Deferred Tax Asset Definition

A deferred tax asset is a line item on a company’s balance sheet that represents a difference between book accounting and tax accounting. It’s an intangible asset for tax credit(s) to be recognized in a future period.

Recent Articles

There’s Still Time to Improve Your Lease Accounting

Summary provided by MaterialAccounting.com: This article discusses how to reassess current lease accounting policies as audit season approaches. For many organizations, audit season is approaching. This means this is a great time to reassess your current...

5 Accounting Tips for Small Businesses

Summary provided by MaterialAccounting.com: This article provides tips to help small businesses organize their accounting processes. As a small business owner, you have a lot on your plate, which probably means that bookkeeping is the last thing you want to be...

Prepaid Expenses Guide: Accounting, Examples, Journal Entries, and More Explained

Summary provided by MaterialAccounting.com: This blog discusses the definition of prepaid expenses, how to account for them, and provides examples. -- Accounting for prepaid expenditures and ensuring they are properly recognized on your financial statements is a...

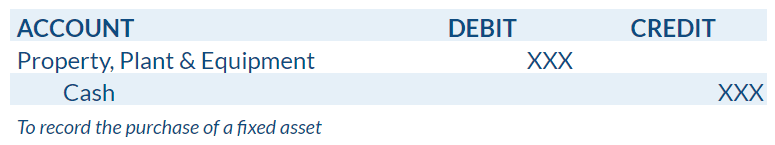

Fixed Assets in Accounting and the Asset Turnover Ratio Explained with Examples and More

Summary provided by MaterialAccounting.com: This article breaks down fixed asset accounting and the asset turnover ratio in an easy-to-understand format with examples. --- Fixed assets are one of the main pillars of business. Many organizations would not exist or...

ASC 840 vs ASC 842: Differences between the Old and New Lease Accounting Standards

Summary provided by MaterialAccounting.com: This article compares and contrasts the new and old FASB lease accounting standards, ASC 842 and ASC 840. ASC 840 summary ASC 840, Leases, is the former lease accounting standard for public and private companies following...

What’s New?: IFRS Updates for 2023

Summary provided by MaterialAccounting.com: This article provides key updates from the IFRS. It is officially summer and a time for well-deserved vacations. This time of year, when most people hear the word “international”, they think of exciting vacation...

FASB expands conceptual framework with reporting entity info

Summary provided by MaterialAccounting: This article discusses changes to the conceptual framework for financial reporting under FASB. The Financial Accounting Standards Board released a new chapter Thursday of its Conceptual Framework describing a reporting...

What Nonprofits Need to Know About ASC 842

Summary provided by MaterialAccounting: Nonprofits transitioning to ASC 842 can read this article from LeaseQuery to get the tricks and tips they need for implementation. ASC 842 at a glance ASC 842 is the new FASB lease accounting standard. It governs how entities...