by GAAP Dynamics | Jun 27, 2023 | Articles, IAS 17, IFRS 16, IFRS Accounting

Summary provided by MaterialAccounting.com: This article provides key updates from the IFRS. It is officially summer and a time for well-deserved vacations. This time of year, when most people hear the word “international”, they think of exciting vacation...

by GAAP Dynamics | Mar 21, 2023 | Articles, IFRS 16, IFRS Accounting, Lease Accounting

Summary provided by MaterialAccounting.com: This article provides an overview of the lease accounting standard, IFRS 16. Lease accounting…a broad accounting topic that transcends industries and, under IFRS 16, makes its way to most balance sheets. It’s hard to...

by GAAP Dynamics | Jun 7, 2022 | Articles, Assurance

Back in my day (gosh, that makes me sound old), audit quality wasn’t really a “thing.” Sure, we did what we thought were good audits, and occasionally they might get reviewed, either internally or by an external firm, but these peer reviews were always rather...

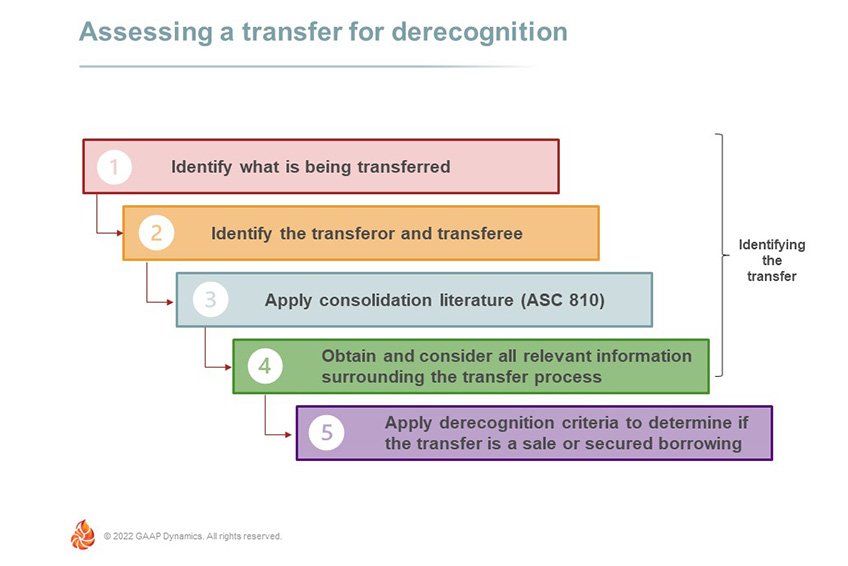

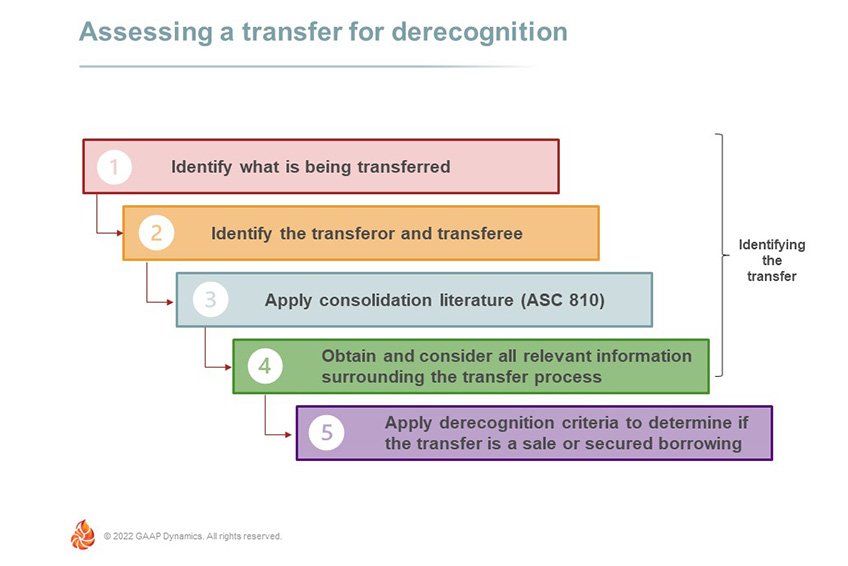

by GAAP Dynamics | May 31, 2022 | Articles, Debt, Financial Services, Industry Accounting, Loans, Sales, Transfer

Repurchase agreements, securitizations, and loan participations are all common transactions executed by banks. Unfortunately, these common transactions can be quite the source of “trouble,” as they involve the transfer of financial assets. ASC 860, Transfers and...

