the auditor’s report to substantially conform with IAASB-adopted standards. These changes will be effective for audits of financial statements for periods ending on or after December 15, 2020. Early implementation is not permitted.

The ASB’s changes were effected by issuing SAS 134 and 135. Following the ASB-established pattern, these changes amend, replace, or establish new AU-C sections. (The ASB also issued SAS 136, establishing AU-C 703, Forming an Opinion and Reporting on Financial Statements of Employee Benefit Plans Subject to ERISA, which is beyond the scope of this article.)

Overview of Changes to Audit Reports

The ASB’s changes greatly impact auditor reports. Briefly, the changes included: 1) moving the opinion to the first part of the report; 2) adding more titles; 3) disclosing management’s and the auditor’s responsibility for going concern issues; 4) introducing key audit matters (KAM); and 5) expanding the disclosure of auditor responsibilities. The major changes are detailed in the following AU-C sections:

- AU-C 700—Forming an Opinion and Reporting on Financial Statements.

- AU-C 701—Communicating Key Audit Matters in the Independent Auditor’s Report.

- AU-C 705—Modifications to the Opinion in the Independent Auditor’s Report.

- AU-C 706—Emphasis-of-Matter Paragraphs and Other-Matter Paragraphs in the Independent Auditor’s Report.

The following sections discuss these changes as well as others affecting the audit process.

AU-C 700—Forming an Opinion and Reporting on Financial Statements

The ASB greatly revised the form and content of the auditor’s standard report on nonissuers’ financial statements in order to meet users’ desires for more information about significant aspects of an audit. The new report form starts under the title “Opinion,” with the existing introductory paragraph that identifies the financial statements under audit and follows with the opinion paragraph. However, the ASB has expanded the requirements to reach the opinion given. Notable additions include the following:

- Considering the “qualitative aspect of the entity’s accounting practices, including indicators of possible bias in management’s judgment.” (AU-C 700.14)

- Evaluating “the relevance of the accounting policies to the entity and whether they have been presented in an understandable manner.” (AU-C 700.15.a)

- Assessing whether the “information in the financial statements is relevant, reliable, comparable, and understandable. In making this evaluation, the auditor should consider whether all required information has been included, and whether such information is appropriately classified, aggregated or disaggregated, and presented.” (AU-C 700.15d)

- Evaluating whether “the financial statements provide adequate disclosures to enable the intended users to understand the effect of material transactions and events on the information conveyed in the financial statements.” (AU-C 700.15e)

- Assessing whether “the financial statements represent the underlying transactions and events in a manner that achieves fair presentation.” (AU-C 700.16b)

Reporting on an audit of a public company’s financial statements under PCAOB standards requires discussing critical audit matters (CAM).

After the “Opinion” section comes “Basis for Opinion,” which was formerly included only in reports with modified opinions. (Now it is included in all reports.) This section is designed to: 1) report that the auditor has followed U.S. GAAS in the audit [If the auditor has also followed other standards, that disclosure may be added. (AU-C 700.43–.45)]; 2) refer to a separate section to describe the auditor’s responsibilities; 3) provide a statement about required independence and other ethical responsibilities; and 4) state whether the auditor believes the audit evidence obtained is sufficient and appropriate for the opinion given (AU-C 700.28).

At this point, sections that the auditor has concluded are necessary, based on the audit findings of the specific engagement, should be added. These include a KAM section if the auditor has been so engaged (discussed below).

The prior reporting model then discussed managements’ and auditors’ responsibilities. The new report expands titles and adds more information. “Responsibilities of Management for the Financial Statements,” has changed little from its prior report form. There is a significant addition, however; when required by the applicable financial reporting framework, an additional paragraph should be added dealing with conditions or events that raise questions about the entity’s ability to continue as a going concern.

The revised “Auditor’s Responsibilities for the Audit of the Financial Statements” section is key to the mission of providing users with more information about significant aspects of an audit. All the items in the old reporting model are carried over, but new items have been added:

- Audits provide a high level, but not absolute, assurance of detecting mis-statements.

- Detecting fraud is more difficult than detecting errors.

- Material items influence users’ economic decisions.

- Professional judgment and skepticism are exercised throughout the audit.

- Procedures are conducted on a test basis.

