This article, "Variable Lease Payments: Implications under the New Lease Standard," originally appeared on CPAJournal.com.

After years of anticipation, the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) have issued their final standards on lease accounting. Accounting Standards Codification (ASC) Topic 842, “Leases,” will be effective for public U.S. companies in 2019, and IFRS 16, Leases, will be effective internationally in the same year. ASC Topic 842 will replace ASC Topic 840, which has provided the primary lease guidance for decades. Under Topic 840, leases for the lessee are either operating leases, which do not require balance sheet recognition, or finance leases, which do. ASC 842 and IFRS 16 will bring all operating leases onto the balance sheet, requiring capitalization of the present value of minimum lease payments as a liability and capitalization of an asset for the “right to use” the underlying assets. Expense recognition will be similar to the current approach, with expenses being recognized evenly across the lease term, although the expense pattern will become front-loaded under IFRS. This different conclusion on the timing of expense recognition represents the most significant area of disagreement by the two boards.

On the other hand, accounting for variable (or contingent) rental payments, which are future rental payments that depend on future outcomes, is not significantly changed under the new rules. This article investigates two of the more difficult decisions that the boards faced when deliberating variable rent costs and examines the implications of those decisions. The focus is on operating lease accounting for the lessee; while finance leases can have variable payment features, they have, by definition, a very high proportion of fixed rents.

Accounting for Variable Lease Payments

Under current U.S. GAAP, leases are finance leases if any of four conditions are met. The fourth condition requires capitalization if the present value of minimum lease payments (MLP) is greater than 90% of the fair value of the asset. Contingent rents (ASC 840-10-25-5) are not currently treated as MLPs; as a result, a contract that has a considerable variable component as well as a fixed amount is not likely to meet the 90% test, and the lease will probably be considered an operating lease in its entirety. Generally, contingent rents are expenses when paid, but an exception exists for rate-based payments. If lease payments are tied to an interest rate, such as LIBOR, U.S. GAAP requires that the lessee determine the rate in effect at the beginning of the lease, assume that this rate will persist throughout the lease’s term, and determine MLPs based on this assumption. The same logic applies to payments based on an index, like the CPI, but it does not apply to payments based on changes in an index, as such changes do not have a mathematical value in effect at lease commencement.

Companies are currently required to disclose rental expense for each period in which an income statement is presented, including separate amounts for contingent rentals (ASC 840-20-50-1). Companies are also required to disclose the basis on which contingent rental payments are determined (ASC 840-10-50-2). A 2005 letter from the SEC Chief Accountant emphasizes that contingent rent amounts should be disclosed and that the basis for these rents should be disclosed with “specificity, not generality” (http://bit.ly/2iBggZk).

Within the text of financial statement disclosures, information pertaining to contingent rentals is usually presented as follows:

CVS Health Corp. (December 31, 2014, Form 10-K): In addition to minimum rental payments, certain leases require additional payments based on sales volume, as well as reimbursement for real estate taxes, common area maintenance and insurance, which are expensed when incurred.

Most companies do not provide extensive detail in their disclosures. For example, Staples, Inc., in its January 31, 2015 Form 10-K, indicated that 139 stores had variable rentals. This level of detail is not commonly provided.

Lease Payments Based on Revenue or Usage

When rental payments are tied to lessee revenues, the leased asset is most commonly a retail store or restaurant. The amount of the contingent payment is usually measured as a percentage of sales beyond a certain sales threshold. From the point of view of the lessor, a low fixed payment component indicates that the lessor is willing to take on additional risk (i.e., risk is being shared). This could potentially reflect faith in a lessee, or may demonstrate difficulty in finding a lessee. For example, if base rent for a restaurant is $80,000 per year, and the contingent amount is 6% of sales over $1 million, the lessee is paying 8% of sales on the first $1 million of sales (or more than 8% if sales are less than $1 million), and 6% thereafter. Lease payments based on usage typically relate to leases involving machinery, vehicles, or aircraft.

The first exposure draft on lease accounting, published in 2010, mandated that these variable rent amounts be estimated and capitalized, a significant change from existing practice. The initial decision to require capitalizing these amounts was opposed by a majority of preparers, who put forth two major arguments. First, they argued that payments based on future events do not meet the conceptual definition of liabilities. Second, they claimed that the cost and subjectivity in estimating future amounts did not justify the improvements in financial reporting that might arise. As a result, FASB and the IASB reversed their decision, and the accounting treatment for variable rents will not be distinctly different under the new rules.

