This article, "ESG Bonds: IFRS 9 Accounting Considerations," originally appeared on GAAPDynamics.com.

ESG bonds are growing in popularity with the rise in interest in environmental, social, and corporate governance issues and the importance that investors are placing on companies to be environmentally and socially responsible. Companies use ESG bonds as a means of raising finance. In last week’s post, Jenny addressed the importance of sustainabililty reporting. In this post, we will take a closer look at ESG bond types and some key IFRS accounting-related considerations.

Types of ESG bonds

ESG bonds are debt instruments that are typically linked to ESG activities. Some examples of ESG bonds are green bonds, social bonds, sustainability bonds, and sustainability-linked bonds.

Green bonds require the issuance proceeds to be used to fund “green” or environmentally beneficial projects or activities, such as:

- Energy efficiency projects

- Renewable energy projects

- Pollution prevention and control projects

- Natural resources and land management projects

- Clean transportation projects

- Wastewater and water management projects

Social bonds finance socially beneficial projects or activities, such as projects related to:

- Socioeconomic advancement

- Sustainable food systems

- Affordable housing

- Access to essential services

Sustainability bonds are those where the funds are earmarked to finance a combination of green or social projects or activities.

Green bonds, social bonds, and sustainability bonds are use of proceeds bonds, meaning the funds raised are earmarked for specific use. Sustainability-linked bonds have more flexibility in terms of how the funds can used (can be for general funding purposes). They do, however, have terms that are linked to the achievement of a sustainability target or sustainability goal of the issuer.

ESG bond accounting considerations

ESG bonds are similar to any other bond with the key difference being that the issuer states that the funds will be used for environmental or social projects in the case of green, social, or sustainability bonds, or the terms of the bonds are linked to sustainability goals of the issuer in the case of sustainability-linked bonds.

As such, IFRS accounting falls under IFRS 9 Financial Instruments. A key accounting consideration for the investor is whether the bond should be accounted for at amortized cost or at fair value through profit or loss. In accordance with IFRS 9, this determination is based on an assessment of the contractual cash flow characteristics and the business model.

Under the contractual cash flow characteristic test, an assessment is done to determine whether the asset’s contractual cash flows are solely payments of principal and interest (referred to as “SPPI”) on the principal amount outstanding. If the bond meets the SPPI criterion, a business model assessment is needed to determine whether the financial assets meet the criteria for classification as subsequently measured at amortized cost or fair value through OCI. Bonds are accounted for subsequently at amortized cost when the cash flows are based solely on principal and interest and where the business model is to hold and collect cash flows.

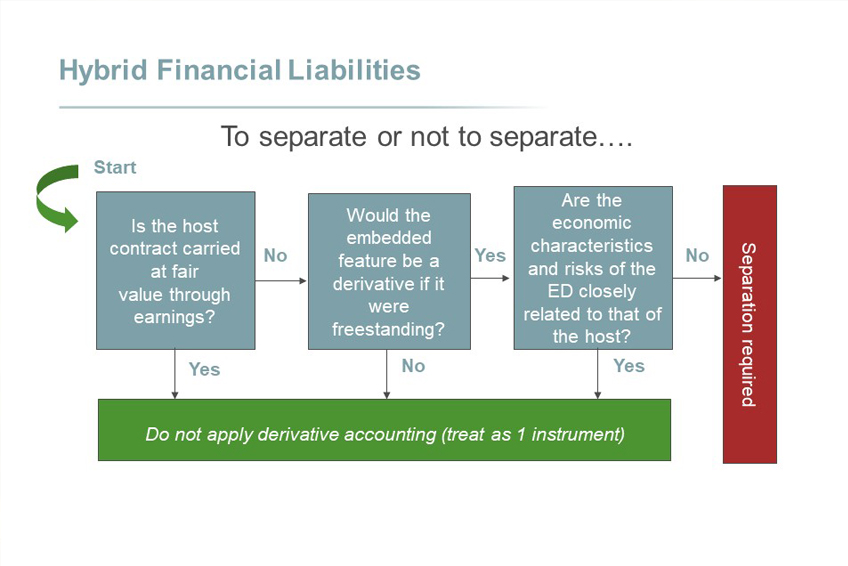

Another accounting consideration for issuers of sustainability-linked bonds is the need to assess whether the contract is a hybrid contract and if so, whether the embedded derivative needs to be bifurcated.

A derivative embedded in a financial liability should be separated ONLY IF:

- It is not closely related to the economic characteristics and risks of the host,

- A separate instrument with the same terms would meet the definition of a derivative, and

- The hybrid instrument is not measured at FV with changes in the P&L.

A common feature in sustainability-linked bonds is a step-up feature in the interest rate where the interest rate paid changes depending upon whether specified sustainable development goals are met. The step-up feature needs to be assessed based on the separation criteria. This feature may not meet the definition of a derivative as the definition of derivative under IFRS 9 is not met if the underlying variable is non-financial and is specific to a party to the contract.

Environmental, social, and governance activities are expected to continue to grow and remain an accounting hot topic. If you would like to stay abreast of current hot topics and developments in accounting and reporting, we can help. If you are interested in an annual update training on U.S. GAAP or IFRS current developments, please reach out. We would love to help!

About GAAP Dynamics

We’re a DIFFERENT type of accounting training firm. We don’t think of training as a “tick the box” exercise, but rather an opportunity to empower your people to help them make the right decisions at the right time. Whether it’s U.S. GAAP training, IFRS training, or audit training, we’ve helped thousands of professionals since 2001. Our clients include some of the largest accounting firms and companies in the world. As lifelong learners, we believe training is important. As CPAs, we believe great training is vital to doing your job well and maintaining the public trust. We want to help you understand complex accounting matters and we believe you deserve the best training in the world, regardless of whether you work for a large, multinational company or a small, regional accounting firm. We passionately create high-quality training that we would want to take. This means it is accurate, relevant, engaging, visually appealing, and fun. That’s our brand promise. Want to learn more about how GAAP Dynamics can help you? Let’s talk!

Disclaimer

This post is published to spread the love of GAAP and provided for informational purposes only. Although we are CPAs and have made every effort to ensure the factual accuracy of the post as of the date it was published, we are not responsible for your ultimate compliance with accounting or auditing standards and you agree not to hold us responsible for such. In addition, we take no responsibility for updating old posts, but may do so from time to time.