- Going concern conditions or events are considered.

- There is communication with those charged with governance. (AU-C 700.35–.37)

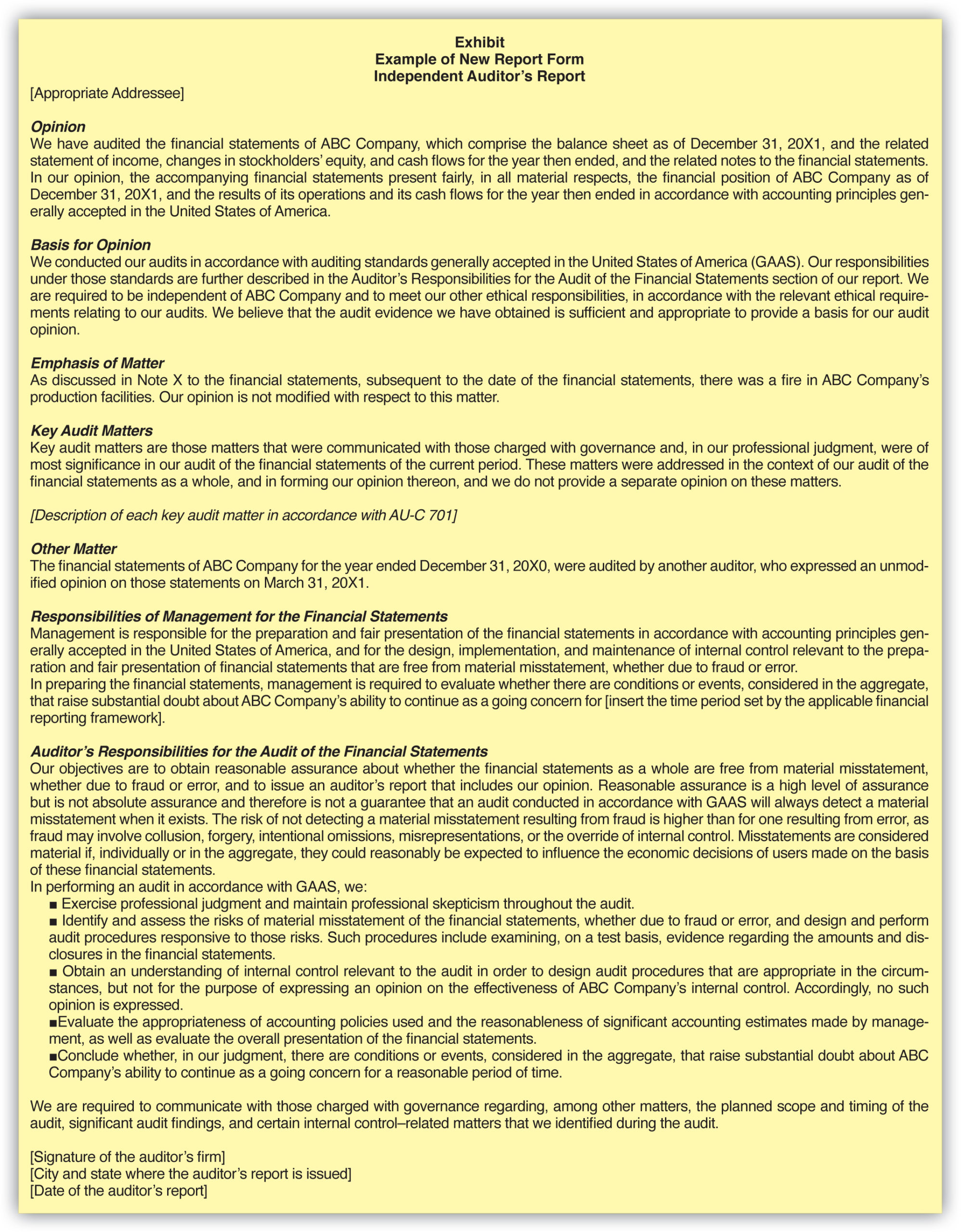

Eight sample auditor reports are shown in AU-C 700.A81. A comprehensive example of the new report format is shown in the Exhibit.