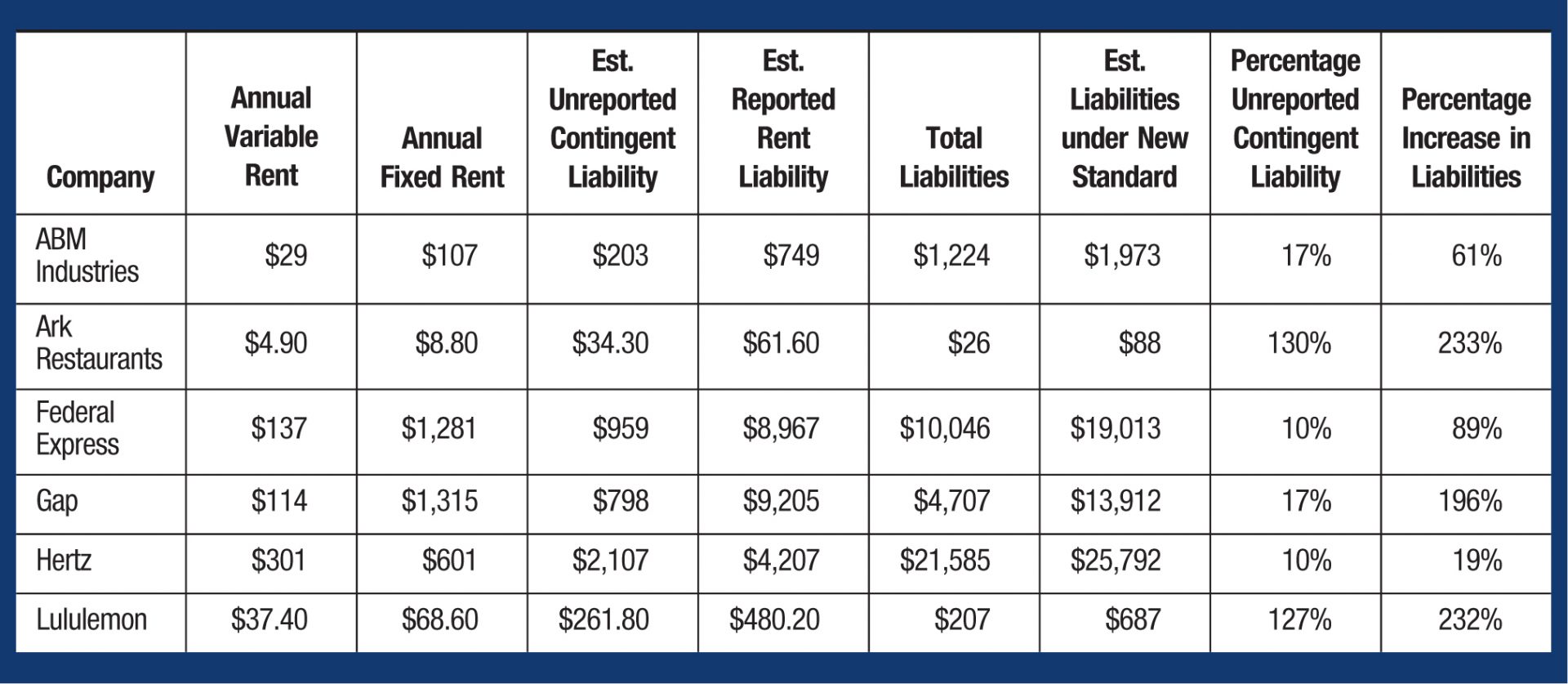

When the new lease standards are in effect, fixed and contingent rentals will be treated differently. Companies with greater proportions of variable rent amounts will have lower liabilities on the balance sheet than if all rents were fixed or predetermined. To explore the impact of the boards’ final decisions, the authors examined lease information from twelve selected companies, including six companies with a relatively high proportion of variable rents and six companies with a relatively small proportion of variable rents. The twelve companies are presented in Exhibits 1 and 2; the data shown is from the fiscal year with a year-end closest to December 31, 2014. Each of the high variable rent companies has variable rents of at least 8% of total rents, and sometimes considerably higher. Most companies in the retail sector currently report a relatively small proportion of contingent rental payments; however, certain companies in retail and other sectors do have a significant contingent rental amount, as demonstrated by the companies shown in Exhibit 1.

