by Accounting Today | Apr 1, 2022 | Articles, Goodwill Accounting, Impairment, Intangible Assets

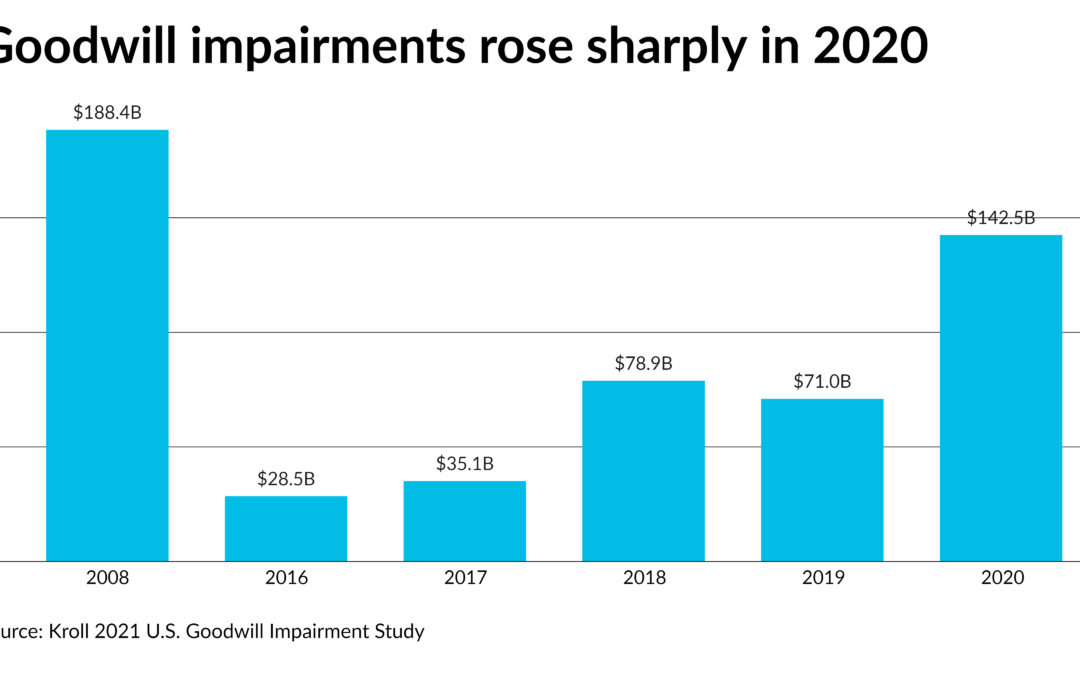

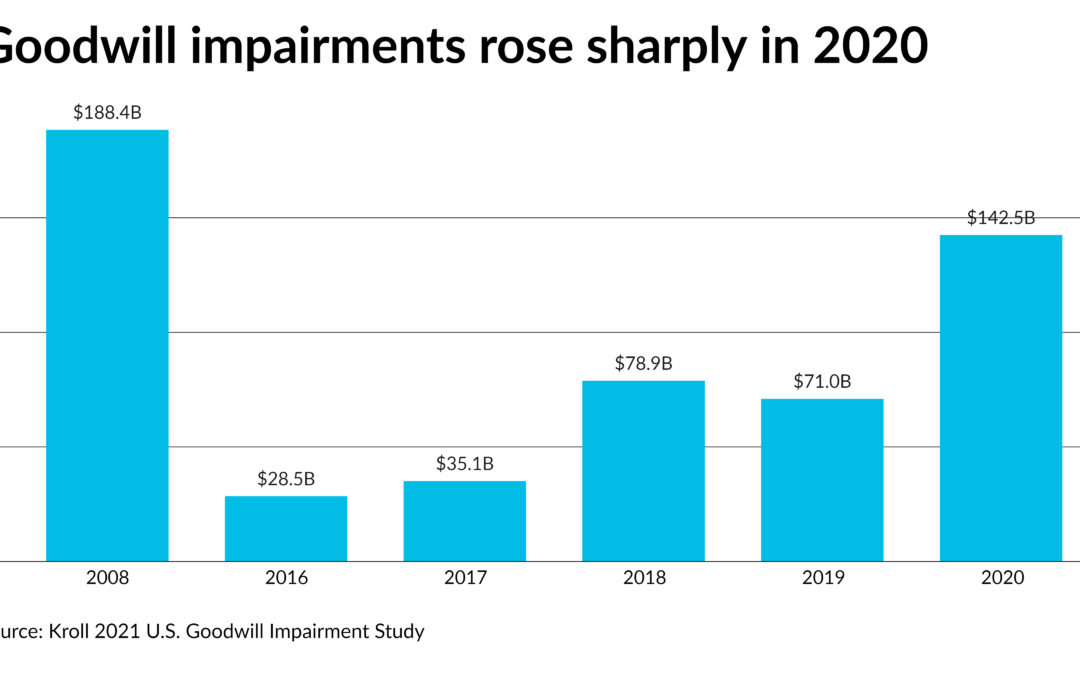

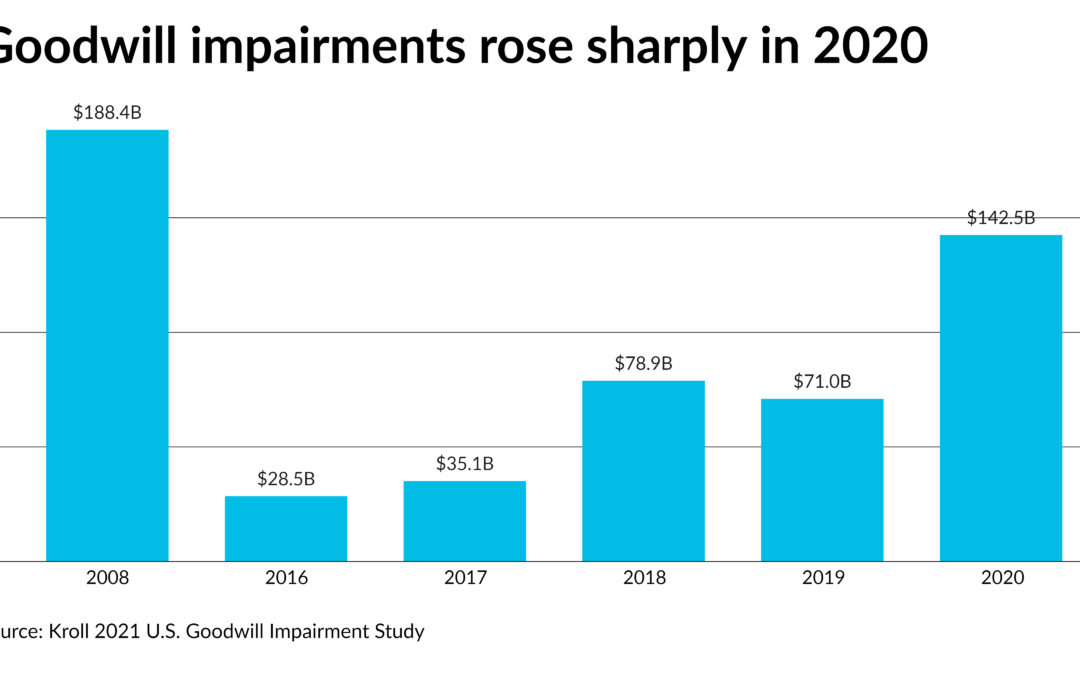

Summary provided by MaterialAccounting: This article discusses the increase in goodwill impairments during the COVID-19 pandemic. The total value of goodwill impairments recorded by U.S. public companies more than doubled in 2020 during the first year of the...

by Accounting Today | Apr 1, 2022 | Articles, GASB, GASB 87, GASB 96, Government Accounting, Lease Accounting

Summary provided by MaterialAccounting.com: Government accountants needs to adopt the new GASB lease accounting standards now to avoid scrambling to achieve compliance in the future. The Governmental Accounting Standards Board set the effective date for the GASB 87...

by Accounting Today | Mar 31, 2022 | Articles, CECL, Debt, Investment Accounting

The Financial Accounting Standards Board released an accounting standards update Thursday aimed at improving the usefulness of information offered to investors about certain loan refinancings, troubled debt restructurings, vintage disclosures and gross write-offs,...

by Accounting Today | Dec 7, 2021 | Articles, Goodwill Accounting, Impairment, Intangible Assets

The CFA Institute released the results Tuesday of a global survey of investment professionals on accounting for goodwill, related disclosures, and how those issues are affecting analysis and investment decision-making.The survey found that investors would prefer one...

by Accounting Today | Nov 11, 2021 | Articles, ASC 842, Debt, Discount Rates, Lease Accounting

The Financial Accounting Standards Board issued an accounting standards update Thursday in an effort to simplify the discount rate guidance for lessees that aren’t public companies, including private companies, nonprofits and employee benefit plans.The amendments in...