Exhibit

Example of New Report Form Independent Auditor’s Report

AU-C 701—Communicating Key Audit Matters in the Independent Auditor’s Report

Reporting on an audit of a public company’s financial statements under PCAOB standards requires discussing critical audit matters (CAM). IAASB standards require reporting KAMs in listed companies’ audits. The ASB chose the title KAM without requiring—but allowing—nonissuer entities to engage auditors to issue such communications. When so engaged, auditors should report KAMs in accordance with AU-C 701.

Reporting KAMs supplements the reporting on the entity’s financial statements; they are not a substitute for

- required financial statement disclosures,

- a modified opinion,

- reporting on going concern issues, or

- separate opinions on individual matters.

KAMs are defined as:

Those matters that, in the auditor’s professional judgment, were of most significance in the audit of the financial statements of the current period. Key audit matters are selected from matters communicated with those charged with governance.

(AU-C 701.07)

KAMs generally require significant auditor attention in performing the audit, including—

- areas of higher assessed risk of material misstatement,

- areas involving significant management judgment, or

- significant events or transactions during the period.

When so engaged, the auditor’s report should include a section headed “Key Audit Matters,” which should be introduced with the following:

Key audit matters are those matters that were communicated with those charged with governance and, in the auditor’s professional judgment, were of most significance in the audit of the financial statements of the current period. These matters were addressed in the context of the audit of the financial statements as a whole, and in forming the auditor’s opinion thereon, and the auditor does not provide a separate opinion on these matters.

(AU-C 701.10)

Descriptions of the matters should include why they were selected and how they were addressed. However, auditors should consider: 1) laws or regulations that prohibit disclosing a matter; and 2) the potential adverse consequences versus the public interest benefit of disclosure. In the (unlikely) event there are no matters to report, a statement to that effect may be made. As with all audit matters, the auditor should document all conclusions reached.

A going concern issue and a qualified opinion should be recognized as KAMs. But those matters should be reported in different sections of the report.

A going concern issue and a qualified opinion should be recognized as KAMs. But those matters should be reported in different sections of the report and refer to the corresponding passages in the KAM section.

AU-C 701 provides extensive KAM guidance in paragraphs A1 through A62. Without third-party requests, however, few nonissuer entities are expected to engage their auditors to report on KAMs, keeping such client and auditor discussions confidential.

AU-C 705—Modifications to the Opinion in the Independent Auditor’s Report

Previous requirements for modifying an auditor’s opinion have not changed. However, the ASB modified AU-C 705 to conform to the revised audit report.

When the auditor qualifies an opinion or issues an adverse or disclaimer of opinion, the “Opinion” title should be modified and an explanation added to the “Basis of Opinion” section. Furthermore, if the auditor is unable to complete the audit, and the report is a disclaimer of opinion, the auditor should modify “Auditor’s Responsibilities for the Audit of the Financial Statements.” Moreover, including a “Key Audit Matters” section is prohibited when an adverse opinion or disclaimer is issued.

AU-C 706—Emphasis-of-Matter Paragraphs and Other-Matter Paragraphs in the Independent Auditor’s Report

AU-C 706 continues past practice of placing an emphasis-of-matter paragraph or other-matter paragraph in the audit report. Further, it continues to require “Emphasis of Matter” and “Other Matter” in the paragraph title when such a paragraph appears in the report.

The principal change involves situations where the client has engaged the auditor to report on KAMs. A matter may not be included in emphasis-of-matter paragraph instead of describing a KAM. Moreover, it directs the auditor to AU-C 570 (discussed below) if going concern is an issue.

Examples of reports with emphasis-of-matter and other-matter paragraphs are available in AU-C 706.A17. The revised guidance continues to provide AU-C 706.A18 and A19 lists of other sections containing requirements for emphasis-of-matter and other-matter paragraphs. AU-C 706.A14 provides guidance on the placement of emphasis-of-matter and other-matter paragraphs within the audit report.

Additional Significant Changes

AU-C 240—Consideration of Fraud in a Financial Statement Audit

Some significant changes were made in this section, such as defining the term “significant unusual transaction,” which is used in the SASs extensively:

Significant transactions that are outside the normal course of business for the entity or that otherwise appear to be unusual due to their timing, size, or nature.

(AU-C 240.11)

The requirement for inquiries of management has been expanded by the addition of:

Whether the entity has entered into any significant unusual transactions and, if so, the nature, terms, and business purpose (or the lack thereof) of those transactions and whether such transactions involved related parties.

