by GAAP Dynamics | Feb 7, 2024 | Articles

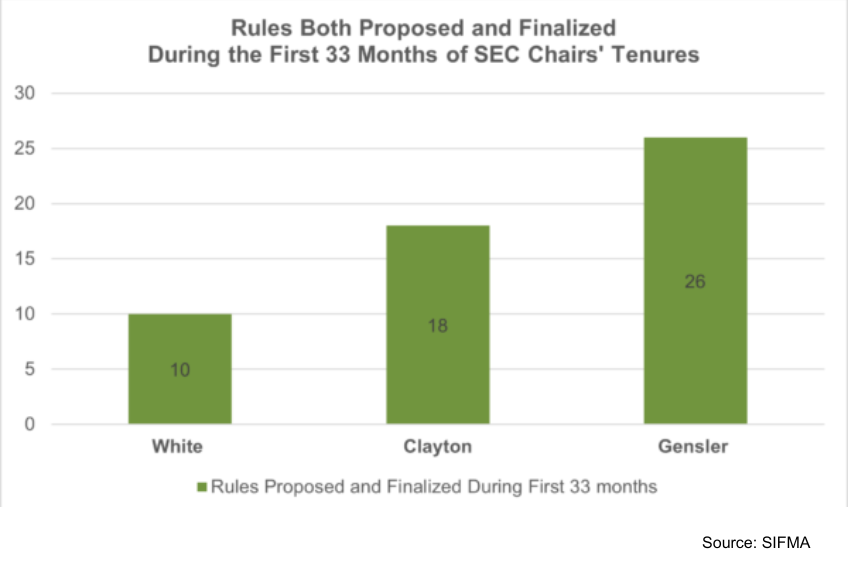

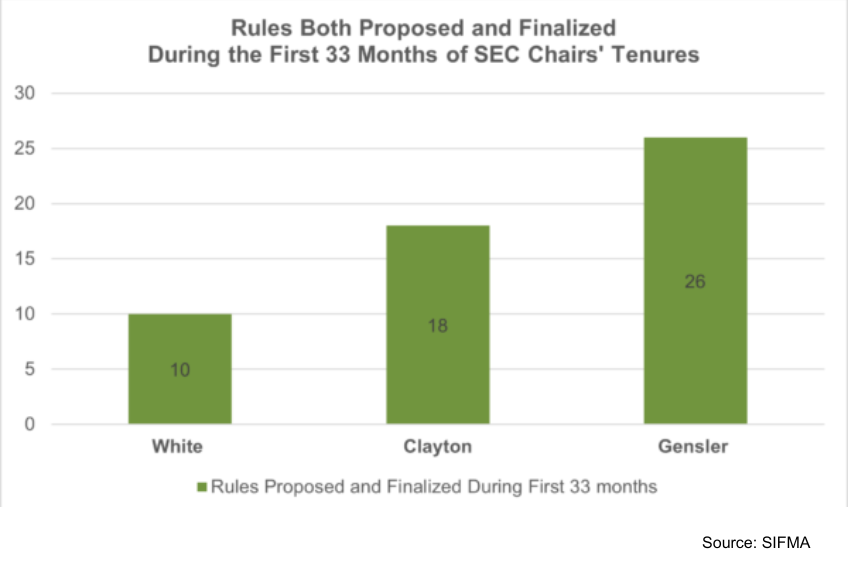

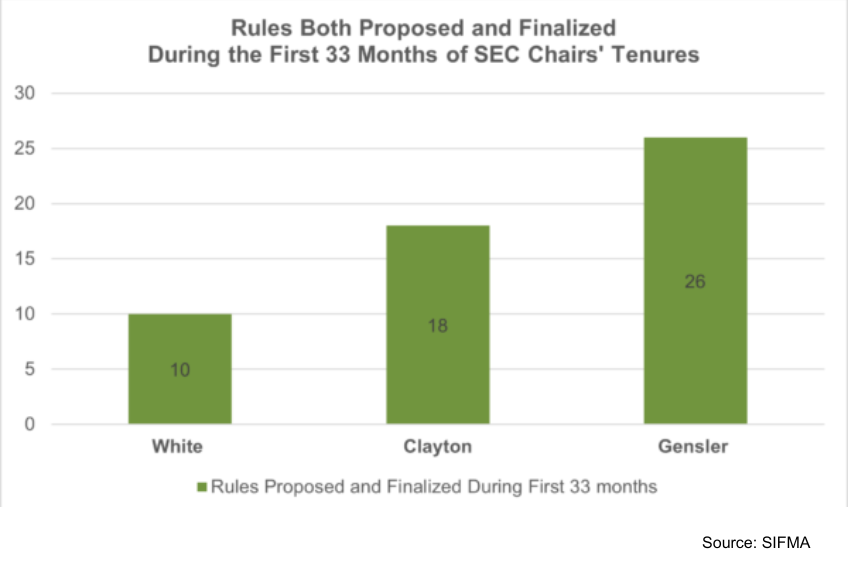

The regulatory landscape for accountants and auditors continues to rapidly evolve with unprecedented rulemaking activity. In this blog we’ll explore the SEC’s agenda and the implications for professionals, alongside heightened scrutiny from the PCAOB and updates...