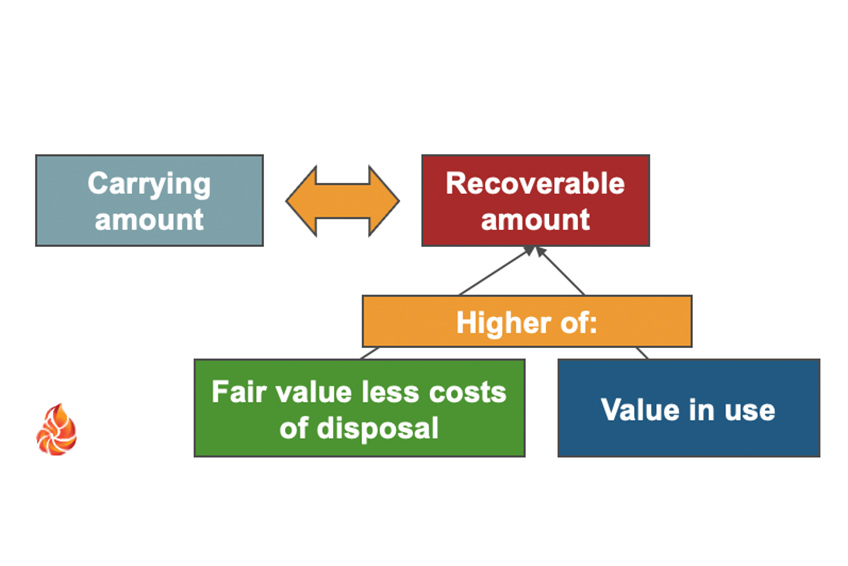

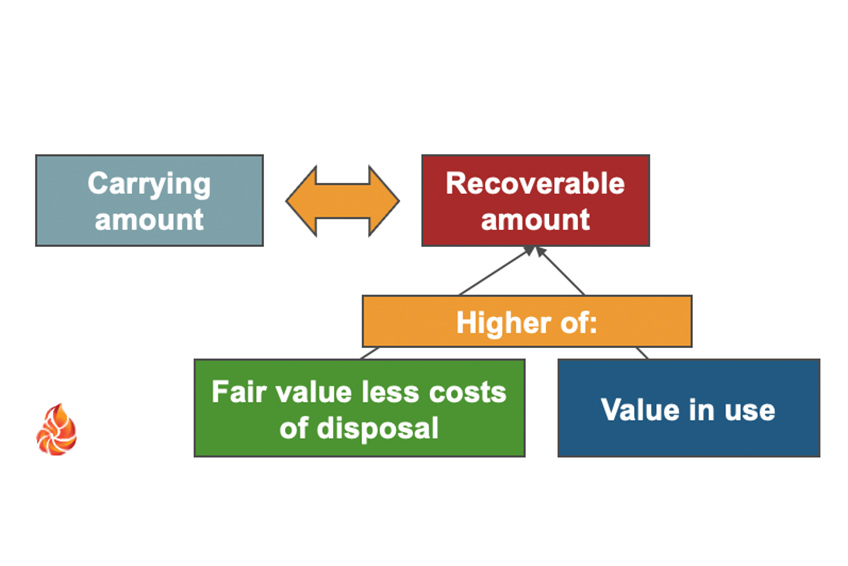

by GAAP Dynamics | May 17, 2022 | Articles, Impairment

Pandemics, growing inflation, war, market instability, shortages on everything from labor to baby formula…it feels like all this year is missing is a plague of locusts! Oh wait, didn’t that happen last year? With all of this market disruption, it begs the question:...