(AU-C 240.17)

The revised guidance expanded the requirements for audit procedures related to the risk of management override to include the following:

- Reading the underlying documentation and evaluating whether the terms and other information about the transaction are consistent with explanations from inquiries and other audit evidence about the business purpose (or the lack thereof) of the transaction

- Determining whether the transaction has been authorized and approved in accordance with the entity’s established policies and procedures

- Evaluating whether significant unusual transactions that the auditor has identified have been properly accounted for and disclosed in the financial statements. (AU-C 240.32c).

The fraud application guidance added the following characteristics of fraud:

Omitting, obscuring or misstating disclosures required by the applicable financial reporting framework or disclosures that are necessary to achieve fair presentation.

(AU-C 240.A6)

In general, the amended standards have focused on the need to audit financial statement disclosures. With respect to frauds, guidance has been added for:

The risk that management may attempt to present disclosures in a manner that may obscure a proper understanding of the matters disclosed (for example, by using unclear or ambiguous language).

(AUC 240.A13)

AU-C 260—The Auditor’s Communications with Those Charged with Governance

Requirements for communicating with those charged with governance were modified by adding 1) significant risks identified in the audit and 2) circumstances that affect the form and content of the auditor’s report. Substantial additions were made to the related application and other explanatory material. The guidance focuses primarily on the two additional requirements and situations where an auditor is engaged to report on KAMs. Auditors should review the entirety of AU-C 260. Subsections .10–.13 and the related guidance points A13 through A40 are particularly important.

AU-C 550—Related Parties

The revisions to this section focus on the auditor’s procedures to reduce the risk of undisclosed related-party transactions. The following are additional significant related-party procedures:

- Inquiries as to the business purpose of transactions with a related party versus an unrelated party (AU-C 550.14)

- Inquiries related to compliance with policies for related-party transaction (AU-C 550.15)

- Inquiries of those charged with governance about related-party transactions (AU-C 550.16)

- Requiring auditors to use concurrent dates to audit related-entity transactions (AU-C550.23).

In addition, helpful guidance for dealing with related-party issues has been added to AU-C 550.

AU-C 570—The Auditor’s Consideration of an Entity’s Ability to Continue as a Going Concern

FASB and GASB standards require management to determine whether substantial doubt exists about an entity’s ability to continue as a going concern, and, if so, to make proper financial statement disclosures. (See ASC 205-40-50, and GASB Statement 56.) The auditor’s report should disclose when the auditor concludes that substantial doubt exists of entity’s ability to continue for a reasonable period of time. In such an event, instead of coverage in an emphasis of matter paragraph, this disclosure is required to be made in a new section, “Substantial Doubt About the Entity’s Ability to Continue as a Going Concern.” Of particular help is the guidance in sections A54 through A56; illustrations of report language are in AU-C 570.A65.

Extensive study will be necessary to learn all of the nuances presented by the new reporting format and the related guidance.

Other Matters

The ASB seeks to increase auditors’ focus on considering note disclosures earlier in the audit process. To this end, and to give effect to several other issues, the following sections were revised:

- AU-C 200—Overall Objectives

- AU-C 210—Terms of Engagement

- AU-C 300—Planning

- AU-C 315—Understanding the Entity

- AU-C 320—Materiality

- AU-C 330—Performance

- AU-C 450—Evaluating Misstatements.

Other important changes include:

- Engagement letters (AU-C 210)

- Expanded guidance suggesting obtaining written representations of potential transactions and any side agreements to significant transaction documents (AU-C 580.A15-A18)

- Reporting on group financial statements (AU-C 600.A97).

The Future

Extensive study will be necessary to learn all of the nuances presented by the new reporting format and the related guidance. Because the new reporting standard is effective for periods ending after December 15, 2020, early study of the revised format and requirements is recommended. It may also be advisable to educate clients about the implications of the new audit report.

Gerald W. Hepp, CPA, is the CEO of Gnosis Praxis Ltd., Novi, Mich.

Alan Reinstein, CPA, DBA, is the George R. Husband Professor of Accounting in the Mike Ilitch School of Business Administration at Wayne State University, Detroit, Mich.