This article, "Accounting for Impairment of Lease Receivables under IFRS 9," originally appeared on GAAPDynamics.com.

Summary provided by MaterialAccounting.com: This article provides an overview of accounting for impairment of lease receivables under IFRS 9.

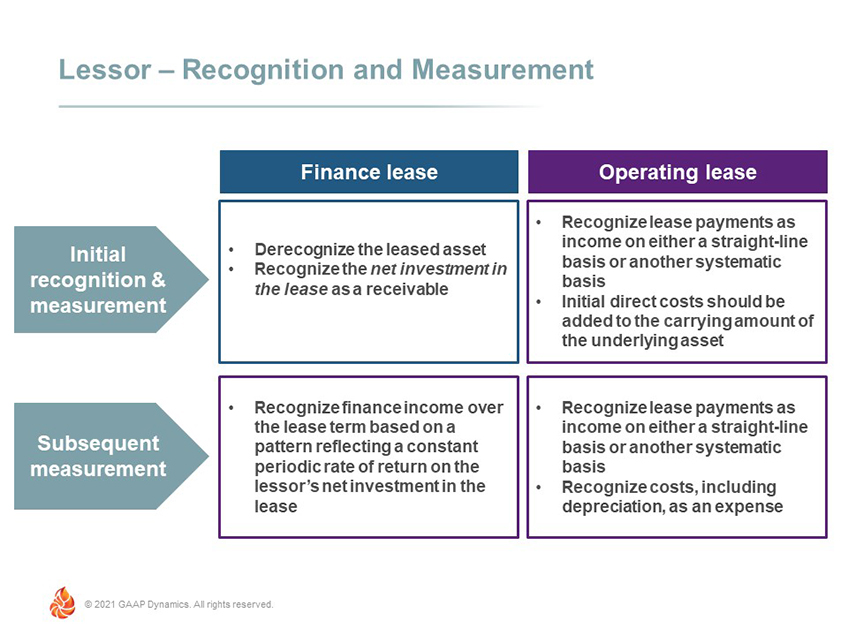

The accounting for leases by lessees and lessors is covered by the IFRS 16 Leases standard. From a lessor perspective, at the inception of the lease, a lessor classifies a lease as either an operating lease or a finance lease.

A lease is classified as an operating lease if it does not transfer substantially all the risks and rewards of ownership of an underlying asset. A lease is classified as a finance lease if it transfers substantially all the risks and rewards incidental to ownership of an underlying asset.

For a finance lease, at the commencement date, the lessor should recognize the assets held under the finance lease in its statement of financial position and present them as a receivable at an amount equal to the net investment in the lease.

The net investment in the lease is the sum of the present value of the lease payments and the present value of the unguaranteed residual value, discounted using the interest rate implicit in the lease (there are special considerations for manufacturer or dealer lessors).

Subsequent to initial measurement, a lessor recognizes finance income over the lease term, based on a pattern reflecting a constant periodic rate of return on the lessor’s net investment in the lease. Additionally, the net investment in the lease is subject to the impairment requirements in IFRS 9 Financial Instruments.

IFRS 9 Expected Credit Loss Model

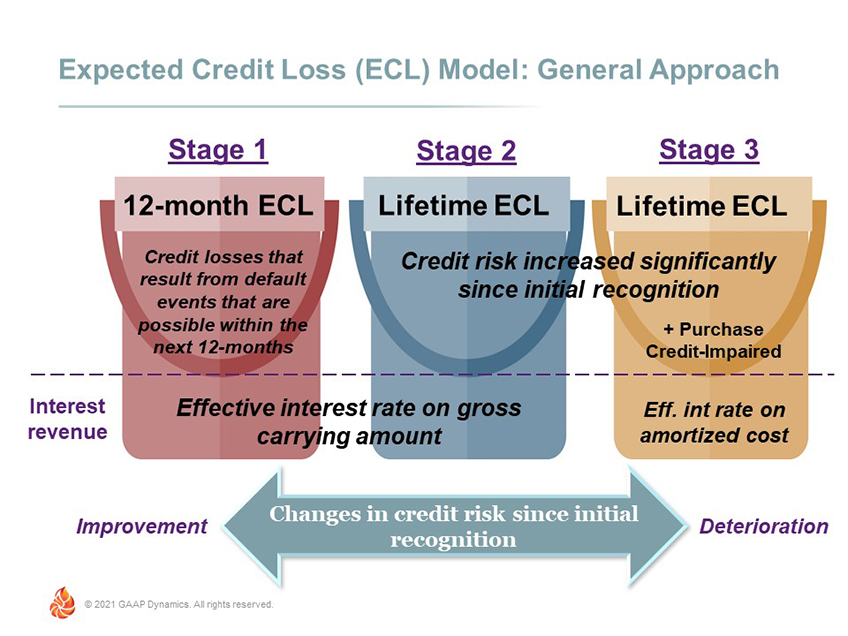

IFRS 9 provides an expected credit loss (ECL) model whereby expected credit losses and changes in those expected credit losses are always accounted for. Under the general impairment approach, which is often referred to as the “Three Bucket Approach”, an entity is required to measure expected credit losses through a loss allowance at an amount equal to either 12-month or lifetime expected credit losses depending on whether there has been a significant increase in credit since initial recognition.

