This article, "The search for lease accounting’s ‘new normal’," originally appeared on AccountingToday.com.

ASC 842, the new lease accounting standard, represents the most significant change in decades to the way companies account for leases under U.S. GAAP. For the first time, companies are required to present most of their operating leases on the balance sheet, which has resulted in a large increase in liability balances on many organizations’ financial statements.

While the new standard is not yet effective for private companies, public companies have already adopted the new rules, and many have entered their second and third years under the new accounting. Add to this the economic turmoil caused by the coronavirus pandemic, many companies (especially those in highly lease-reliant industries) have been motivated to take a closer look at their lease portfolio and the impacts on their operations.

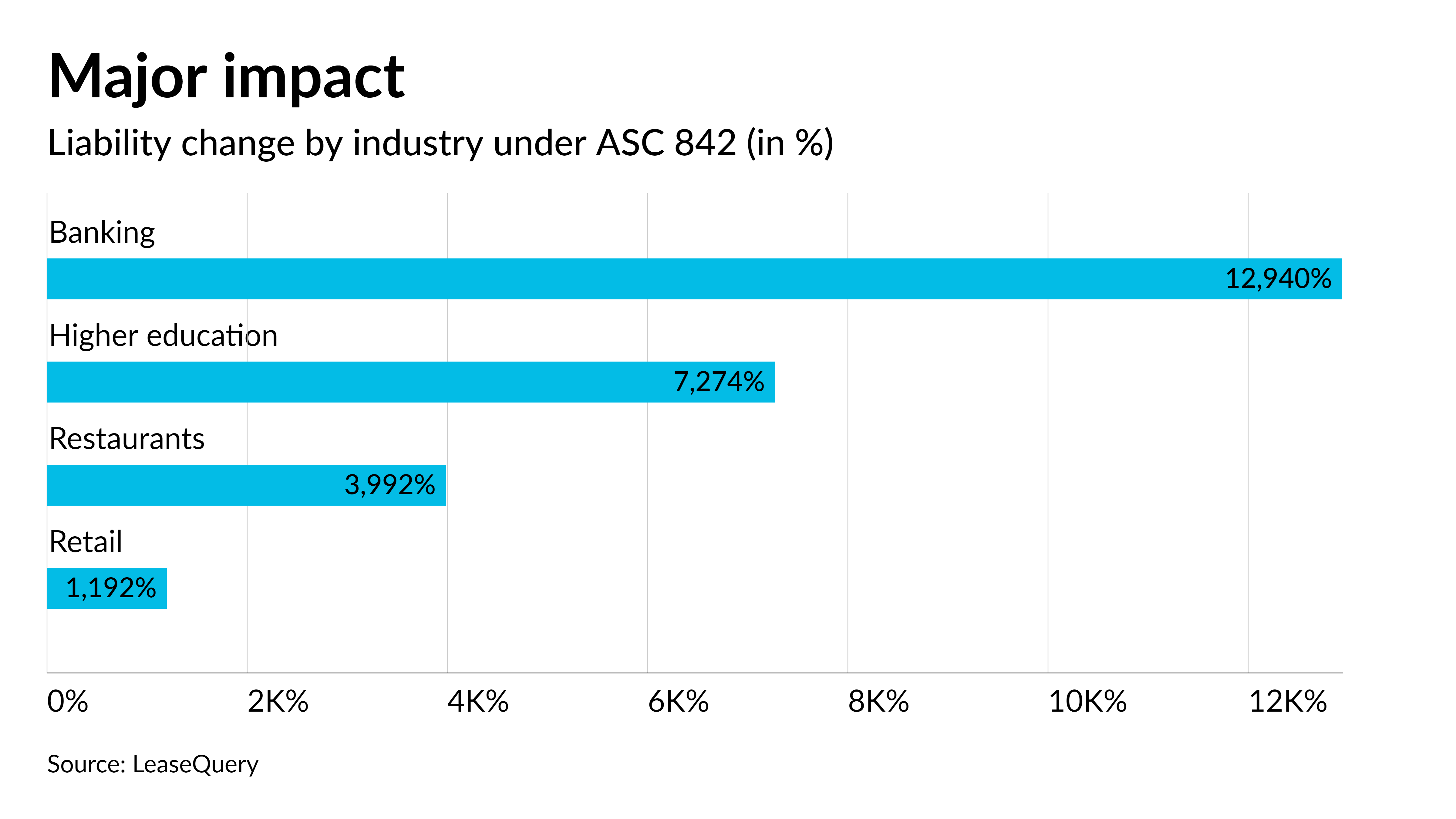

Adoption of the new lease accounting standard has impacted every company with operating leases in their business model. However, certain industries have experienced a bigger jump in their liability balances than others due to the nature of their businesses and services. As seen in LeaseQuery’s recent Lease Liability Index Report, several key industries were significantly impacted by the new standard, including higher education, restaurants and retail. These same industries were also directly impacted by the worldwide pandemic, which changed their markets and the way they serve their customers. Businesses within these industries have likely been thinking through new strategies and innovations to respond to recent economic strains and leasing decisions are a critical area that these types of companies can leverage.