EXHIBIT 1

High Variable Rent Companies (dollars in millions)

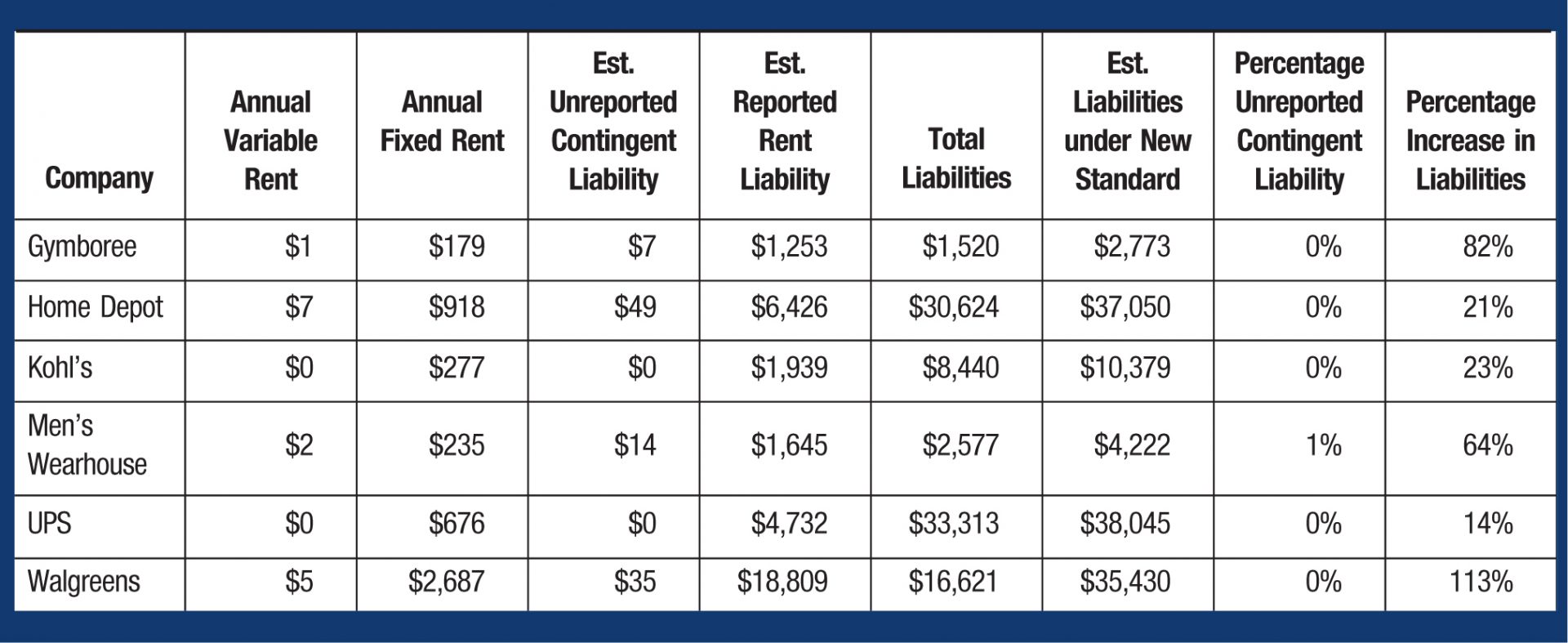

EXHIBIT 2

Low Variable Rent Companies (dollars in millions)

To evaluate the relative impact of potential lease capitalization, a 7-times expense approach is used for the purpose of “what-if” capitalization of both fixed rent expense and variable rent expense. Such straightforward metrics are employed by ratings agencies to add certain obligations to balance sheets for analysis and rating purposes. (Moody’s Corporation often uses an 8-times expense factor for retail firms and a 6-times expense factor for companies in many other industries.) A 7-times expense approach roughly equates to an average remaining lease term of 10 years at a borrowing rate of 7%. A 10-year, 7% lease would have a capitalization factor of 7.02 (present value of ordinary annuity); a 15-year lease would have a capitalization factor of 9.11. In its January 31, 2015 Form 10-K, Belk, Inc. indicated that one of its restrictive covenants treats rent expense as a part of its leverage ratio, with rent expense being multiplied by a factor of eight:

The leverage ratio is calculated by dividing adjusted debt, which is the sum of the Company’s outstanding debt and rent expense multiplied by a factor of eight, by pre-tax income plus net interest expense and non-cash items, such as depreciation, amortization, and impairment expense.