Expected credit losses are required to be measured through a loss allowance at an amount equal to 12-month expected credit losses if there has been no significant deterioration in credit quality since initial recognition or there is a low credit-risk at the reporting date. Once credit risk increases significantly and the resulting credit quality is not considered to be low credit risk, recognition of full lifetime expected credit losses is required.

What is considered a “significant” increase in credit risk is not specifically quantified in the guidance. Rather, judgment needs to be applied in making the determination and applying the principles of IFRS 9 to a given financial instrument. The IASB did take into consideration though, that tracking changes in credit risk may not be practical for some entities or worth it from a cost/benefit perspective. As such, IFRS 9 also permits an alternative simplified approach as an operational simplification for certain receivables.

Specific to lease receivables, an entity can make a policy choice to apply either the general approach or a simplified approach. Under the simplified approach, a loss allowance is always recognized based on lifetime expected credit losses. The simplified approach policy election for lease receivables can make life easier at it requires no tracking of changes in credit risk.

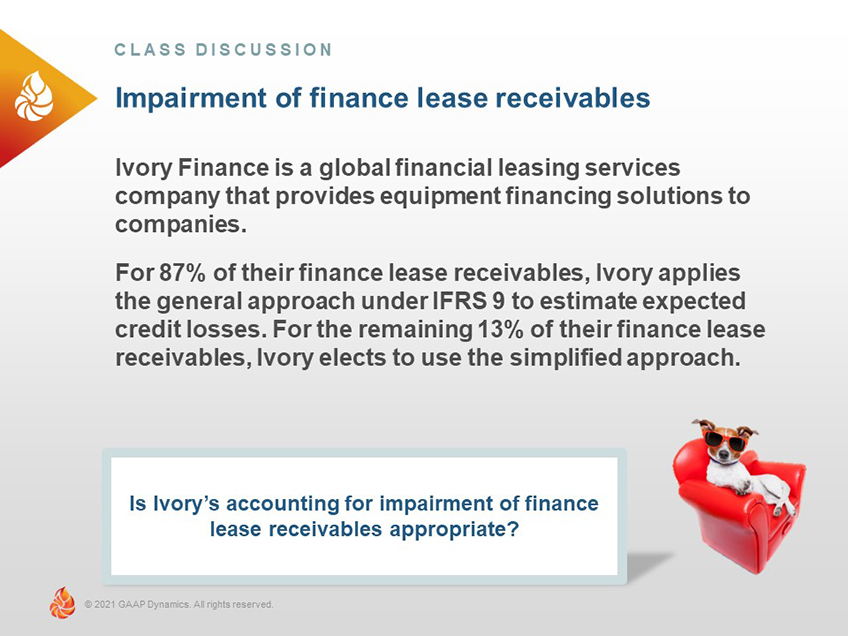

All right, before we close out this post, let’s take a look at an application issue.

There was a similar scenario recently reviewed by the European Securities and Markets Authority (ESMA) and ESMA disagreed with the accounting for the ECL allowance on their finance receivables. Specifically, they disagreed with the ECL allowance in relation to the finance receivables being based on two different approaches (the general approach and the simplified approach).

Under IFRS 9, if an entity chooses an accounting policy to measure the loss allowance at an amount equal to lifetime ECLs for its finance receivables, it should be applied consistently to all its financial receivables.

If you are interested in keeping up to date with current IFRS accounting issues and developments, consider taking our 2021 IFRS Essential eLearning series. Or, if you prefer live webinars for your company, please contact us for details and get a webinar scheduled for your organization.

About GAAP Dynamics

We’re a DIFFERENT type of accounting training firm. We don’t think of training as a “tick the box” exercise, but rather an opportunity to empower your people to help them make the right decisions at the right time. Whether it’s U.S. GAAP training, IFRS training, or audit training, we’ve helped thousands of professionals since 2001. Our clients include some of the largest accounting firms and companies in the world. As lifelong learners, we believe training is important. As CPAs, we believe great training is vital to doing your job well and maintaining the public trust. We want to help you understand complex accounting matters and we believe you deserve the best training in the world, regardless of whether you work for a large, multinational company or a small, regional accounting firm. We passionately create high-quality training that we would want to take. This means it is accurate, relevant, engaging, visually appealing, and fun. That’s our brand promise. Want to learn more about how GAAP Dynamics can help you? Let’s talk!

Disclaimer

This post is published to spread the love of GAAP and provided for informational purposes only. Although we are CPAs and have made every effort to ensure the factual accuracy of the post as of the date it was published, we are not responsible for your ultimate compliance with accounting or auditing standards and you agree not to hold us responsible for such. In addition, we take no responsibility for updating old posts, but may do so from time to time.