Higher education

The higher education industry experienced a more than 7,000% increase in liability balances due to ASC 842 and the requirement to present operating leases on the balance sheet. This industry also had to immediately respond to the coronavirus pandemic with flexibility and quick action to maintain services in a new environment marked by social distancing. Colleges and universities shifted to a virtual learning model almost overnight. While online courses have been an option for many years now, the move to a completely virtual environment has had long-lasting effects on the education industry and what students will expect in the future.

Even after social distancing and COVID-related restrictions are eased, virtual learning is a format that will stay in higher demand than ever before. As more students look to achieve their higher education goals through online courses, colleges and universities should expect to see corresponding decreases in on-campus services such as housing and food.

Higher education organizations must now critically review their business model and operations to determine if strategic decisions should be made to better position themselves to capture the benefits of a more hybrid educational environment. For example, some colleges and universities might find cost-savings opportunities available by reducing their real estate footprint due to the decrease in on-campus activity. On the other hand, the need for more technology to serve their stakeholders could mean some institutions will rely on more technology assets in the future and new decisions about whether to purchase or lease those assets will be present.

Restaurants

The restaurant industry was another environment that felt the immediate impact of the pandemic. Government restrictions on businesses as well as society’s heightened focus on social distancing and health concerns meant many restaurants faced drastic decreases in consumer business. In many cases, this resulted in closures and downsizing for some businesses.

Conversely, the sudden shift to online ordering and delivery services created new opportunities for these businesses. Many consumers were taking part in food delivery services for the first time out of necessity, but the conveniences realized from these options is translating into continued demand for them into the future.

The restaurant industry has a historically active leasing environment, with many on-site restaurant locations being managed through operating leases. As a result, not only did this industry see an immediate impact on their balance sheet due to adopting the new lease standard (an average liability increase of 41x), but they also encountered new leasing decisions as a result of their response to changing consumer behaviors forced by the pandemic.

A greater demand for delivery options means restaurant companies might be considering a reduction in the size and number of on-site spaces needed to serve their customers. However, with enhancements to food and safety standards and procedures, these same companies may also need new equipment, leading to more leases in the future.

Retail

Given the new lease accounting standard and the coronavirus pandemic, the retail industry has also experienced significant changes. This industry has long been reliant on operating leases, with many retail locations leasing storefront space in malls and shopping centers featuring a variety of retail stores. The operating leases retail companies enter into often include a payment structure based on business performance as landlords structure their leasing arrangements to include payments based on percentage of sales.

When the pandemic hit, many retail companies found themselves struggling to stay in business and profitable given shelter-in-place and self-quarantining proclamations. These businesses were locked into operating lease arrangements that they had to continue to make payments for despite the fact that their financial performance was hit by the reduction in consumer sales. As a result, 54% of retailers said they asked for rent concessions to help manage the impact of the pandemic. Other retail companies faced lease abandonment and renegotiation situations as their need for retail space changed.

Benefits beyond compliance

The effects of the new ASC 842 lease accounting rules and the economic changes from the pandemic have had a lasting impact on businesses and the way they manage their operations and finances. While adopting ASC 842 is a time-consuming task, there are benefits to having a more in-depth understanding of an organization’s leasing activity. Complying with the new lease accounting standards has pushed many companies to centralize and enhance their lease data, which in turn makes these organizations better prepared to make beneficial leasing and procurement decisions in the future.

In addition, by having more data at their disposal, companies negatively impacted by the pandemic were able to more quickly and successfully respond to the economic challenges by identifying opportunities to renegotiate leases, request rent concessions or change procurement strategies and capture cost savings. Dedicated lease accounting software solutions help companies simplify their new accounting requirements and manage and analyze their lease activity. Arming accountants with the best technology — one that offers reporting functionality that makes accessing information and data analysis easy and fast — can be the difference in making the right strategic decisions for the post-pandemic economy.