Exhibit 1 indicates that, based on this 7-times expense approach, Gap, Inc. is projected to have nearly triple its current total liabilities once new lease accounting rules are in place; however, an additional $798 million of computed liabilities due to future contingent payments will continue to be off balance sheet, not meeting the threshold of lease liability treatment. For the year ended February 1, 2015, Lululemon Athletica, Inc., reported minimum rental payments of $68 million and contingent payments of $37 million, with the overall proportion of contingent rentals at approximately 35%. Using the 7-times capitalization factor, the new lease accounting rules will require capitalization of $480 million of fixed payments as liabilities, but will not require the $261 million variable amount to be treated as a liability. Total liabilities will increase by approximately 232% to approximately $687 million; however, the 127% increase due to variable rent costs will not be required.

The new lease accounting rules will have economic consequences.

Looking outside of retail companies, FedEx Corp. indicates that its $137 million of contingent rental expense is usage-based (i.e., aircraft usage), representing 10% of total rent expense. ABM Industries Inc. reports that $29 million of $136 million rent expense is variable, computed as a function of revenues earned. ABM is involved in multiple lines of service, but the $29 million amount relates to leases of the parking garages and parking lots that it operates. Hertz, Inc. reports $301 million of variable rental amounts, mostly tied to real estate, as stated in its December 31, 2014, 10-K disclosure:

Many of the Company’s concession agreements and real estate leases require the Company to pay or reimburse operating expenses, such as common area charges and real estate taxes, to pay concession fees above guaranteed minimums or additional rent based on a percentage of revenues or sales (as defined in those agreements) arising at the relevant premises, or both.

Exhibit 2 presents six companies that contrast the companies in Exhibit 1. This group seldom uses variable rental provisions in leases, so these companies will treat essentially all of their future lease payments as MLPs. For Walgreens, capitalizing operating leases should dramatically change the balance sheet; however, the company only has a small variable rental amount, and the treatment of this small amount under the forthcoming lease rules is fairly insignificant. Gymboree, Inc. should see its total liabilities rise from $1.5 billion to an estimated $2.8 billion, even though the company does not use variable amounts extensively in rental contracts.

Effects on Business Practice: Revenue and Usage Variable Payments

The new lease accounting rules will have economic consequences. Debt covenants may need to be renegotiated to allow for the additional liabilities that must be reported. In the future, lessee companies could choose to enter into shorter leases, perhaps with more renewal options; under the new rules, the shorter the lease term, the smaller the lease liability (and corresponding asset). Lessee companies could likewise choose to have a relatively larger variable payment component in new leases. The IASB staff mentioned this concept in a staff paper during lease deliberations (http://bit.ly/2ibyD3X):

The staff also acknowledge that excluding variable lease payments that do not depend on an index or a rate from the measurement of lease assets and lease liabilities may create an incentive to restructure lease payments. For instance, a lessee could structure future leases to include a greater proportion of the total lease payments as variable payments (that do not depend on an index or rate) as opposed to fixed payments, which would reduce its reported lease liabilities.

A follow-up issue is determining whether variable rent amounts are, in fact, truly variable. Current accounting practice uses a judgment-based determination to assess whether “contingent” amounts are economically sound. If a lease for retail space requires payments of $1,000 per month, or $4,000 per month if at least some small level of revenue is earned, clearly the payments are fixed in substance, and the $4,000 monthly amount should be treated as an MLP. The boards responded to these potential incentives by emphasizing the definition of in-substance minimum lease payments; any contingent rentals that lack genuine variability are to be treated as MLPs and capitalized. Potential indicators of disguised MLPs could include below-market fixed rents or contingent rents that seem nearly certain to occur. This remains, however, a principles-based assessment.

Lease Payments Based on an Index or Rate

Contractual payment amounts can also contemplate the effects of inflation or changing interest rates. Besides leases of retail space, office building leases can also have inflation-adjustment features. One way to incorporate inflation expectations in a lease contract is to build in scheduled rent increases; any scheduled payment is an MLP. A second approach, which more directly hedges the risk of inflation, is to require a variable payment amount. A contingent amount based on an index or rate would normally be included in a lease contract if the lessor or lessee believes that future inflation could be difficult to predict. The following provides an example of such a disclosure from Best Buy Company, Inc. (Form 10-K, January 31, 2015):

Most of the leases contain renewal options and escalation clauses, and certain store leases require contingent rents based on factors such as specified percentages of revenue or the consumer price index.