by GAAP Dynamics | Oct 18, 2023 | Articles

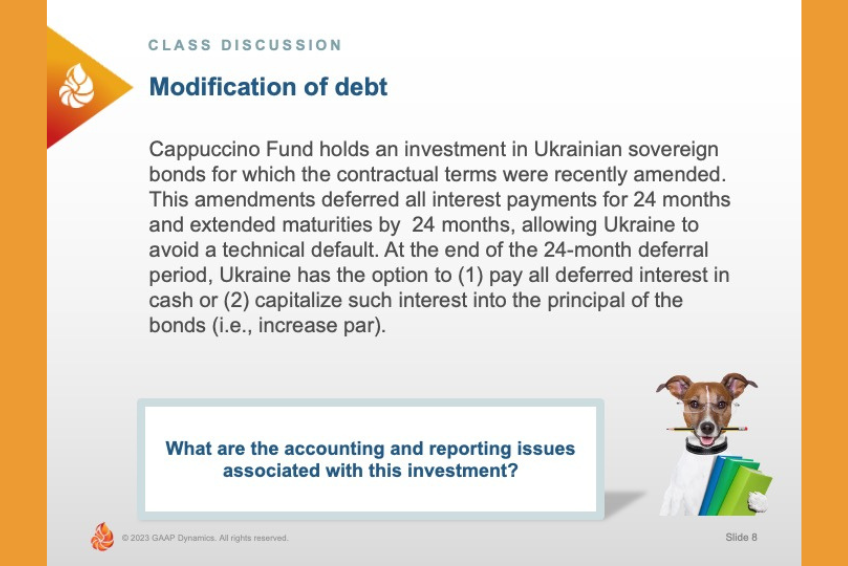

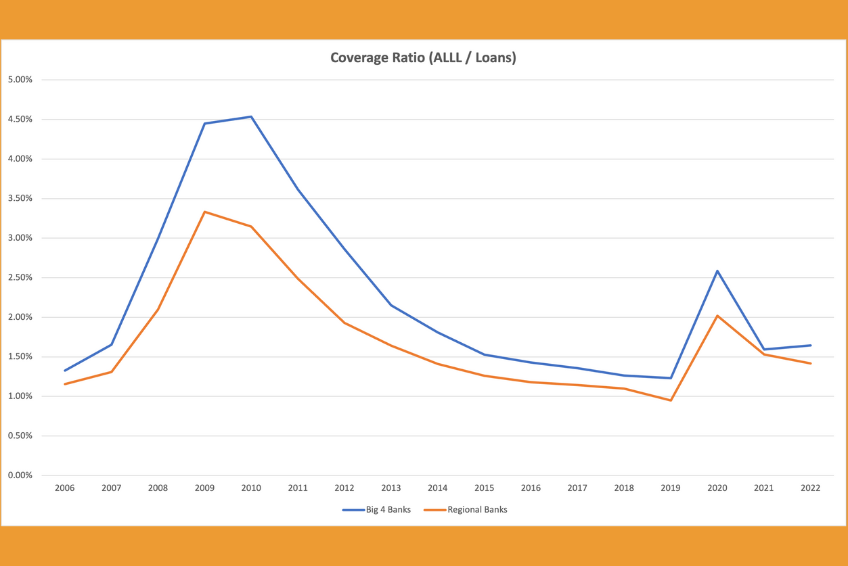

If you’re reading this post, you know that investment companies are unique and must follow industry-specific accounting and reporting rules under ASC 946. You must also know that finding industry-specific training for investment management entities, like hedge funds...

by GAAP Dynamics | Oct 11, 2023 | Articles

In the interest of saving you time, we’ll cut to the chase! We’ve lowered the price for our U.S. GAAP eLearning library subscription! This may raise a few questions in your mind, which is why we’ve decided to write this post. After receiving some candid and...

by GAAP Dynamics | Oct 4, 2023 | Articles

A GAAP Dynamics Blog Powered by Intelligize® More often than I’d like to admit, I get a wild hair, go down a rabbit hole, and spend way too much time writing a post about an accounting topic. What can I say? I’m an accounting geek at heart! Case in point: My Alice in...

by GAAP Dynamics | Sep 27, 2023 | Articles

Accounting updates are a necessary evil, but that doesn’t mean they have to be mind-numbingly boring! I’m happy to announce that we’ve just released our U.S. GAAP Update training for 2023 and it’s available for you to experience the GAAP Dynamics’ difference in...