This amount can be based on an index, such as the consumer price index (CPI), or rate, such as the prime rate. Between 2005 and 2015, the CPI for all Urban Consumers (CPI-U) increased at an annualized rate of about 1.8%. While inflation has been low in recent years, expectations are that inflation will grow at some point in the future, which could lead to an additional emphasis on inflation concerns in new long-term lease contracts.

On day one of a lease, future variable payments based on any index or rate are treated simply. Because such payments can only be roughly estimated and may never occur, both current and forthcoming rules require the lessee to assume that the current rate will persist throughout the lease. In the case of future payments based on changes in an index, however, there is no day one value to use, and no future index-based payments are assumed in this case. It is important to note that FASB and the IASB reached different decisions about reassessing the lease liability during the lease term when the index or rate actually changes. FASB will not require reassessment, while the IASB will. The reassessment process does not update to a true expected value or fair value, but instead updates based only on the information known to that point. FASB ultimately decided, however, that the cost of providing the reassessed lease liability amounts to users exceeds the benefits.

The following example contrasts the differences between the FASB and IASB approaches to index-based payments. Assume a lease term of 10 years and an appropriate discount rate of 7%. Payments are $100,000, due at the beginning of each year, increased for changes in consumer prices. If the CPI is 100 at lease commencement and grows by exactly 3% each year, the first payment will be $100,000 and grow to $103,000 in the second year, $115,927 in the sixth year, and $130,447 in the tenth year.

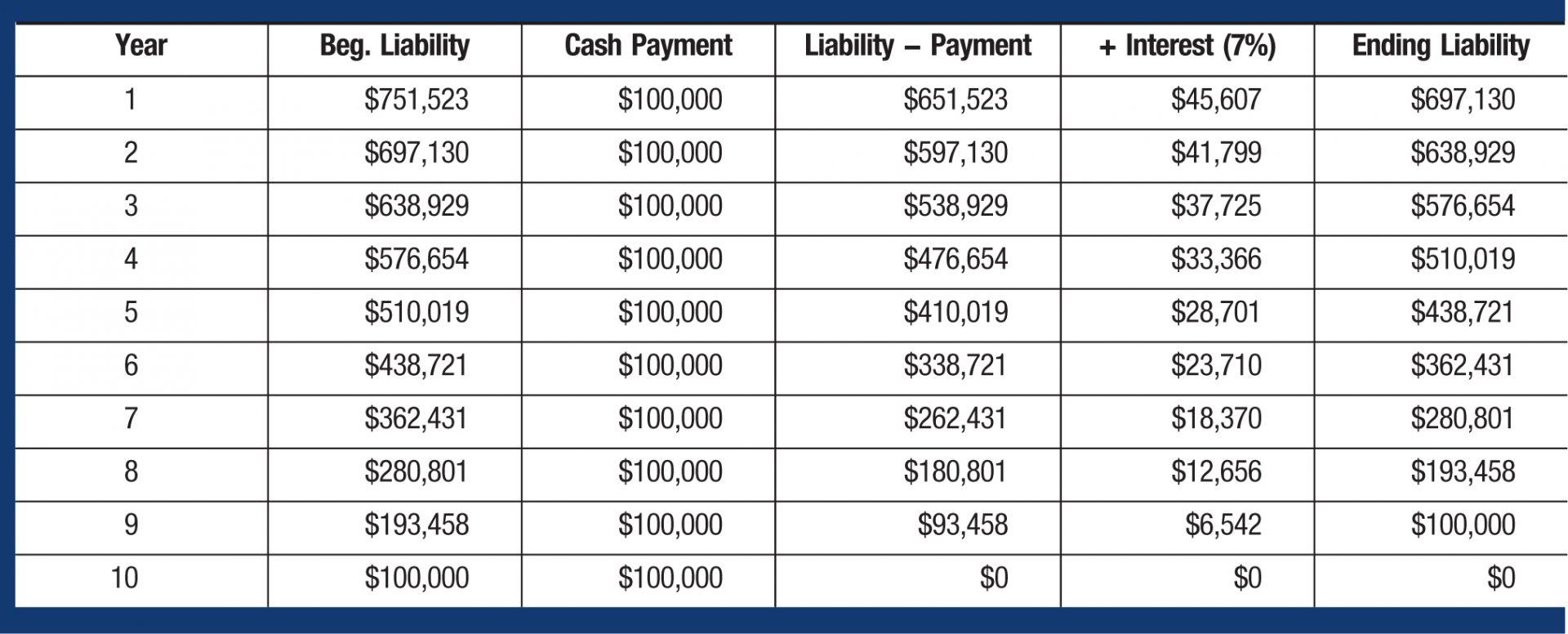

At the beginning of the lease, the 10 payments of $100,000 are MLPs. Any additional amounts paid based on increases in the CPI are variable lease payments. Under both U.S. GAAP and IFRS, the lease liability (asset) will be $751,523. Exhibit 3 shows the original lease liability amortization table for balance sheet purposes; at the end of five years, the amortization table shows that the lease liability will be $438,721.

EXHIBIT 3

Lease Liability Amortization Table (at Lease Commencement)

Under U.S. GAAP, this amortization table is not revised; thus, the lease liability will in fact be $438,721 on the balance sheet after year five. IFRS 16, however, requires reassessing the lease liability after actual payment amounts increase. For example, at the end of year five, it is known that the sixth payment will be $115,927, because the year five CPI change can be measured on December 31. The remaining payments are all assumed to be the same, or $115,927, and the lease liability is reassessed to be $508,571, 16% higher than it would be under U.S. GAAP. If the 3% annual inflation continues, then the best estimate of the lease liability at the end of year five would be even higher ($538,000).

Therefore, out of three possible options for liability and asset measurement, FASB settled on the most basic approach, which is to ignore changes in an index or rate entirely. The IASB, however, decided to ratchet up the lease liability (and asset) whenever the index grows. Neither board will require firms to project or forecast future changes in the index; this is consistent with the decision made for variable rents based on revenue.

Income Statement Effects of Variable Payments

As mentioned above, the expense pattern for operating leases will differ between U.S. GAAP and IFRS rules. For a U.S. GAAP operating lease with even payments, lease expense essentially equals cash paid (more specifically, effective interest amortization of the asset plus interest on the liability). This means that the expense pattern is straight-line over the lease term. Lease expense is classified as an operating expense. Any variable payments will simply be added to this expense amount.

Under IFRS, all leases are treated the same; there is no operating versus finance distinction, and the expense pattern will be front-loaded. The lease asset will be depreciated (usually straight-line), and the lease liability will generate interest expense (front-loaded). When a company has variable rent payments based on revenue/usage, these will be recognized in profit or loss as incurred. For index/rate variable payments, the required reassessments will lead to slightly higher expenses in earlier years and lower expenses in later years, assuming the index grows over time. Reassessment increases the asset and liability by the same amount, which slightly accelerates the income statement recognition of variable payments.

Possible Ramifications

FASB and the IASB responded to comment letters by backing off on their initial proposals in the area of variable rental amounts. Both boards agreed to keep contingent rentals based on revenue or usage off of the balance sheet, saving companies from having to engage in extensive forecasting. While this extends the current accounting guidance that has existed for years, it differs from the new treatment of fixed rental payments, which will now be capitalized for all leases. Going forward, this leads to different treatments depending on whether payments are fixed or variable.

The boards also removed the potential for forecasting of indices or rates such as the CPI. The IASB, though, did agree to a reassessment model. If payments are tied to changes in an index, IFRS will require a slow incremental process of increasing the lease liability as the index increases. In the United States, this will not be true.

In summary, no forecasting of future unknown lease payments will take place, and in the United States, contingent rents tied to either revenue/usage or rates/indexes will generally not lead to a liability on the balance sheet. In the immediate term, debt covenants may need to be renegotiated to account for the balance sheet impact of operating leases. In the longer term, some companies may gradually shift toward variable payments in leases to reduce liability amounts on the balance sheet. Investors and analysts will need time to ascertain whether the lack of balance sheet accounting for future unknown contingent rentals will present challenges when assessing the financial position of a company.

John Briggs, PhD, CPA, CMA is an associate professor of accounting at James Madison University, Harrisonburg, Va.

Joseph Beams, PhD, CPA is the Oil & Gas Professor of Accounting at the University of New Orleans, New Orleans, La.

Charles P. Baril, PhD, CPA is a professor of accounting at James Madison University.

Luis Betancourt, PhD, CPA is an associate professor of accounting at James Madison University.